The IPOX® Week #642

Diversified IPOX® 100 U.S.

(ETF: FPX) soars as all-time highs all abound.

IPOX® SPAC (SPAC) jumps

past S&P 500 (SPX) YTD; Enovix up +57.88%.

IPO M&A surge as Avalara (AVLR US), Signify Health (SGFY US) get buy-out.

4 sizeable deals launch last week, Naqi Water Co. (NAQI AB) set to debut.

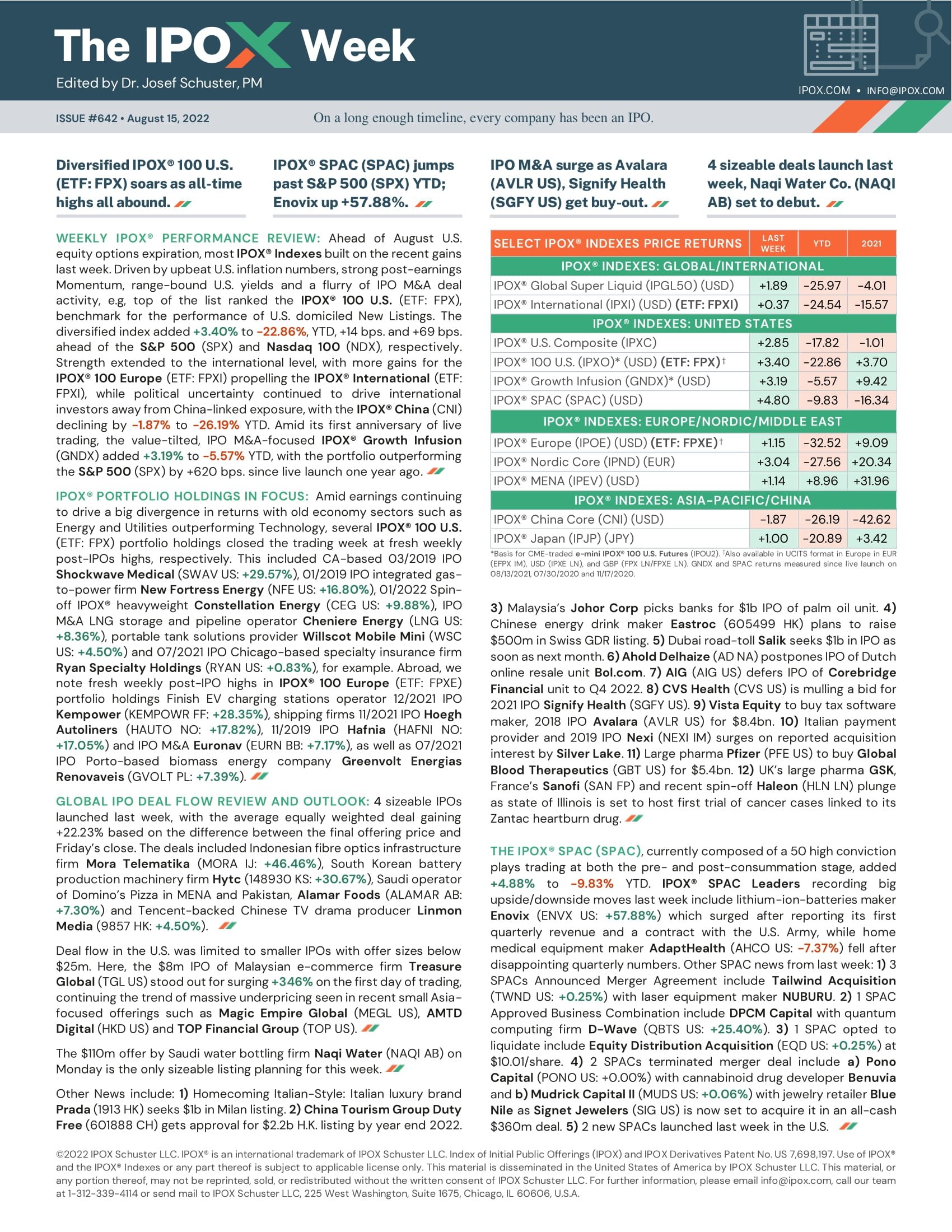

WEEKLY IPOX® performance review: Ahead of August U.S. equity options expiration, most IPOX® Indexes built on the recent gains last week. Driven by upbeat U.S. inflation numbers, strong post-earnings Momentum, range-bound U.S. yields and a flurry of IPO M&A deal activity, e.g, top of the list ranked the IPOX® 100 U.S. (ETF: FPX), benchmark for the performance of U.S. domiciled New Listings. The diversified index added +3.40% to -22.86%, YTD, +14 bps. and +69 bps. ahead of the S&P 500 (SPX) and Nasdaq 100 (NDX), respectively. Strength extended to the international level, with more gains for the IPOX® 100 Europe (ETF: FPXI) propelling the IPOX® International (ETF: FPXI), while political uncertainty continued to drive international investors away from China-linked exposure, with the IPOX® China (CNI) declining by -1.87% to -26.19% YTD. Amid its first anniversary of live trading, the value-tilted, IPO M&A-focused IPOX® Growth Infusion (GNDX) added +3.19% to -5.57% YTD, with the portfolio outperforming the S&P 500 (SPX) by +620 bps. since live launch one year ago.

