Upcoming IPOs

Aspen Insurance Holdings Ltd. (Ticker: AHL US) is a Bermuda-domiciled company specializing in specialty property and casualty insurance and reinsurance, offering complex, bespoke solutions with a focus on underwriting excellence. Aspen Insurance Holdings plans to list on the NYSE on May 8, 2025. Selling shareholders are planning to offer 11.0 million shares at a price range of $29.00 to $31.00, potentially raising $330.0 million (USD) if priced at the mid-point. According to the filing, Aspen Insurance Holdings Ltd. will not receive any proceeds from the IPO, as only existing shareholders are selling shares. The company has an estimated market capitalization of $2755.2 million (USD). Aspen was acquired by Apollo Global Management in February 2019; prior to the acquisition, its shares traded on the NYSE.

Auntea Jenny (Shanghai) Industrial Co., Ltd. (Ticker: 2589 HK) is a China-based company specializing in the manufacturing and distribution of non-alcoholic beverages, including grain tea, milk tea, and freshly squeezed fruit tea, alongside offering catering services. Auntea Jenny plans to list on the Hong Kong Stock Exchange (HKEX), with trading expected to commence on May 8, 2025. The company is offering 2.41 million common shares, priced in the range of HKD 95.57 to HKD 113.12 per share. This IPO aims to raise approximately HKD 272.8 million (equivalent to about $32.4 million USD). Based on the offering information, the company has a reported market capitalization of approximately $1.41 billion USD. The offering consists entirely of primary shares, indicating proceeds will go to the company. CLSA Ltd, CMBC Securities Co Ltd, and China Merchants Securities (HK) Co Ltd are among the managers handling the offering.

American Integrity Insurance Group, Inc. (Ticker: AII US) is a company headquartered in Florida, focusing on providing personal residential property insurance primarily for homeowners and condominium owners in Florida, with recent expansion into Georgia and South Carolina. American Integrity Insurance Group plans to list on the NYSE on May 8, 2025. The IPO consists of 6.875 million shares offered at a price range of $15.00 to $17.00, aiming to raise approximately $110.0 million (USD) if priced at the midpoint. Of these shares, 6.25 million are offered by the company and 625,000 by selling stockholders. Reportedly, the company will receive proceeds from the shares it sells, while selling stockholders will receive proceeds from their portion. American Integrity Insurance Group would have an estimated market capitalization of $313.31 million at launch. Founded in 2006, the company states it is the seventh largest writer of residential property insurance in Florida.

