The IPOX® Week #647

IPOX® 100 U.S. (ETF: FPX) sheds -4.47%, beats benchmarks anew.

IPOX® Growth Infusion (GNDX) takes +174 bps. from S&P last week.

IPOX® SPAC (SPAC) falls just -1.41%, as select specialty stocks gain.

$13bn Corebridge Financial IPO debuts. More IPOs lined up as IPO window opens.

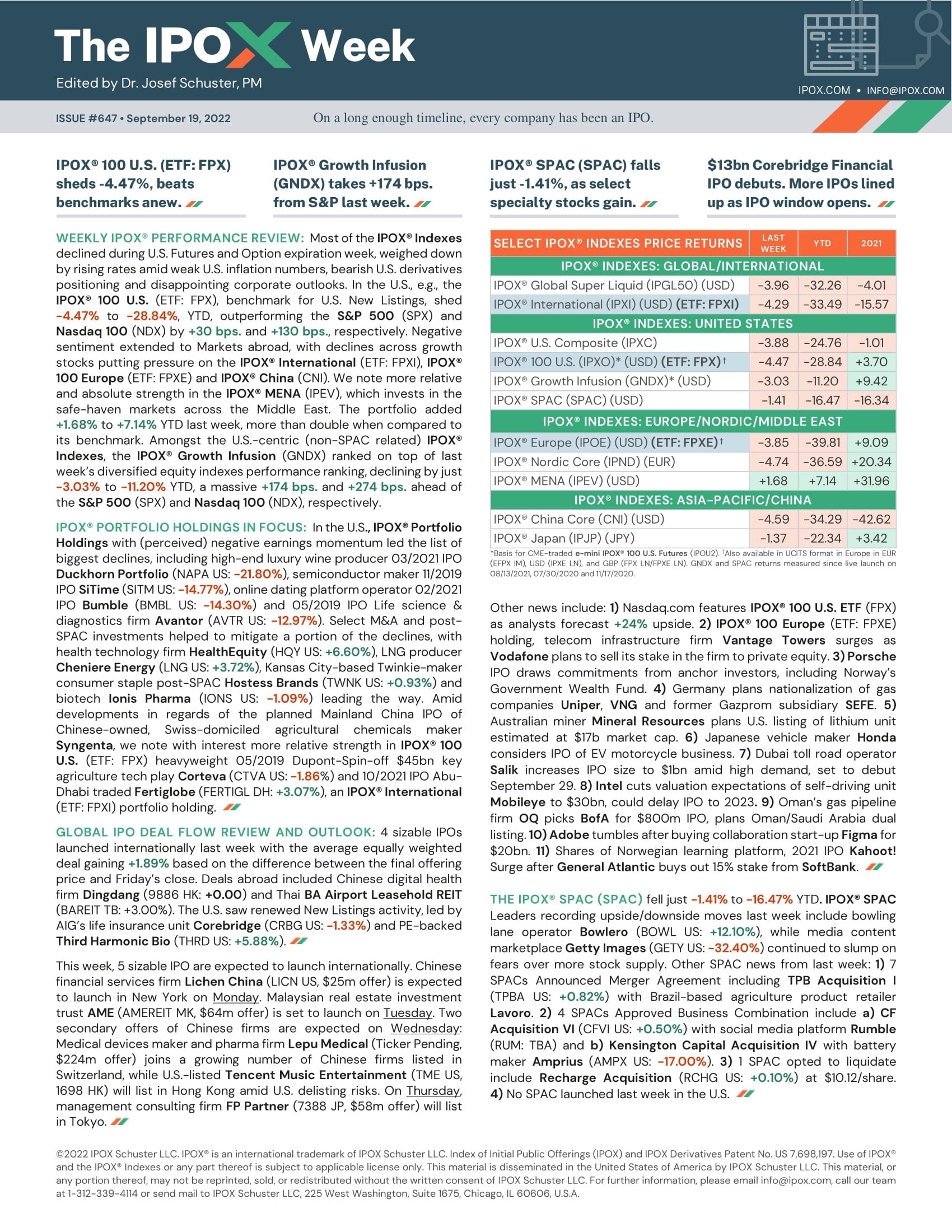

WEEKLY IPOX® performance review: Most

of the IPOX® Indexes declined

during U.S. Futures and Option expiration week, weighed down by rising rates

amid weak U.S. inflation numbers, bearish U.S. derivatives positioning and

disappointing corporate outlooks. In the U.S., e.g., the IPOX® 100 U.S. (ETF: FPX),

benchmark for U.S. New Listings, shed -4.47% to -28.84%, YTD, outperforming the S&P 500

(SPX) and Nasdaq 100 (NDX) by +30 bps. and +130 bps., respectively. Negative sentiment extended

to Markets abroad, with declines across growth stocks putting pressure on the IPOX® International

(ETF: FPXI), IPOX® 100

Europe (ETF: FPXE) and IPOX® China (CNI). We note

more relative and absolute strength in the IPOX® MENA (IPEV), which

invests in the safe-haven markets across the Middle East. The portfolio added +1.68% to +7.14% YTD last week, more than double when compared to its benchmark. Amongst

the U.S.-centric (non-SPAC related) IPOX®

Indexes, the IPOX® Growth Infusion

(GNDX) ranked on top of last week’s diversified equity indexes performance

ranking, declining by just -3.03% to -11.20% YTD, a massive +174

bps. and +274 bps. ahead of the S&P 500 (SPX) and Nasdaq 100 (NDX),

respectively.