IPOX® Portfolio holdings in focus: Amid earnings continuing to drive a big divergence in returns with old economy sectors such as Energy and Utilities outperforming Technology, several IPOX® 100 U.S. (ETF: FPX) portfolio holdings closed the trading week at fresh weekly post-IPOs highs, respectively. This included CA-based 03/2019 IPO Shockwave Medical (SWAV US: +29.57%), 01/2019 IPO integrated gas-to-power firm New Fortress Energy (NFE US: +16.80%), 01/2022 Spin-off IPOX® heavyweight Constellation Energy (CEG US: +9.88%), IPO M&A LNG storage and pipeline operator Cheniere Energy (LNG US: +8.36%), portable tank solutions provider Willscot Mobile Mini (WSC US: +4.50%) and 07/2021 IPO Chicago-based specialty insurance firm Ryan Specialty Holdings (RYAN US: +0.83%), for example. Abroad, we note fresh weekly post-IPO highs in IPOX® 100 Europe (ETF: FPXE) portfolio holdings Finish EV charging stations operator 12/2021 IPO Kempower (KEMPOWR FF: +28.35%), shipping firms 11/2021 IPO Hoegh Autoliners (HAUTO NO: +17.82%), 11/2019 IPO Hafnia (HAFNI NO: +17.05%) and IPO M&A Euronav (EURN BB: +7.17%), as well as 07/2021 IPO Porto-based biomass energy company Greenvolt Energias Renovaveis (GVOLT PL: +7.39%).

global ipo deal flow review and outlooK: 4 sizeable IPOs launched last week, with the average equally weighted deal gaining +22.23% based on the difference between the final offering price and Friday’s close. The deals included Indonesian fibre optics infrastructure firm Mora Telematika (MORA IJ: +46.46%), South Korean battery production machinery firm Hytc (148930 KS: +30.67%), Saudi operator of Domino’s Pizza in MENA and Pakistan, Alamar Foods (ALAMAR AB: +7.30%) and Tencent-backed Chinese TV drama producer Linmon Media (9857 HK: +4.50%).

Deal flow in the U.S. was limited to smaller IPOs with offer sizes below $25m. Here, the $8m IPO of Malaysian e-commerce firm Treasure Global (TGL US) stood out for surging +346% on the first day of trading, continuing the trend of massive underpricing seen in recent small Asia-focused offerings such as Magic Empire Global (MEGL US), AMTD Digital (HKD US) and TOP Financial Group (TOP US).

The $110m offer by Saudi water bottling firm Naqi Water (NAQI AB) on Monday is the only sizeable listing planning for this week.

Other News include: 1) Homecoming Italian-Style: Italian luxury brand Prada (1913 HK) seeks $1b in Milan listing. 2) China Tourism Group Duty Free (601888 CH) gets approval for $2.2b H.K. listing by year end 2022. 3) Malaysia’s Johor Corp picks banks for $1b IPO of palm oil unit. 4) Chinese energy drink maker Eastroc (605499 HK) plans to raise $500m in Swiss GDR listing. 5) Dubai road-toll Salik seeks $1b in IPO as soon as next month. 6) Ahold Delhaize (AD NA) postpones IPO of Dutch online resale unit Bol.com. 7) AIG (AIG US) defers IPO of Corebridge Financial unit to Q4 2022. 8) CVS Health (CVS US) is mulling a bid for 2021 IPO Signify Health (SGFY US). 9) Vista Equity to buy tax software maker, 2018 IPO Avalara (AVLR US) for $8.4bn. 10) Italian payment provider and 2019 IPO Nexi (NEXI IM) surges on reported acquisition interest by Silver Lake. 11) Large pharma Pfizer (PFE US) to buy Global Blood Therapeutics (GBT US) for $5.4bn. 12) UK’s large pharma GSK, France’s Sanofi (SAN FP) and recent spin-off Haleon (HLN LN) plunge as state of Illinois is set to host first trial of cancer cases linked to its Zantac heartburn drug.

THE IPOX® SPAC (SPAC), currently composed of a 50 high conviction plays trading at both the pre- and post-consummation stage, added +4.88% to -9.83% YTD. IPOX® SPAC Leaders recording big upside/downside moves last week include lithium-ion-batteries maker Enovix (ENVX US: +57.88%) which surged after reporting its first quarterly revenue and a contract with the U.S. Army, while home medical equipment maker AdaptHealth (AHCO US: -7.37%) fell after disappointing quarterly numbers. Other SPAC news from last week: 1) 3 SPACs Announced Merger Agreement include Tailwind Acquisition (TWND US: +0.25%) with laser equipment maker NUBURU. 2) 1 SPAC Approved Business Combination include DPCM Capital with quantum computing firm D-Wave (QBTS US: +25.40%). 3) 1 SPAC opted to liquidate include Equity Distribution Acquisition (EQD US: +0.25%) at $10.01/share. 4) 2 SPACs terminated merger deal include a) Pono Capital (PONO US: +0.00%) with cannabinoid drug developer Benuvia and b) Mudrick Capital II (MUDS US: +0.06%) with jewelry retailer Blue Nile as Signet Jewelers (SIG US) is now set to acquire it in an all-cash $360m deal. 5) 2 new SPACs launched last week in the U.S.