Zenergy Battery Tech

Zenergy Battery Tech (Ticker: 3677 HK) is a China-domiciled company specializing in the research, development, production, and sales of lithium-ion battery products, primarily for electric vehicles (EV) and energy storage systems (ESS). Zenergy provides integrated battery solutions including cells, modules, and packs.

The company plans its IPO on the Hong Kong Stock Exchange Main Board on April 14, 2025, offering shares at HKD 8.27 each. This H-Share listing involves a global offering expected to raise approximately HKD 1.005 billion (USD 129.3 million), based on the total estimated offer shares and price, with 10% allocated to the Hong Kong public offer. Zenergy held a 1.8% market share among EV battery manufacturers in China by installation capacity in 2024. Sponsors include CMB International Capital Limited and China International Capital Corporation Hong Kong Securities Limited.

Duality Biotherapeutics

Duality Biotherapeutics Inc (Ticker: 9606 HK) is a China-based biotechnology company operating in the biomedical/gene industry, focusing on antibody-drug conjugates. Duality Biotherapeutics plans its IPO on the Hong Kong Stock Exchange on April 15, 2025. The company is offering 15.07 million shares, with an indicative price range of HKD 94.60 to HKD 103.20 per share. It aims to raise up to HKD 1.56 billion (approximately USD 200.7 million). The final offer price is expected to be determined on April 11, 2025. Cornerstone investors have reportedly agreed to subscribe for up to USD 65 million worth of shares. Key managers involved in the offering include CICC, BOCI Asia, and CMB International.

Chagee Holdings

Chagee Holdings Ltd. (Ticker: CHA US) is a Chinese, Cayman Islands-incorporated holding company operating the CHAGEE premium tea drinks brand. Chagee Holdings plans to list on the NASDAQ on April 17, 2025, offering 14.7 million shares at a price range of $26.00 to $28.00 per share, aiming to raise approximately $396.0 million USD. The company operates the largest store network among premium freshly-made tea brands in China, with over 6,400 teahouses globally as of Dec 31, 2024. The estimated market capitalization is $5.0 billion USD. The company conducts its Chinese operations via subsidiaries and does not use a VIE structure. The IPO is managed by Citigroup, Morgan Stanley, Deutsche Bank Securities, and CICC.

OMS Energy Technologies

OMS Energy Technologies, Inc. (Ticker: OMSE US), a Cayman Islands-incorporated company with headquarters in Singapore, is a growth-oriented manufacturer of surface wellhead systems (SWS) and oil country tubular goods (OCTG) for the oil and gas industry. The company plans to list on NASDAQ on April 17, 2025. OMS Energy Technologies is offering 5.6 million ordinary shares at a price range of $8.00-$10.00, aiming to raise $50.0 million. The company serves onshore and offshore exploration and production activities, primarily in the Asia Pacific and MENA regions. Roth Capital Partners is the manager for the offering.

AIRO Group

AIRO Group Holdings Inc. (Ticker: AIRO US) is a United States company specializing in aerospace, autonomy, and air mobility platforms. AIRO Group Holdings plans to list on the NASDAQ on April 17, 2025, planning to offer 5.0 million shares at a price range of $14.00 to $16.00 per share, aiming to raise $75.0 million USD. The company focuses on drones, avionics, training, and electric air mobility solutions for the aerospace and defense market. According to sources, the company's estimated market capitalization post-IPO is approximately $373.31 million USD. The offering is managed by Cantor Fitzgerald, BTIG, Mizuho, and Bancroft Capital.

Digital Grid

DIGITAL GRID Corporation (Ticker: 350A JP), a Japanese company, operates the Digital Grid Platform (DGP), a marketplace enabling companies to directly trade electricity and procure environmental attributes like renewable energy certificates. The company also provides aggregation services for distributed power sources and offers decarbonization-related consulting and learning services. DIGITAL GRID plans to list on the Tokyo Stock Exchange Growth Market on April 22, 2025. The offering consists of 1.827 million shares (a mix of new and existing) priced between JPY 4,400 and JPY 4,570, aiming to raise approximately USD 56.55 million (approx. JPY 8.48 billion). The estimated market capitalization at IPO is USD 183.64 million (approx. JPY 27.55 billion). Daiwa Securities is the lead underwriter.

SmartStop Self Storage REIT

SmartStop Self Storage REIT, Inc. (Ticker: SMST US), a US-based internally managed Real Estate Investment Trust, specializes in owning and operating self-storage facilities across the United States and Canada. SmartStop plans to list on the NYSE on April 2, 2025. The IPO consists of 27.0 million shares offered within a price range of $28.00 to $36.00, aiming to raise approximately $864.0 million. As the 11th largest self-storage owner/operator in the U.S., its portfolio includes 159 properties. The estimated market capitalization is $1.64 billion. The offering is managed by Citigroup, Wells Fargo Securities, KeyBanc Capital Markets, and BMO Capital Markets.

