The IPOX® Watch - IPO Pre-Launch Analysis: Cava Group, Inc.

COMPANY DESCRIPTION

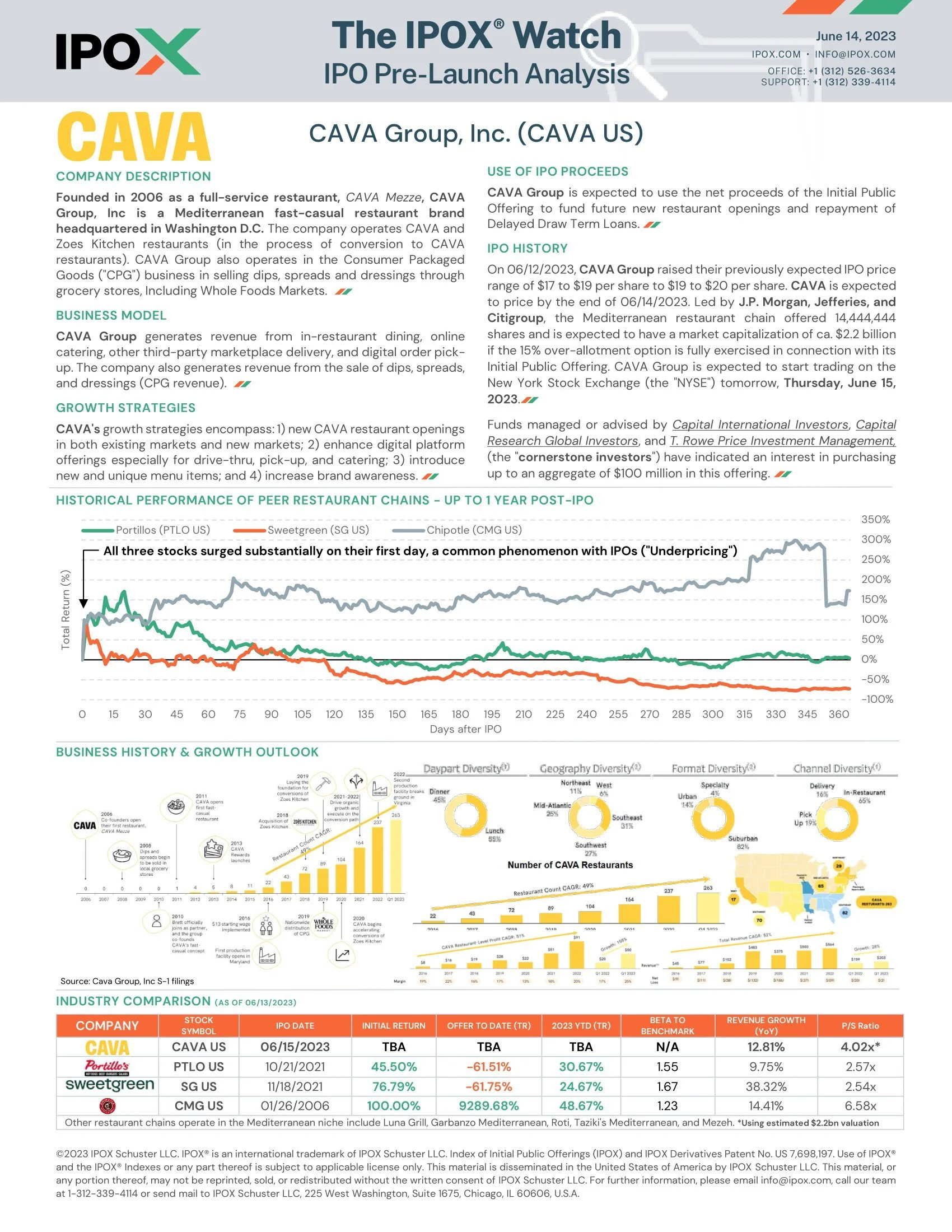

Founded in 2006 as a full-service restaurant, CAVA Mezze, CAVA Group, Inc is a Mediterranean fast-casual restaurant brand headquartered in Washington D.C. The company operates CAVA and Zoes Kitchen restaurants (in the process of conversion to CAVA restaurants). CAVA Group also operates in the Consumer Packaged Goods ("CPG") business in selling dips, spreads and dressings through grocery stores, Including Whole Foods Markets.

BUSINESS MODEL

CAVA Group generates revenue from in-restaurant dining, online catering, other third-party marketplace delivery, and digital order pick-up. The company also generates revenue from the sale of dips, spreads, and dressings (CPG revenue).

GROWTH STRATEGIES

CAVA's growth strategies encompass: 1) new CAVA restaurant openings in both existing markets and new markets; 2) enhance digital platform offerings especially for drive-thru, pick-up, and catering; 3) introduce new and unique menu items; and 4) increase brand awareness.

USE OF IPO PROCEEDS

CAVA Group is expected to use the net proceeds of the Initial Public Offering to fund future new restaurant openings and repayment of Delayed Draw Term Loans.

IPO HISTORY

On 06/12/2023, CAVA Group raised their previously expected IPO price range of $17 to $19 per share to $19 to $20 per share. CAVA is expected to price by the end of 06/14/2023. Led by J.P. Morgan, Jefferies, and Citigroup, the Mediterranean restaurant chain offered 14,444,444 shares and is expected to have a market capitalization of ca. $2.2 billion if the 15% over-allotment option is fully exercised in connection with its Initial Public Offering. CAVA Group is expected to start trading on the New York Stock Exchange (the "NYSE") tomorrow, Thursday, June 15, 2023.

Funds managed or advised by Capital International Investors, Capital Research Global Investors, and T. Rowe Price Investment Management, (the "cornerstone investors") have indicated an interest in purchasing up to an aggregate of $100 million in this offering.