The IPOX® Week #641

Headlines

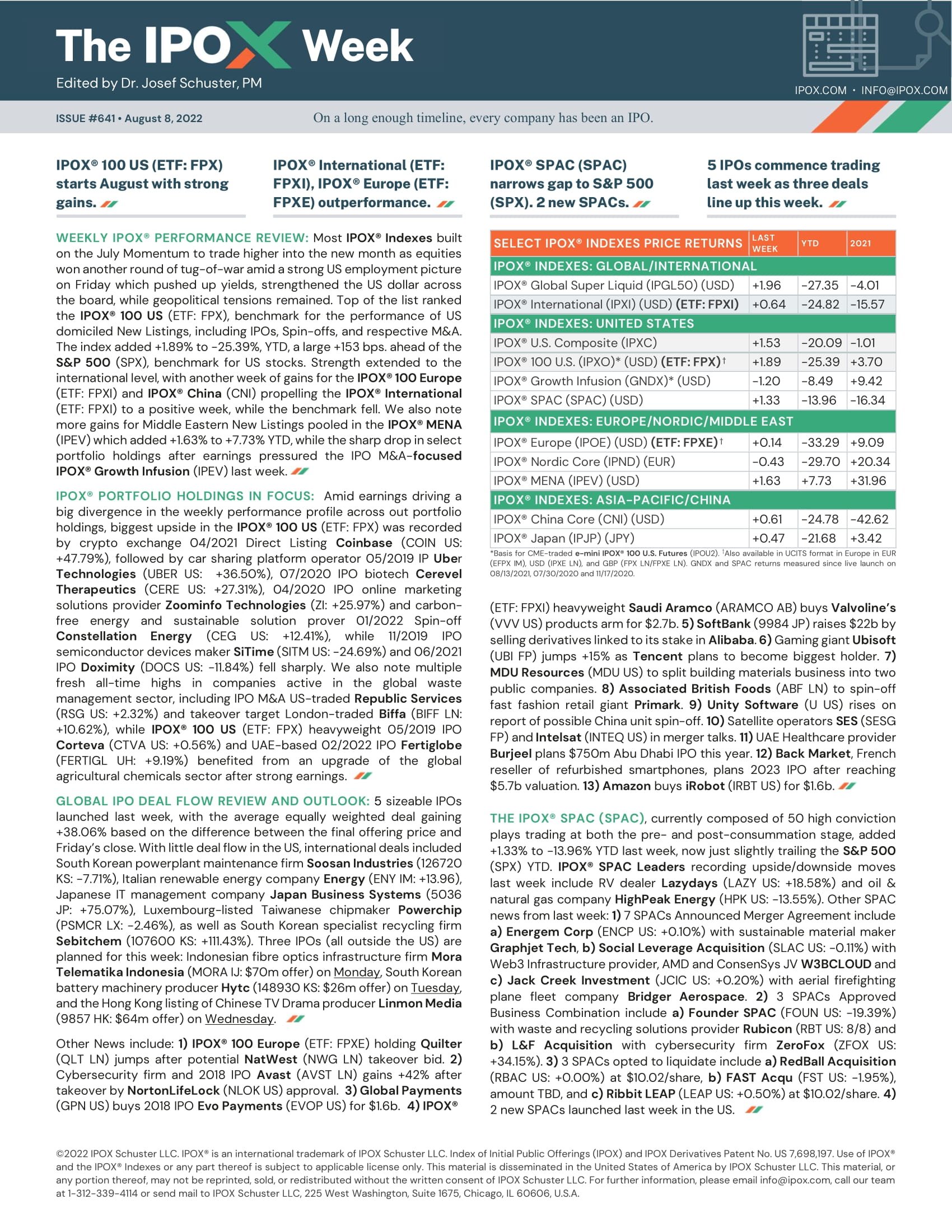

IPOX® 100 US (ETF: FPX) starts August with strong gains.

IPOX® International (ETF: FPXI), IPOX® Europe (ETF: FPXE) outperformance.

IPOX® SPAC (SPAC) narrows gap to S&P 500 (SPX). 2 new SPACs.

5 IPOs commence trading last week as three deals line up this week.

IPOX® Performance Review

Most IPOX® Indexes

built on the July Momentum to trade higher into the new month as equities won another round of tug-of-war amid a strong US employment picture on Friday which

pushed up yields, strengthened the US dollar across the board, while geopolitical tensions remained. Top of the list ranked the IPOX® 100 US (ETF: FPX), benchmark for the performance of US domiciled New Listings,

including IPOs, Spin-offs, and respective M&A. The index added +1.89% to -25.39%, YTD, a large +153 bps. ahead of the S&P 500 (SPX), benchmark for US stocks. Strength extended to the international level, with another week of

gains for the IPOX® 100 Europe (ETF: FPXI) and IPOX® China

(CNI) propelling the IPOX® International

(ETF: FPXI) to a positive week, while the benchmark fell. We also note more gains for Middle Eastern New Listings pooled in the IPOX® MENA (IPEV) which added +1.63% to +7.73% YTD, while the sharp drop in select

portfolio holdings after earnings pressured the IPO M&A-focused IPOX®

Growth Infusion (GNDX) last week.

