IPOX® High Dividend 7% Strategy

A Unique Dividend Strategy Combining Income & Growth

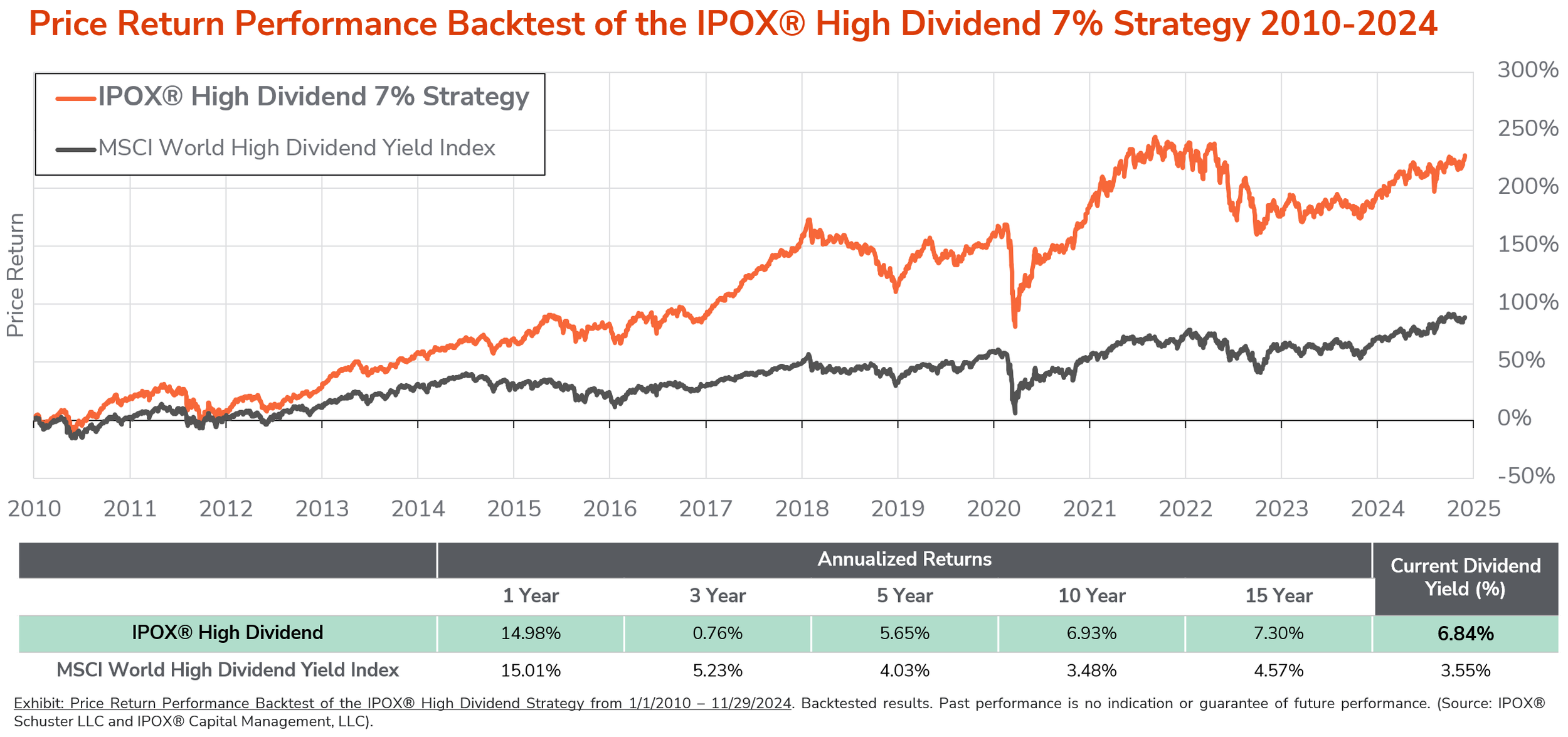

The IPOX® High Dividend 7% Strategy is a distinctive index strategy focused on identifying and tracking opportunities within the universe of high-dividend paying global IPOs, spin-offs, direct listings, de-SPACs, and IPO-driven M&A. This unique approach targets companies that offer attractive dividend yields, aiming for a target yield of 7%, alongside robust growth potential, representing a distinct equity sector with its own performance dynamics. By focusing on mispriced opportunities where initial market perceptions may underestimate long-term value, the strategy aims to deliver a compelling combination of income and capital appreciation.

Key Features and Benefits:

Income & Growth: Combines dividend income potential with new listing growth.

Early Access to Value: Targets undervalued IPOs for yield and appreciation.

Innovative Sector Exposure: Access to tech, renewables, biotech, and other growth areas.

Potential Income Stability: Dividend focus may reduce volatility compared to pure growth.

Proven IPO Selection: Leverages IPOX®'s patented technology and 20+ years of experience.

Early Insights: Benefits from IPOX® Research.

Why Track High Dividend IPOs?

High dividend IPOs present a compelling investment case:

Unique Return Profiles: New listings, particularly those with a dividend focus, can offer distinct return characteristics.

Combining Investment Philosophies: Merges the potential of high-growth new listings with the income potential of dividend-paying stocks.

Broad Appeal: Appeals to investors seeking both income and growth characteristics in a portfolio.

For more information about the IPOX® High Dividend 7% Strategy, including licensing opportunities, please contact info@ipox.com.