The IPOX® Watch: Bausch + Lomb (BLCO US)

COMPANY DESCRIPTION

Founded in 1853, Bausch + Lomb Corporation is the pure play eye health business spinoff of Bausch Health (BHC, formerly Valeant Pharmaceuticals). Bausch + Lomb develops, manufactures, and markets a diverse portfolio in a) vision care/consumer health care (contact lenses, lens care products, OTC eye drops, eye vitamins), b) ophthalmic pharmaceuticals (prescription products for post-operative treatments and treatments for a number of eye conditions), and c) surgical (medical device equipment, consumables, and instrumental tools and technologies).

BUSINESS MODEL

Bausch + Lomb generates revenue from product sales, licensing, co-promotion of products, and contract service.

IPO HISTORY

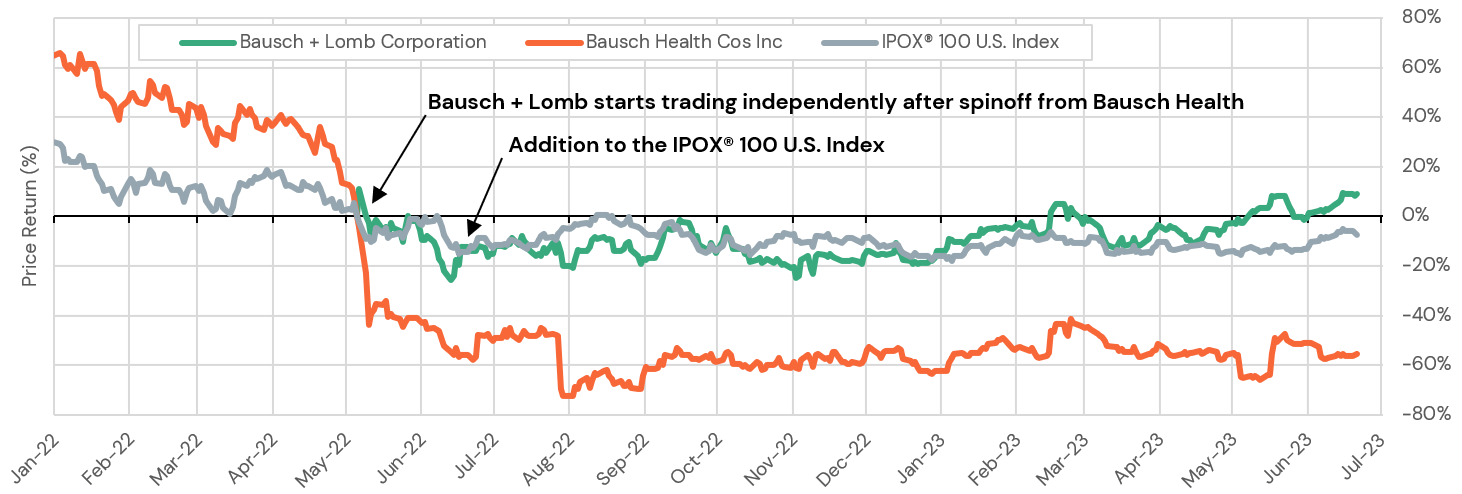

On 05/06/2022, Bausch + Lomb began trading on the NYSE led by Morgan Stanley. The global eye health company offered 35 million shares, all from the selling shareholder (BHC) at $18.00 per share, below its expected price range ($21-$24). Bausch + Lomb was valued at ca. $6.3 billion at offer. The shares opened at $18.50 and closed the first day higher at $20.00 (+11.11%).

BHC remains as the controlling shareholder after the completion of the offering. Bausch + Lomb was also listed on the Toronto Stock Exchange (TSX)

Bausch + Lomb was included in the IPOX® 100 U.S. Index (ETF: FPX US, FPX LN) on 06/20/2022 and has gained +23.68% since addition to the indexes.