Not Just Another Index.

It’s The New Generation.®

We offer specialized solutions for investors seeking exposure to New Listings - a proxy for economic growth and innovation.

New: The IPOX® High Dividend 7% Strategy

An Innovative Index Strategy

combining Income & Growth!

Upcoming Global IPOs

The IPOX® Newsletters

IPOX® in the News

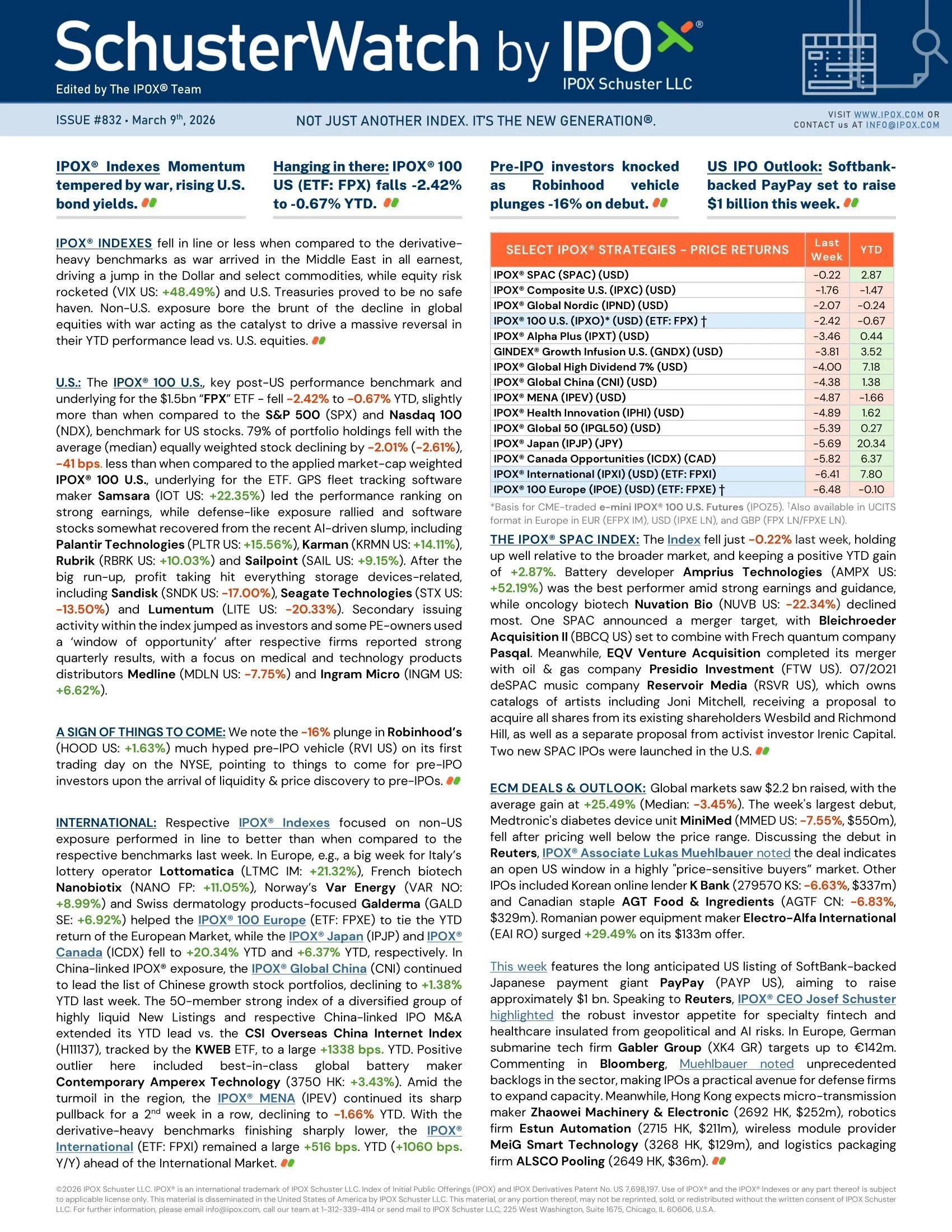

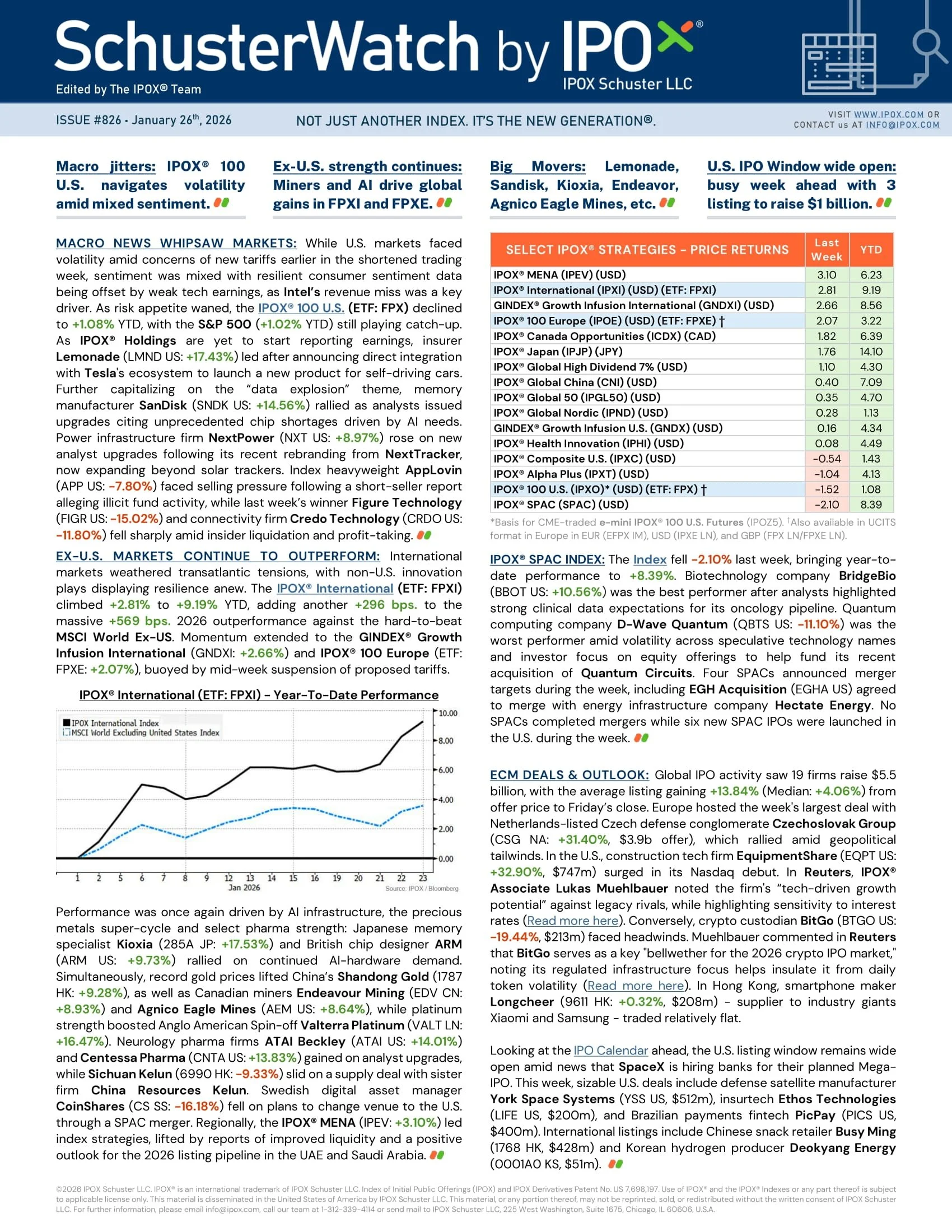

Reuters covered the Nasdaq debut of Medtronic's diabetes unit, MiniMed, which opened below its offer price amid heightened market volatility. The $5.35 billion listing highlights ongoing challenges in the new issues market. IPOX® Research Associate Lukas Muehlbauer provided expert commentary on the debut, noting that while the offering "shows that the U.S. IPO market is still open," current economic conditions clearly dictate "that it has become a price-sensitive buyers' market."

A recent Bloomberg article highlights the massive outperformance of European defense and aerospace IPOs, which have averaged 87% gains since 2020. Driven by geopolitical tensions and NATO rearmament, this surge in investor demand is prompting a fresh wave of public listings. IPOX® Research Analyst Lukas Muehlbauer provided expert commentary, explaining that ongoing conflicts have created unprecedented backlogs, making IPOs a practical way for defense firms to raise cash and expand capacity.

Reuters highlights SoftBank-backed PayPay’s upcoming $13.4 billion U.S. IPO, a highly anticipated offering expected to boost a volatile listing market. Discussing current market dynamics, IPOX® CEO Josef Schuster noted robust investor appetite is particularly strong for specialty firms across healthcare and select fintech that are insulated from geopolitical and AI-related risks.

A recent Reuters article highlights Medtronic’s plan to spin off its diabetes unit, MiniMed, targeting a $7.9 billion valuation in its upcoming U.S. IPO. Seeking to raise up to $784 million, the move allows Medtronic to focus on high-margin growth markets. IPOX® Research Associate Lukas Muehlbauer provided expert commentary on the spin-off, noting that while MiniMed offers investors pure-play exposure to diabetes technology as an established business, its recent net losses mean investors will demand a clear path to profitability.