IPOX® Portfolio Holdings in Focus

Amid earnings driving a big divergence

in the weekly performance profile across out portfolio holdings, biggest upside

in the IPOX® 100 US

(ETF: FPX) was recorded by crypto exchange 04/2021 Direct Listing Coinbase

(COIN US: +47.79%),

followed by car sharing platform operator 05/2019 IP Uber Technologies

(UBER US: +36.50%),

07/2020 IPO biotech Cerevel Therapeutics

(CERE US: +27.31%),

04/2020 IPO online marketing solutions provider Zoominfo Technologies

(ZI: +25.97%)

and carbon-free energy and sustainable solution prover 01/2022 Spin-off Constellation Energy

(CEG US: +12.41%),

while 11/2019 IPO semiconductor devices maker SiTime (SITM US: -24.69%)

and 06/2021 IPO Doximity (DOCS US: -11.84%)

fell sharply. We also note multiple fresh all-time highs in companies active in

the global waste management sector, including IPO M&A US-traded Republic Services

(RSG US: +2.32%)

and takeover target London-traded Biffa (BIFF LN: +10.62%),

while IPOX® 100 US

(ETF: FPX) heavyweight 05/2019 IPO Corteva (CTVA US: +0.56%) and UAE-based

02/2022 IPO Fertiglobe (FERTIGL UH: +9.19%) benefited

from an upgrade of the global agricultural chemicals sector after strong

earnings.

Global IPO Outlook and Review

5 sizeable IPOs launched last week,

with the average equally weighted deal gaining +38.06% based on the difference between the final offering

price and Friday’s close. With little deal flow in the US, international deals

included South Korean powerplant maintenance firm Soosan Industries

(126720 KS: -7.71%),

Italian renewable energy company Energy (ENY IM: +13.96), Japanese IT

management company Japan Business Systems (5036 JP: +75.07%),

Luxembourg-listed Taiwanese chipmaker Powerchip

(PSMCR LX: -2.46%),

as well as South Korean specialist recycling firm Sebitchem

(107600 KS: +111.43%).

Three IPOs (all outside the US) are planned for this week: Indonesian fibre optics infrastructure firm Mora Telematika Indonesia (MORA IJ: $70m offer)

on Monday, South Korean battery machinery producer Hytc

(148930 KS: $26m offer) on Tuesday, and the Hong Kong listing of Chinese

TV Drama producer Linmon Media

(9857 HK: $64m offer) on Wednesday.

Other News include: 1) IPOX® 100 Europe

(ETF: FPXE) holding Quilter (QLT LN) jumps after potential NatWest

(NWG LN) takeover bid. 2) Cybersecurity firm and 2018 IPO Avast (AVST

LN) gains +42% after takeover by NortonLifeLock

(NLOK US) approval. 3) Global Payments (GPN US) buys

2018 IPO Evo

Payments (EVOP US) for $1.6b. 4) IPOX®

International (ETF: FPXI) heavyweight Saudi Aramco

(ARAMCO AB) buys Valvoline’s (VVV US) products arm for $2.7b. 5) SoftBank (9984

JP) raises $22b by selling derivatives linked to its stake in Alibaba.

6)

Gaming giant Ubisoft (UBI FP) jumps +15% as Tencent

plans to become biggest holder. 7) MDU Resources (MDU US) to

split building materials business into two public companies. 8) Associated British

Foods (ABF LN) to spin-off fast fashion retail giant Primark.

9) Unity

Software (U US) rises on report of possible China unit spin-off.

10)

Satellite operators SES (SESG FP) and Intelsat (INTEQ US) in merger

talks. 11)

UAE Healthcare provider Burjeel plans

$750m Abu Dhabi IPO this year. 12) Back Market, French reseller of

refurbished smartphones, plans 2023 IPO after reaching $5.7b valuation. 13) Amazon buys

iRobot (IRBT

US) for $1.6b.

IPOX® SPAC Index

The IPOX® SPAC

(SPAC), currently composed of 50 high conviction plays trading at both the pre-

and post-consummation stage, added +1.33% to -13.96% YTD last week, now just

slightly trailing the S&P 500 (SPX) YTD. IPOX® SPAC Leaders

recording upside/downside moves last week include RV dealer Lazydays

(LAZY US: +18.58%) and oil & natural gas company HighPeak Energy

(HPK US: -13.55%). Other SPAC news from last week: 1) 7

SPACs Announced Merger Agreement include a) Energem Corp (ENCP

US: +0.10%) with sustainable material maker Graphjet Tech,

b)

Social Leverage Acquisition (SLAC US: -0.11%) with Web3

Infrastructure provider, AMD and ConsenSys JV W3BCLOUD and

c) Jack

Creek Investment (JCIC US: +0.20%) with aerial firefighting

plane fleet company Bridger Aerospace. 2) 3 SPACs Approved

Business Combination include a) Founder SPAC (FOUN US: -19.39%)

with waste and recycling solutions provider Rubicon (RBT US: 8/8) and

b)

L&F Acquisition with cybersecurity firm ZeroFox

(ZFOX US: +34.15%). 3) 3 SPACs opted to liquidate include a) RedBall

Acquisition (RBAC US: +0.00%) at $10.02/share, b) FAST Acqu (FST US: -1.95%), amount TBD, and c) Ribbit LEAP

(LEAP US: +0.50%) at $10.02/share. 4) 2 new SPACs launched last week

in the US.