GRK Infra

GRK Infra Oyj (Ticker: GRK FH), a Finnish infrastructure construction group operating in Finland, Sweden, and Estonia, plans to list on Nasdaq Helsinki on April 2, 2025 (pre-list). GRK is offering 2.97 million new shares at a price of EUR 10.12 per share, aiming to raise EUR 30.1 million (approximately USD 32.64 million). The company will use the IPO proceeds to execute its growth strategy, including geographic expansion and strengthening its capital structure. Carnegie Investment Bank and Nordea are managing the IPO. The offering also includes a secondary share sale by existing shareholders. GRK's core business is in civil engineering, road and rail construction, and environmental technology.

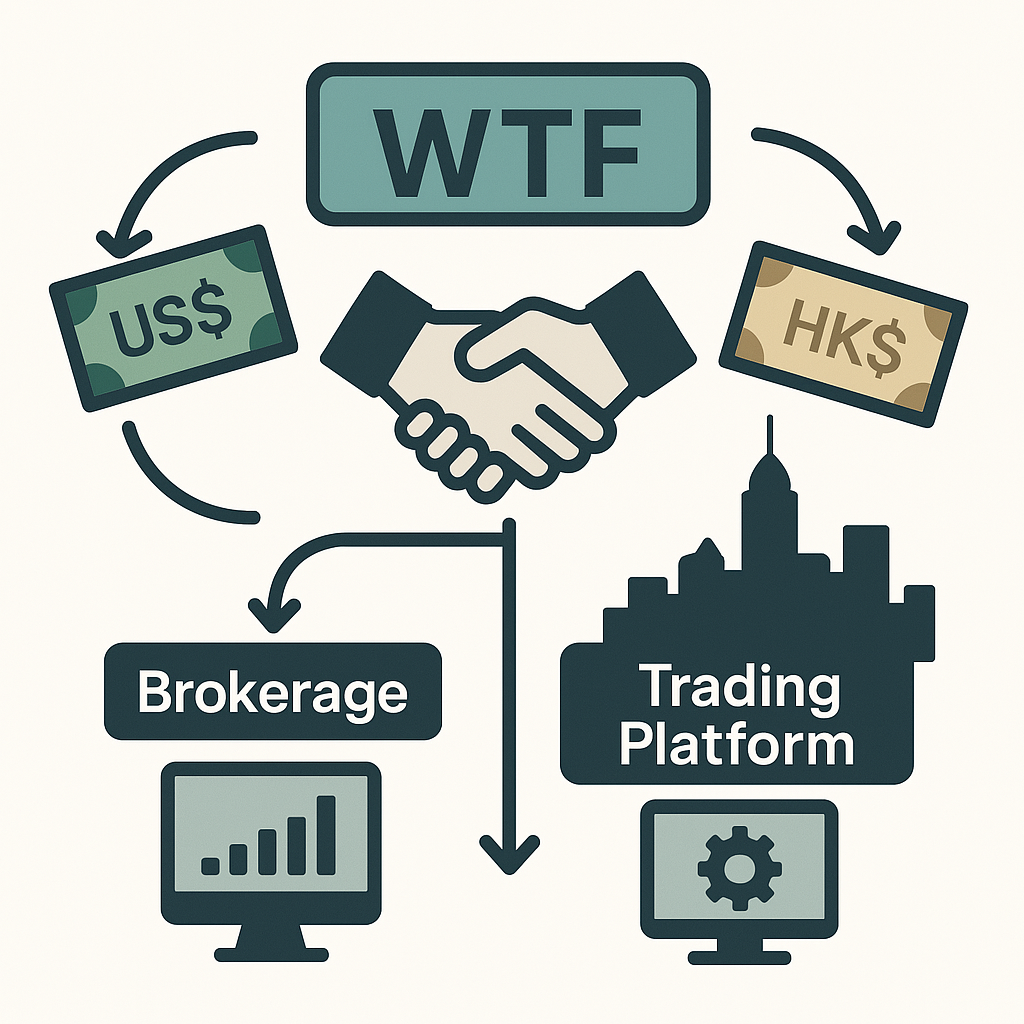

Waton Financial

Waton Financial Ltd. (Ticker: WTF US), a British Virgin Islands-incorporated holding company providing securities brokerage and financial technology services, primarily through its Hong Kong subsidiaries, is expected to list on NASDAQ on April 1, 2025. Waton Financial is offering 5.0 million shares with a price range of $4.00 to $6.00, aiming to raise $25.0 million. Waton Securities International Limited (WSI) provides brokerage services for securities listed on exchanges like HKEX and NYSE/NASDAQ, margin financing, and bond distribution. Waton Technology International Limited (WTI) focuses on software licensing for trading platforms. Waton Financial reported revenues of $10.8 million and net income of $1.0 million for the 12 months ended September 30, 2024. Market capitalization is estimated at $241.03 million. Cathay Securities is managing the offering.