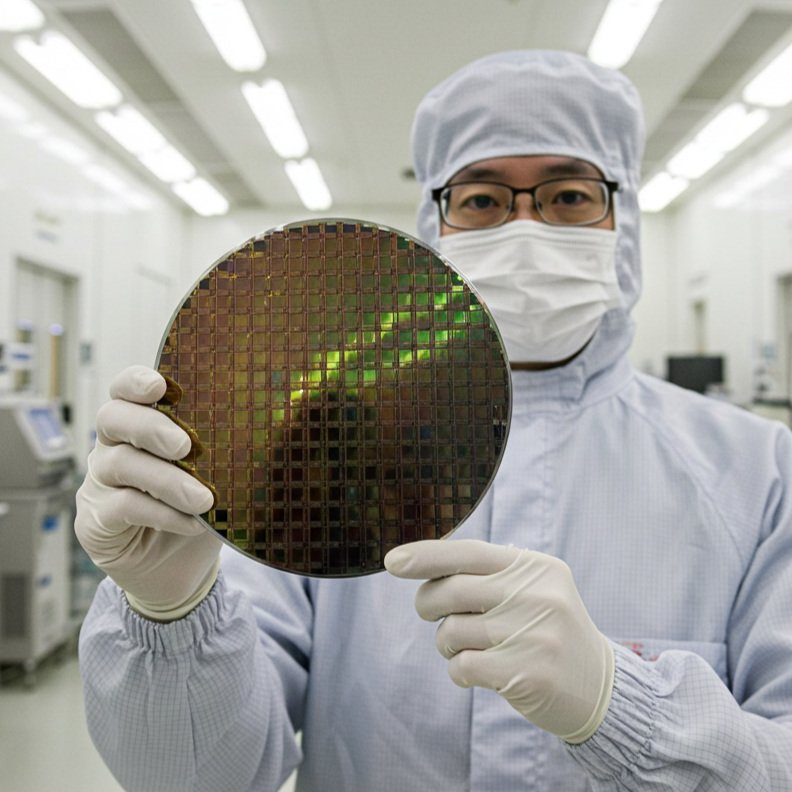

Hainan Drinda New Energy Technology Co., Ltd. (Ticker: 2865 HK), also known as Drinda, is a China-based specialized manufacturer of high-efficiency photovoltaic (PV) cells, focusing on N-type TOPCon technology. Drinda, already listed on the Shenzhen Stock Exchange (002865 CH), is pursuing a secondary H-share listing on the Hong Kong Stock Exchange (HKEX), expected to commence trading on May 8, 2025. The company is offering 63.43 million primary shares priced between HKD 20.40 and HKD 28.60 each. This offering aims to raise approximately HKD 1.81 billion (around $200 million USD). Drinda ranked first globally among specialized manufacturers for N-type TOPCon cell shipments in 2024. BOCI Asia, CCB International Capital, and CLSA are among the managers for the offering.