Reuters highlights Generate Biomedicines' upcoming U.S. IPO, targeting a $2.17 billion valuation. As the biotech IPO market resurges, the firm aims to raise $425 million for its AI-driven drug discovery pipeline. IPOX® Research Associate Lukas Muehlbauer provided expert commentary, noting that Generate's institutional backing and pharma partnerships offer significant credibility. However, he emphasized that investors will closely scrutinize the platform's valuation, demanding clear proof of its AI capabilities.

The IPOX® Update

The global IPO market is currently heating up with several blockbuster listings in the pipeline. SpaceX is preparing for a record-breaking $50 billion public offering, recently adding Citigroup to its underwriter lineup. In the consumer sector, Roark Capital is weighing a $2 billion IPO for Inspire Brands, the owner of Dunkin'. Meanwhile, Europe anticipates a major boost to the London Stock Exchange as Oaktree Capital Management selects banks for a £2.5 billion listing of wealth management provider Utmost Group Plc.

Elon Musk’s SpaceX is reportedly preparing to confidentially file for a U.S. initial public offering as early as March, aiming for a record-breaking June listing. This highly anticipated share sale could raise up to $50 billion and command a staggering valuation exceeding $1.75 trillion, bolstered by its recent acquisition of the artificial intelligence startup xAI. SpaceX has already aligned major financial institutions, including Bank of America, Goldman Sachs, JPMorgan, and Morgan Stanley, to lead this historic, market-defining public market debut.

The U.S. IPO market faces headwinds as Clear Street and Liftoff Mobile withdraw their listings. IPOX® Associate Lukas Muehlbauer and IPOX® VP Kat Liu noted that AI-driven volatility and crypto declines forced these moves to avoid "failed" IPO stigmas. Meanwhile, Bain Capital explores a $3 billion IPO for Dessert Holdings. In Europe, Thyssenkrupp plans a $13.5 billion materials spin-off, while UI Boustead REIT preps a $788 million Singapore float.