Bgin Blockchain

Bgin Blockchain Ltd. (Ticker: BGIN US), a Cayman Islands-incorporated company with operations in Singapore, Hong Kong, and the U.S., designs and sells cryptocurrency mining equipment, focusing on alternative currencies. The company plans to list on NASDAQ on April 1, 2025. The IPO consists of 6.3 million shares with a price range of $7.00-$9.00, aiming to raise $50.0 million. Bgin's subsidiaries design and sell mining machines with proprietary ASIC chips for mining cryptocurrencies. They also offer miner hosting services. The underwriters are Chardan and The Benchmark Company. For the fiscal year ended December 31, 2023, and the six months ended June 30, 2024, the company sold 67,998 and 47,252 mining machines, respectively. The company reported revenue of $392.23 million and net income of $201.94 million for the last 12 months, with operations heavily dependent on KAS coins. Market cap is $652 million.

Newsmax

Newsmax Inc (Ticker: NMAX US), a United States-based internet content and news provider, plans to list on the New York Stock Exchange on March 31, 2025. Newsmax completed its IPO under Regulation A+, raising $75 million through the sale of 7.5 million Class B Common Stock shares at $10.00 per share. Newsmax, founded in 1998 and operating the Newsmax channel since 2014, is now reportedly the fourth highest-rated cable news channel in the U.S. According to the CEO, the IPO proceeds, combined with previous private funding, will be used to "accelerate growth initiatives, expand programming, and enhance digital presence." Digital Offering LLC acted as the lead selling agent.

CoreWeave

CoreWeave, Inc. (Ticker: CRWV US), a company specializing in cloud computing infrastructure and services for AI, plans to list on NASDAQ on March 28, 2025. Describing itself as "The AI Hyperscaler," CoreWeave offers a proprietary cloud platform optimized for AI workloads. The IPO consists of 49 million shares (47.18 million offered by the company and 1.82 million by selling stockholders) with a price range of $47.00 to $55.00, aiming to raise approximately $2.5 billion. Its market cap is estimated at $24.15 billion. The company was founded in 2017. CoreWeave's platform is used by major AI companies, including Cohere, IBM, Meta, Microsoft, Mistral, and NVIDIA. The lead underwriters are Morgan Stanley, J.P. Morgan, Goldman Sachs, Barclays, Citigroup, MUFG, Deutsche Bank Securities, Jefferies, Mizuho, Wells Fargo Securities and BofA Securities.

Process Technologies Group

Process Technologies Group, Inc. (Ticker: 339A JP), a Japanese company providing digital solutions and digital engineering services for major manufacturers, plans to list on the Tokyo Stock Exchange Growth Market on March 28, 2025. The IPO offering consists of 3,807,200 shares (707,200 primary and 3,100,000 secondary) with an indicative price range of ¥1,890 - ¥1,950 (USD 12.76 - 13.17). The offering aims to raise approximately USD 49.51 million. An overallotment option of 571,000 shares is available. The company was established in 2020. The lead underwriter is Nomura. Major shareholders, predominantly venture capital funds managed by JAFCO (JAFCO SV6), are the sellers in this offering. Proceeds from sale of new shares will go to company.

Asker Healthcare

Asker Healthcare Group AB (Ticker: ASKER SS), a Swedish company operating in the medical labs and testing services industry, plans to list on the Stockholm Stock Exchange on March 27, 2025. The IPO offering consists of 126.95 million shares (21.43 million primary and 105.52 million secondary) at a fixed price of SEK 70 (USD 6.85), aiming to raise SEK 8.89 billion (USD 869.14 million). An overallotment option of 19.04 million shares also exists. The IPO could give the company an implied market valuation of SEK 26.8 billion (approximately USD 2.6 billion). Cornerstone investors have committed to acquiring shares worth SEK 5.8 billion. Majority owner Nalka Invest AB intends to retain a majority stake. The company intends to use about SEK 1.2 from IPO proceeds billion to refinance existing credit facilities. BNP Paribas, Carnegie, Citi, Danske Bank and Nordea are managing the offering.