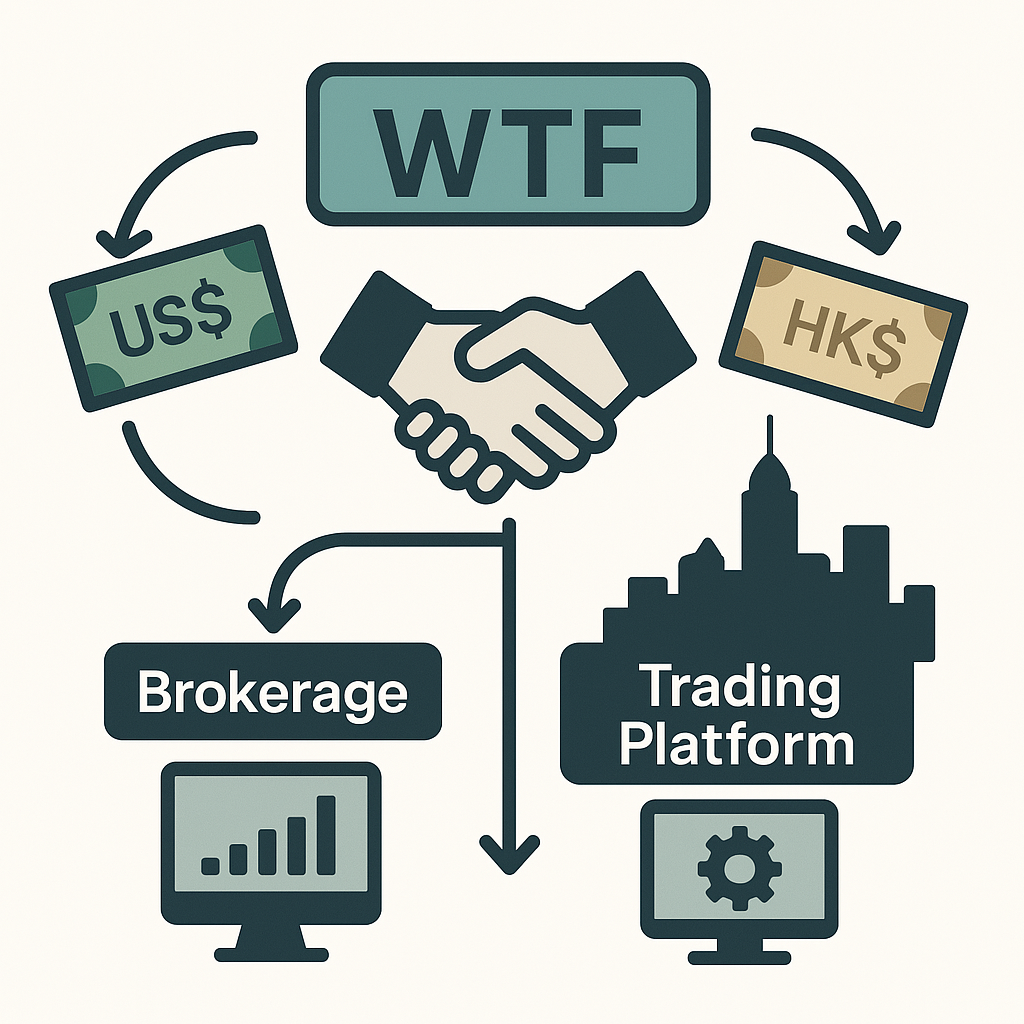

eToro Group Ltd. (Ticker: ETOR US) is an Israeli, British Virgin Islands incorporated company operating a global trading platform for retail investors. As of December 31, 2024, eToro reported having approximately 3.5 million funded accounts across 75 countries. The platform allows users to trade assets like equities, commodities, currencies, and cryptoassets, and offers educational content through eToro Academy, social trading via CopyTrader, and eToro Money services. eToro Group Ltd. plans its IPO on NASDAQ on May 14, 2025. The company intends to offer 10.0 million shares at an indicative price range of $46.00 to $50.00, aiming to raise approximately $480 million if priced at the $48.00 mid-point. The company's market capitalization is reported at approximately $3.88 billion.

PFISTERER Holding SE (Ticker: PFSE GR) is a German company specializing in developing, manufacturing, and selling products for the connection and insulation of electrical conductors for power grid interfaces. Pfisterer plans to list on the Frankfurt Stock Exchange on or around May 14, 2025, planning to offer 3.50 million new shares and approximately 1.69 million secondary shares at a price range of EUR 25.00 to EUR 29.00 per share, raising between EUR 149.2 million and EUR 173.1 million (approximately USD 170.11 million to USD 197.69 million). Pfisterer reportedly plans to use the IPO proceeds primarily to accelerate profitable growth and expand manufacturing capacities. The IPO is expected to result in a free float of up to approximately 38.5%. Berenberg and COMMERZBANK are acting as Joint Global Coordinators and Joint Bookrunners for the offering.

Qualco Group SA (Ticker: QUALCO GR (expected)) is a Greek fintech company specializing in credit management software and services for banking and non-banking sectors across over 30 countries. Qualco Group plans to list on the Athens Stock Exchange on May 15, 2025. The IPO aims to raise up to €98 million (approximately $111 million) through 10.5 million new shares (raising €52.9 million-€57.3 million for the company) and existing shares from current owners (up to €41 million), priced at €5.04-€5.46 per share. Qualco reportedly plans to use proceeds from new shares for expansion. Cornerstone investors have committed €43 million-€47 million to the offering. The company is backed by investors including Pacific Investment Management Co. (Pimco).

Green Tea Group (Ticker: 6831 HK) is a Chinese company operating casual Chinese restaurants in Mainland China, focusing on fusion cuisine at accessible price points with décor inspired by traditional Chinese culture. Green Tea Group plans to list on the HKEX on May 16, 2025, planning to offer 168,364,000 shares at HKD 7.19 per share, to raise approximately HKD 1,210.54 million. The total offer size is valued at approximately USD 156.21 million. Green Tea Group reportedly plans to use the IPO proceeds for its restaurant network expansion, with intentions to open 150 new restaurants in 2025, and a further 200 and 213 in 2026 and 2027, respectively. As of early 2025, the company operated 493 restaurants across China and Hong Kong SAR. The IPO is sponsored by Citigroup Global Markets Asia Limited and CMB International Capital Corporation Limited.

d'Alba Global (Ticker: 483650 KS) is a South Korean luxury vegan skincare (K-beauty) company known for its products featuring white truffle, including its popular d'Alba mist serum. d'Alba Global plans to list on the KOSPI exchange on May 22, 2025. The company intends to offer 654,000 shares priced between KRW 54,500 and KRW 66,300 per share. This offering aims to raise between KRW 35.6 billion and KRW 43.4 billion (approximately $25 million to $30.5 million), potentially valuing the company at up to KRW 800.2 billion (approx. $563 million). According to company statements, proceeds combined with existing capital will reportedly fund potential M&A activities in industries relevant to its core target demographic of women in their 30s and 40s.

Past IPOs

Disclaimer

The IPOX Deal Calendar may not provide a complete list of all global initial public offerings (IPOs). Deals presented are subject to minimum market capitalization requirement (around $100 million) or minimum deal size requirement (around $25 million). Informations about the companies may contain errors. Images are for illustrative purposes only. Companies pursing an IPO on Over-The-Counter (OTC) markets, best efforts offerings, closed-end fund (CEF), REITs, mainland China stock (A share) are not included. Please refer to the Legal Disclaimer.