The IPOX® Week #638

IPOX® Indexes stage big end-of-week rally as June expiration lows hold.

Weak China, USD pressure IPOX® International (ETF: FPXI). GNDX leads.

IPOX® SPAC (SPAC) gains as no new SPACs launched last week in the U.S.

Deal of Week: GSK to spin-off consumer unit Haleon (HLN LN) Monday.

IPOX® Performance Review

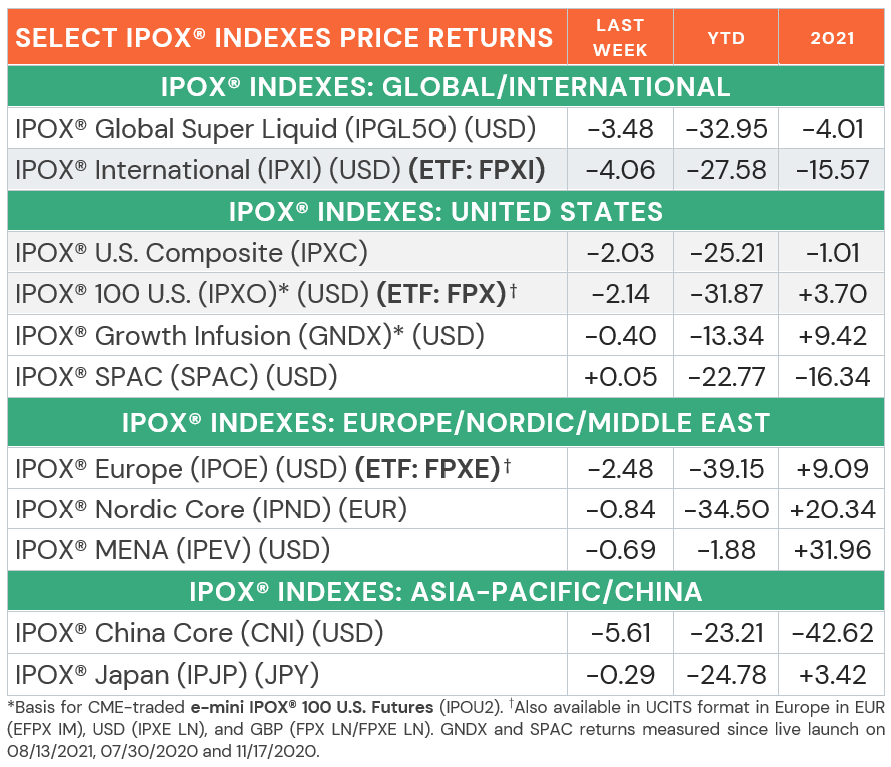

Most IPOX® Indexes fell during last week’s options expiration week, still closing well above lows set during June’s expiration week. Amid falling yields, yield curve gyrations, the soaring U.S. Dollar, stable equity risk (VIX: -1.67%) and ahead of U.S. earnings, the IPOX® 100 U.S. (ETF: FPXI) – benchmark for U.S. New Listings – declined -2.14% to -31.87% YTD, lagging the key U.S. benchmarks, however, significantly outperformed other portfolios focusing on unseasoned stocks. Big selling across Chinese Financials weighed on sentiment for non-U.S. domiciled exposure, including the tech tilted IPOX® China (CNI), while strong earnings and big momentum for large pharma propelled the innovative IPO M&A focused IPOX® Growth Infusion (GNDX) to a great (relative) week.

The IPOX® Growth Infusion Index (GNDX) keeps outperforming major benchmarks

IPOX® Portfolio Holdings in Focus

Amid downgrades and reported growth jitters to select industry stocks, big losses across unseasoned high beta-exposure, including software makers DigitalOcean (DOCN US: -23.89%) and Datadog (DDOG US: -13.57%) outweighed the positive impact of a good week for health care, including Ionis Pharma (IONS: +5.81%), Privia Health (PRVA US: +4.07%) and Shockwave Medical (SWAV US: +3.40%). Considering the strong buy-out activity across Europe, IPOX® Holding telecom services provider Airtel Africa (AAF LN: +5.96%) surged towards a fresh post-IPO high Friday.

Global IPO Deal Flow Review and Outlook

13 sizable IPOs launched globally last week, 8 of which listed in Hong Kong. The average equally weighted deal gained +13.89%, based on the difference between the final offering price and Friday’s close. Depository shares of Hong Kong-based financial services provider AMTD Digital Inc. (HKD US: +107.82%) started trading in the U.S. on Friday. The H.K. IPOs included the $1.7 billion listing of lithium mining firm Tianqi Lithium Corp (9696 HK: -3.35%), learning services IPO Readboy Education (2385 HK: -1.71%), LNG producer Huzhou Gas (6661 HK: -0.33%), IT Services provider Sinohealth Holdings (2361 HK: +9.89%), medical device maker MicroPort NeuroTech (2172 HK: -0.16%), investment manager Noah Holdings (6686 HK: -3.77%), Retailer MINISO Group (9896 HK: -5.22%) and logistics firm Deewin Tianxia (2418 HK: +0.00%). Outside Hong Kong, the semiconductor and display materials provider Youngchang Chemical Co Ltd (112290 KS: -15.59%) and semiconductor firm HPSP Co Ltd (403870 KS: +73.00%) both listed in South Korea, while the Danish stock exchange saw the listing of the REIT Swiss Properties Invest A/S (SWISS DC: +12.82%). The second largest offering of the week was the $707 million listing of Chinese wind turbine manufacturer Ming Yang Smart Energy (MYSE LI: +7.07%) in London. 3 IPOs are expected to trade internationally next week. Massive GSK consumer spinoff Haleon (HLN LN) will start trading in London on Monday, with ADRs set to follow in New York on Friday, while Spanish renewables developer OPDEnergy (OPDE SM) is expected to list on Friday. Outside Europe, Indonesian nickel miner Hillcon Tbk PT (HILL IJ) is expected to trade Wednesday. Other news include: 1) Frontline agrees to buy IPOX® 100 Europe (ETF: FPXE) holding Euronav. 2) ConocoPhillips to acquire 30% stake in LNG project of IPOX 100 U.S. (ETF: FPX) holding Sempra Energy. 3) Thai Life Insurance raises $1 billion from Thailand’s largest IPO this year, trading set to start July 25. 4) China Vanke’s Onewo Space-Tech unit said to target September for $2 billion IPO in Hong Kong. 5) U.S. payments processor Stripe suffers 30% valuation cut in latest round.

The IPOX® SPAC (SPAC)

The IPOX® SPAC Index (SPAC) rose +0.05% to -22.77% YTD as select stocks surged, such as workforce lodging provider Target Hospitality (TH US: +63.60%). Other SPAC news: 1) 2 SPACs Announced Merger Agreement include: a) Deep Machine Acquisition (DMAQ US: +0.30%) with car maker Chijet Motor and b) FAST Acquisition (FZT US: +0.20%) with resort developer Falcon’s Beyond. 2) 3 SPACs Approved Business Combination include a) Social Capital Suvretta III with chronic kidney disease focused biotech ProKidney (PROK US: -29.80%), b) Global SPAC Partners with AI company Gorilla Technology (GRRR US: +8.35%) and c) B Riley Principal 150 Merger (MRPM US: +1.65%) with professional esports team FaZe Clan (FAZE US: 7/20). 3) 1 SPAC Terminated Merger include Ace Global (ACBA US. +0.15%) with H.K.-based digital cooking content platform DDC. 4) 2 SPACs announced to liquidate include Pershing Square Tontine (PSTH US: +0.70%) at $20.05. 5) No new SPACs launched last week in the U.S.