Dynamic Map Platform

Dynamic Map Platform Co., Ltd. (Ticker: 336A JP), a Japanese company specializing in high-precision 3D map data (HD maps) for autonomous driving and related location solutions, plans to list on the Tokyo Stock Exchange Growth Market on March 27, 2025. The IPO offering is for 6.16 million shares (4.81 million primary and 1.35 million secondary) with an indicative price range of ¥1,130-¥1,200 (USD 7.63 - 8.10). The upsized IPO aims to raise up to ¥7.4 billion (USD 50.3 million). An overallotment option of up to 924,000 primary shares exists. The company was incorporated in 2016. Key shareholders include INCJ and GeoTechnologies, which are the sellers in this offering, proceeds reportedly go to them. SMBC Nikko is the bookrunner. The Market Cap is USD 148.45 million.

Nanshan Aluminum

Nanshan Aluminum International (Ticker: 2610 HK), a leading high-quality alumina manufacturer in Southeast Asia, plans to list on the Hong Kong Stock Exchange on March 25, 2025. The IPO offering is for a price range between HKD 26.6-31.5 per share, with a lot size of 100 shares. The company is among the top three major alumina production enterprises in Southeast Asia. The deal aims to raise approximately HKD 2.58 Billion (USD 329.90 million). Key underwriters include Huatai Financial Holdings (Hong Kong) Limited. The indicated market capitalization is approximately USD 2 billion.

Umm Al Qura for Development and Construction Co.

Umm Al Qura for Development and Construction Co. (UQDC) (Ticker: 4325 SA), the owner and developer of the MASAR Destination in Mecca, Saudi Arabia, will begin trading on the Saudi Exchange's Main Market (TASI) on March 24, 2025. The company offered 130.79 million shares, representing 9.09% of its post-IPO capital, at a final offer price of SAR 15 (USD 4) per share. This implies a market capitalization of approximately SAR 21.58 billion (approximately USD 5.75 billion). 10% were for retail investors and 90% to institutions. The retail offering was 20 times oversubscribed, and the institutional offering was 241 times oversubscribed. The company, backed by the Public Investment Fund (PIF) and General Organization for Social Insurance (GOSI), raised $523 million (SAR1.96 billion) from the share sale. The Masar project, where company is a developer is a large redevelopment project, including residential units, hotel keys and a large retail area.

Yupi Indo Jelly

Yupi Indo Jelly Gum Tbk PT (Ticker: YUPI IJ), an Indonesian confectionery manufacturer and the ASEAN gummy candy market leader, plans to list on the Indonesia Stock Exchange on March 25, 2025. The IPO involves offering 854.45 million shares (30% primary, 70% secondary), representing 10% of the company's capital. The shares were priced at IDR 2,390 (USD 0.1463) per share, within the indicative range of IDR 2,100 - 2,500 (USD 0.13-0.15), raising IDR 2.04 trillion (USD 124.98 million). The company will receive IDR 612.69 billion from primary share offering, the rest is going to selling shareholder, PT Sweets Indonesia. Company will use the funds for capital expenditures (72% - new factory) and working capital (28% - business expansion). CIMB Niaga Securities and Mandiri Sekuritas PT are the underwriters. The market capitalization is IDR 20.42 trillion (USD 1.25 billion).

Visen Pharma

Visen Pharma (Ticker: 2561 HK), a late-stage biopharmaceutical company focused on endocrinology treatments in China (including Hong Kong, Macau, and Taiwan), and plans to list on the Hong Kong Stock Exchange on March 21, 2025. The IPO offering is for 9.9 million shares at an offer price range of HKD 68.44 - 75.28, with aims to raise approximately between HKD 677.56 - 745.27 million (around USD 92 million). The company has one core product, lonapegsomatropin (a once-weekly growth hormone for pediatric growth hormone deficiency, or PGHD) and two other pipeline drugs, TransCon CNP (for achondroplasia) and palopegteriparatide (for hypoparathyroidism). The IPO Proceeds will be used to develop their pipeline of drugs. Key underwriters include Jefferies Hong Kong Limited and Morgan Stanley Asia Limited. The indicated market cap range is approximately USD 1 billion.

TXR Robotics

TXR Robotics (Ticker: 484810 KS), a South Korean company specializing in conveyor equipment manufacturing and logistics automation solutions, plans to list on the KOSDAQ on March 20, 2025. The IPO offering consists of 3,075,400 new shares at a confirmed price of KRW 13,500 (within the indicative range of KRW 11,500-13,500), aiming to raise KRW 41.52 billion (USD 28.58 million based on offer size of 28.58M in table). The company provides logistics automation equipment like wheel sorters, flap sorters, and tilt-tray sorters, as well as robot automation solutions including AMRs, AGVs, and mobile manipulators for logistics and factory automation. The underwriters are NH Investment & Securities, Shinhan Investment & Securities, and Eugene Investment & Securities. Institutional investors showed strong demand with an oversubscription rate of 862.62:1.

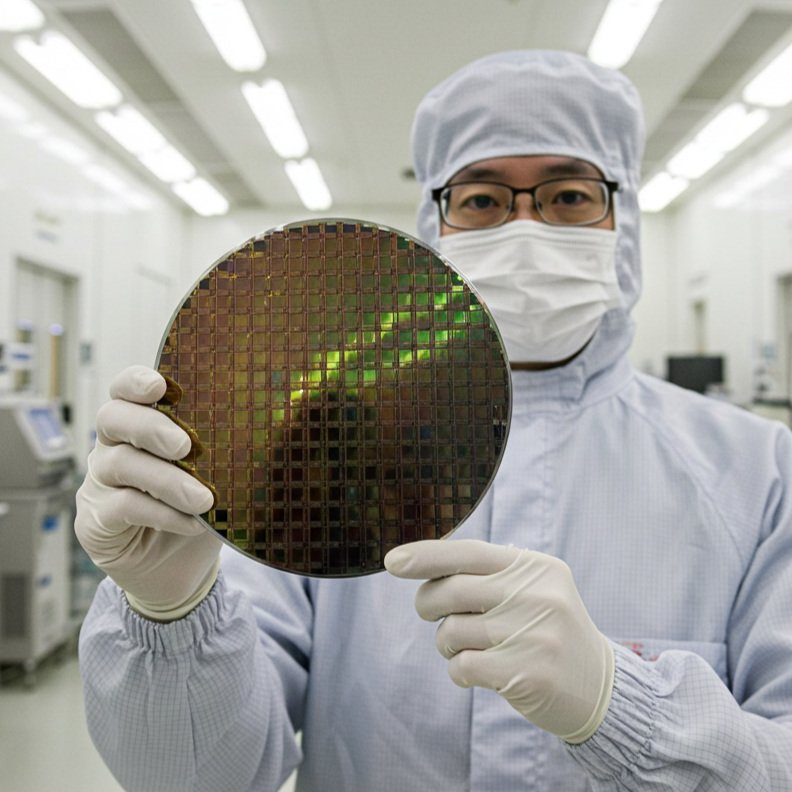

JX Advanced Metals

JX Advanced Metals Corporation (Ticker: 5016 JP), a Japanese company specializing in high-purity metals and compound semiconductor wafers for the microelectronics industry, plans to list on the Tokyo Stock Exchange on March 19. JX Advanced Metals, a subsidiary of Eneos Holdings, is offering 465,160,100 existing shares at an indicative price of ¥862 per share, aiming to raise approximately ¥400.9 billion (USD 3 billion).

The IPO proceeds will go to the parent company, Eneos Holdings, which reportedly plans to use the funds for shareholder returns and decarbonization investments. Joint global coordinators on the deal are Daiwa Securities Group, JPMorgan Chase & Co., Morgan Stanley and Mizuho Financial Group. This IPO is the largest in Japan since SoftBank Corp's 2018 listing.

Entaj Industrial Services

Entaj Industrial Services Co. (Ticker: ENTAJ AB) is a Saudi Arabian poultry company operating under the brand name "Entaj". It is the 5th largest operator in the Kingdom's poultry market, holding a 7.6% market share. Entaj is offering 30% of its share capital (9 million shares) in an IPO on the Saudi Stock Exchange (Tadawul) Main Market (TASI). The firm is selling 9.00M shares at the price of SAR 50 (USD $13.33). The total offer size is SAR 450.00M (USD $119.97 million). The offering is managed by SNB Capital. The institutional book-building process is complete, with the final offer price set at SAR 50 per share, and the order book was 208.4x oversubscribed. The retail offering period will run from February 26 to February 27, 2025. 10% of the offered shares (900,000 shares) are allocated to retail investors. The expected listing date is March 17, 2025.

Seoul Guarantee Insurance

Seoul Guarantee Insurance Co. (Ticker: 031210 KS) is a South Korean state-owned company operating in the insurance industry.

Seoul Guarantee Insurance Co. is expected to start trading on the KOSPI on March 14, 2025. The firm is selling 6,982,160 shares at KRW 26,000, set at the bottom end of the initially guided range. This offering represents a 10% stake in SGI being sold by the KDIC, which controls 93.85% of the insurance company. The total offer size is KRW 181.5 billion ($125.4 million USD), with an expected market capitalization of KRW 1.82 trillion ($1.26 billion USD). The offering is managed by Samsung Securities Co. and Mirae Asset Securities Co.

The IPO has been re-attempted after a previous attempt in 2023 was dropped due to tepid investor response. The current IPO's target valuation has been slashed by about 40% compared to the 2023 attempt. To attract investors, the company has committed to paying KRW 200 billion (~$138.2 million USD) in dividends for 2024, equivalent to approximately 11% dividend yield for IPO subscribers, and plans to maintain this payout level through 2027.

Asyad Shipping

Asyad Shipping (Ticker: ASCO OM), an Omani shipping company and subsidiary of state-controlled logistics firm Asyad Group, is expected to list on the Muscat Stock Exchange on or around March 12, 2025. The IPO raised approximately $333 million, pricing at the top end of the indicative range. The company's market capitalization upon listing will be about $1.7 billion. Asyad Group sold at least 20% of Asyad Shipping's total issued share capital, over 1 billion shares. 75% of shares in IPO were for institutional investors. Anchor investors include a unit of the Qatar Investment Authority and a local investment firm, Mars Development and Investment, owned by the Omani Government. Established in 2003, Asyad Shipping operates a fleet of around 90 ships.

Alpha Data

Alpha Data PJSC (Ticker: Pending), a United Arab Emirates-based digital transformation provider and system integrator, expected to list on the Abu Dhabi Securities Exchange (ADX) on March 11, 2025. The IPO involved offering 400 million shares, representing 40% of the company's share capital, at a price range of AED 1.45 to AED 1.50 per share. The final offer price was set at AED 1.50, raising AED 600 million (USD 163.38 million). The offering consisted entirely of secondary shares. The subscription period ran from February 20 to February 25, 2025, with the final price announced on February 26, after a book-building process.

Röko

Röko AB (Ticker: ROKOB SS), a Swedish investment company, planning to list on the Stockholm Stock Exchange on March 11, 2025. The IPO involves the sale of 2.58 million existing Class B shares at a price of SEK 2,048 (USD 194.53), aiming to raise SEK 5.28 billion (USD 501.92 million). The offering consists entirely of secondary shares from existing shareholders, including Mellby Gard Intressenter AB and Santhe Dahl Invest AB. The IPO could give the company an implied market capitalization of almost SEK 30 billion (approx. USD 2.85 billion). 60 cornerstone investors have committed to 95% of the offering. The remaining shares will be offered to retail and institutional investors. Skandinaviska Enskilda Banken AB is the lead manager, with Carnegie Investment Bank AB and Danske Bank A/S also involved.

Chifeng Gold

Chifeng Jilong Gold Mining Co Ltd (Ticker: 6693 HK), a Chinese gold mining company, plans to list on the Hong Kong Stock Exchange on March 10, 2025. The IPO offering is for 205.65 million shares at a price range of HKD 13.72 - 15.83, aiming to raise HKD 3.26 billion (USD 418.72 million). The company operates seven gold and polymetallic mines in China, Laos, and Ghana. A greenshoe option of 15% (30.85M shares) exists. The company highlights its rapid growth, ranking fifth among Chinese gold producers in terms of both resources and 2023 production, and low all-in sustaining costs (AISC). Key underwriters include ABCI, BOCI, CCB International, CICC, and CLSA. The market cap is estimated to be around USD 3.5 billion.

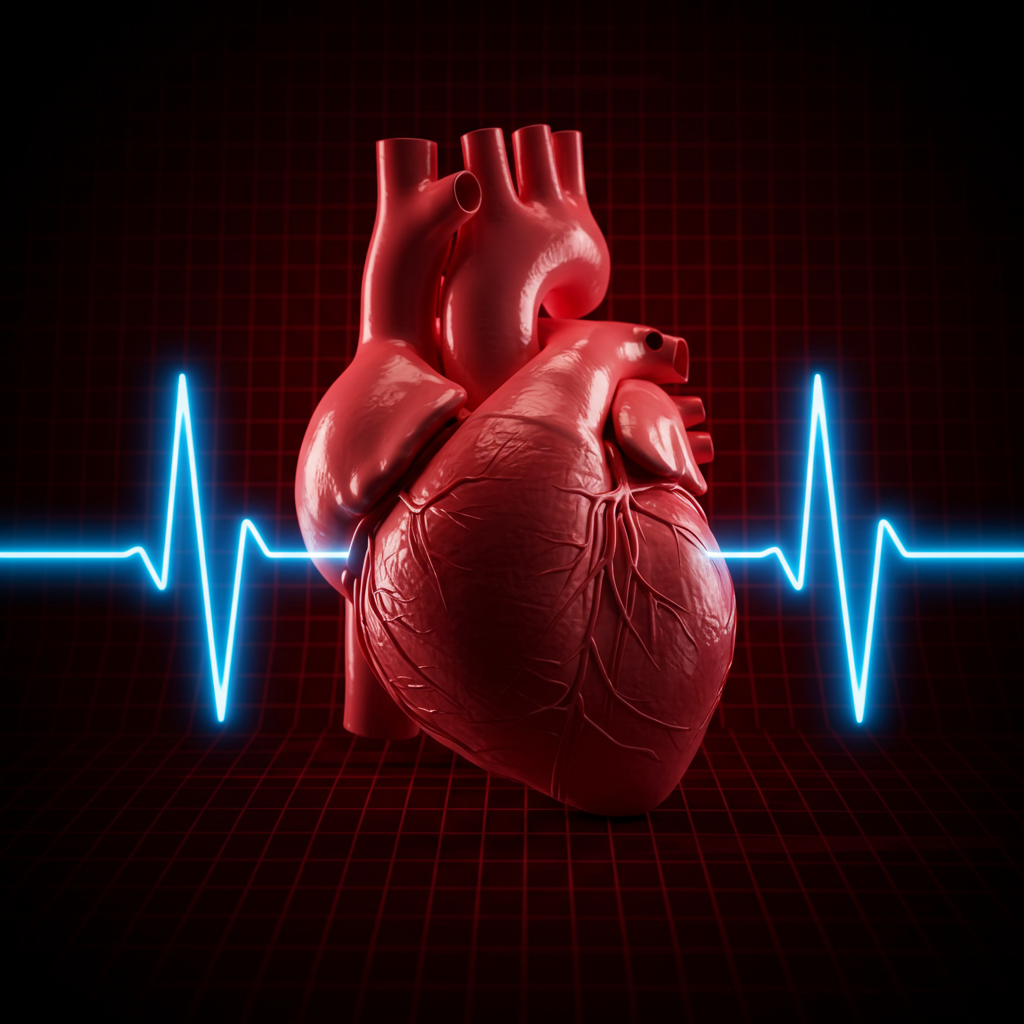

Kestra Medical Technologies

Kestra Medical Technologies, Ltd. (Ticker: KMTS US), a Bermuda-incorporated company specializing in wearable cardioverter defibrillators (WCDs), plans to list on NASDAQ on March 6, 2025. Kestra’s IPO was upsized from 10.0 million shares to 11.88 million, and priced at $17, above a price range of $14.00-$16.00, aiming to raise $202 million. The company's ASSURE WCD product, launched in 2022, is used in over 550 U.S. hospitals.

The offering is managed by BofA Securities, Goldman Sachs, Piper Sandler, Wells Fargo Securities and Stifel. Kestra reported revenue of $45.8 million and a net loss of $84.8 million for the 12 months ended Oct. 31, 2024, market cap is $714.75 million.

Mixue Group

Mixue Group (Ticker: 2097 HK) is a Chinese fruit and tea drinks, coffee, and ice cream chain, considered the world's largest fast-food chain by store count, with 45,000 stores in mainland China and 11 other countries, primarily through a franchise network.

Mixue Group is seeking to raise HK$3.45 billion (USD $443 million) in a Hong Kong IPO, with trading expected to start on March 3, 2025. The firm initially targeting to raise up to $1 billion, but scaled back the IPO size. Five cornerstone investors have committed to purchasing $200 million worth of stock. The firm is selling 17.06 million shares at the price of HK$202.5 each (USD $26.02). The expected Market Capitalization at offer is $9.8 billion. The offering is managed by CMB International Capital Ltd, China International Capital Corp HK Securities, GF Securities Hong Kong Brokerage Ltd, Goldman Sachs (Asia), Huatai Financial Holdings Hong Kong Ltd, and ICBC International.

Pantech Global

Pantech Global Bhd (Ticker: PGLOBAL MK) is a Malaysian company operating in the steel industry, specifically as a manufacturer of pipe fittings and welded pipes.

Pantech Global is expected to list on the Main Market of Bursa Malaysia on March 3, 2025. The total offer size is MYR 178.32 million (USD $39.89 million). The offering is managed by Alliance Islamic Bank Bhd. The IPO was heavily oversubscribed, receiving RM663.63 million in retail interest. The public portion of 21.25 million shares was oversubscribed by 44.93 times. The proceeds will be used for expansion, capital expenditure (74%), working capital (13%), loan repayment (8%) and listing expenses.

Tential

TENTIAL Inc. (Ticker: 325A) is a Japanese company that operates the "TENTIAL" brand, focusing on casual clothing, sandals, socks, insoles, bedding and sleep accessories in the premium segment. The company says that it emphasizes a science-backed approach, incorporating athlete feedback and aiming for products with demonstrable functional benefits.

TENTIAL Inc. will list on February 28, 2025, on the Tokyo Stock Exchange's Growth Market. The firm selling shares at the price yet to be determined. The expected Market Capitalization at offer is $85.52 million. The total offer size is $35.78 million. The offering is managed by Nomura.

Qualisys

Qualisys Holding AB (Ticker: QSYS SS) is a Swedish technology company specializing in 3D motion capture systems. They offer complete solutions including high-speed cameras, software, and accessories. Their primary markets are Life Sciences, Sports, Engineering, and Entertainment.

The company is going public with an IPO on Nasdaq First North Premier Growth Market. Qualisys Holding AB announced the IPO on February 13, 2025, and it is expected to start trading on February 21, 2025. The firm is selling 4.51 million shares at the price of SEK 76.00. The total offer size is SEK 342.82 million (USD $31.78 million). All offered shares are existing shares sold by Selling Shareholders (Vätterledens Invest, Cilix AB, Fredrik Müller Invest AB, and MLOne AB). Qualisys will not receive proceeds from the offering.

Orum Therapeutics

Orum Therapeutics Inc. (Ticker: 475830 KS) is a South Korean biotechnology company that develops novel therapeutics, focusing on ADC (Antibody-Drug Conjugate) and TPD (Targeted Protein Degradation) technologies. The lead product candidate, ORM-6151 was licensed to Bristol-Myers Squibb in 2023. In July 2024, Orum Therapeutics entered into a technology transfer agreement with Vertex Pharmaceuticals, potentially worth up to $310 million per target for up to three targets.

Orum Therapeutics Inc. is expected to start trading on the KOSDAQ on February 14, 2025. The firm is selling 2.5 million shares, all primary, at a finalized price of KRW 20,000, which was below the initially proposed range of KRW 24,000-30,000. The expected Market Capitalization at offer is KRW 418.58 billion (USD $288.28 million). The total offer size is KRW 50 billion (USD $34.44 million), reduced from an initial filing amount of KRW 75 billion. The offering is managed by Korea Investment & Securities Co.

Northpointe Bancshares

Northpointe Bancshares Inc. (Ticker: NPB) is a bank holding company incorporated in Michigan, backed by private equity firm Castle Creek. It operates primarily through its wholly-owned banking subsidiary, Northpointe Bank, offering a nationwide mortgage purchase program, residential mortgage loans, digital deposit banking to retail customers, and custodial deposit services to loan servicing clients.

Northpointe Bancshares Inc. will list on February 14, 2025, on NYSE. The firm is selling 8.8 million shares at the price range of $16.00-$18.00, with the company offering 7.35 million shares and selling stockholders offering 1.47 million shares. The expected Market Capitalization at offer is $561.72 million. The total offer size is $149.9 million. The offering is managed by Keefe, Bruyette & Woods (A Stifel Company).

Ferrari Group

Ferrari Group PLC (Ticker: FERGR NA) is a UK-based company operating in the transportation/services industry, specializing in luxury logistics, particularly the transportation and handling of jewelry and other luxury items. The company, established in Italy in 1959, is not related to the automaker Ferrari NV.

Ferrari Group PLC is expected to start trading on Euronext Amsterdam on February 13, 2025. The firm is selling 22.8 million shares, representing a 25% stake from the controlling Deiana family, at a price range of EUR 8.00-9.00 (USD $8.39-$9.44). The expected Market Capitalization at offer is up to EUR 822 million (approximately $888 million). The total offer size is EUR 205.20 million (USD $215.23 million). The offering is managed by ABN Amro Bank NV, Goldman Sachs Bank Europe SE, and Jefferies GmbH.

Aardvark Therapeutics

Aardvark Therapeutics (Ticker: AARD) is a clinical-stage biopharmaceutical company focusing on developing small-molecule therapeutics to activate innate homeostatic pathways for the treatment of metabolic diseases, including obesity. Their lead product candidate, ARD-101, is an oral gut-restricted small-molecule agonist of certain TAS2Rs for which they have initiated a Phase 3 clinical trial for hyperphagia associated with the genetic disorder Prader-Willi Syndrome (PWS). They also intend to evaluate ARD-101 in a Phase 2 clinical trial for hyperphagia associated with hypothalamic obesity, a rare condition that can be congenital or acquired through brain injury.

Aardvark Therapeutics will list on February 14, 2025, on NASDAQ. The firm is selling 5.9 million shares at the price range of $16.00-$18.00. The expected Market Capitalization at offer is around $363 million. The total offer size is $100 million. The offering is managed by Morgan Stanley/BofA Securities/Cantor/RBC Capital Markets.