ipox® PortFolio holDings in focus: In the

U.S., IPOX® Portfolio Holdings with (perceived) negative earnings

momentum led the list of biggest declines, including high-end luxury wine

producer 03/2021 IPO Duckhorn Portfolio (NAPA US: -21.80%), semiconductor maker 11/2019 IPO SiTime

(SITM US: -14.77%), online dating platform operator 02/2021

IPO Bumble (BMBL US: -14.30%) and 05/2019 IPO Life science & diagnostics

firm Avantor (AVTR US: -12.97%). Select M&A and post-SPAC investments

helped to mitigate a portion of the declines, with health technology firm HealthEquity

(HQY US: +6.60%), LNG producer Cheniere Energy (LNG

US: +3.72%), Kansas City-based Twinkie-maker consumer

staple post-SPAC Hostess Brands (TWNK US: +0.93%) and biotech Ionis Pharma (IONS US: -1.09%) leading the way. Amid developments in

regards of the planned Mainland China lPO of

Chinese-owned, Swiss-domiciled agricultural chemicals maker Syngenta, we

note with interest more relative strength in IPOX® 100 U.S. (ETF: FPX)

heavyweight 05/2019 Dupont-Spin-off $45bn key agriculture tech play Corteva (CTVA

US: -1.86%) and 10/2021 IPO Abu-Dhabi traded Fertiglobe (FERTIGL DH: +3.07%), an IPOX® International (ETF: FPXI)

portfolio holding.

global ipo deal flow review and outlooK: 4 sizable IPOs launched internationally last

week with the average equally weighted deal gaining +1.89% based on the difference between the final

offering price and Friday’s close. Deals abroad included Chinese digital health

firm Dingdang (9886 HK: +0.00)

and Thai BA Airport Leasehold REIT (BAREIT TB: +3.00%). The U.S. saw

renewed New Listings activity, led by AIG’s life insurance unit Corebridge (CRBG US: -1.33%) and PE-backed Third Harmonic Bio

(THRD US: +5.88%).

This week, 5 sizable

IPO are expected to launch internationally. Chinese financial services firm Lichen

China (LICN US, $25m offer) is expected to launch in New York on Monday.

Malaysian real estate investment trust AME (AMEREIT MK, $64m offer) is

set to launch on Tuesday. Two secondary offers of Chinese firms are

expected on Wednesday: Medical devices maker and pharma firm Lepu Medical (Ticker Pending, $224m offer)

joins a growing number of Chinese firms listed in Switzerland, while

U.S.-listed Tencent Music Entertainment (TME US, 1698 HK) will list in

Hong Kong amid U.S. delisting risks. On Thursday, management consulting

firm FP Partner (7388 JP, $58m offer) will list in Tokyo.

Other news include: 1) Nasdaq.com features IPOX® 100 U.S. ETF

(FPX) as analysts forecast +24% upside. 2) IPOX® 100 Europe

(ETF: FPXE) holding, telecom infrastructure firm Vantage Towers surges

as Vodafone plans to sell its stake in the firm to private equity. 3)

Porsche IPO draws commitments from anchor investors, including Norway’s

Government Wealth Fund. 4) Germany plans nationalization of gas

companies Uniper, VNG and former

Gazprom subsidiary SEFE. 5) Australian miner Mineral Resources

plans U.S. listing of lithium unit estimated at $17b market cap. 6)

Japanese vehicle maker Honda considers IPO of EV motorcycle business. 7)

Dubai toll road operator Salik increases

IPO size to $1bn amid high demand, set to debut September 29. 8) Intel

cuts valuation expectations of self-driving unit Mobileye to $30bn,

could delay IPO to 2023. 9) Oman’s gas pipeline firm OQ picks BofA for $800m IPO, plans Oman/Saudi Arabia dual

listing. 10) Adobe tumbles after buying collaboration start-up Figma

for $20bn. 11) Shares of Norwegian learning platform, 2021 IPO Kahoot!

Surge after General Atlantic buys out 15% stake from SoftBank.

The IPOX® SPAC (SPAC): The IPOX® SPAC Index fell just -1.41% to -16.47% YTD. IPOX® SPAC

Leaders recording upside/downside moves last week include bowling lane operator

Bowlero (BOWL US: +12.10%), while media content

marketplace Getty Images (GETY US: -32.40%) continued to slump on

fears over more stock supply. Other SPAC news from last week: 1) 7 SPACs

Announced Merger Agreement including TPB Acquisition I (TPBA US: +0.82%) with Brazil-based

agriculture product retailer Lavoro. 2)

4 SPACs Approved Business Combination include a) CF Acquisition VI (CFVI

US: +0.50%) with social media

platform Rumble (RUM: TBA) and b) Kensington Capital Acquisition IV

with battery maker Amprius (AMPX US: -17.00%). 3) 1 SPAC opted

to liquidate include Recharge Acquisition (RCHG US: +0.10%) at $10.12/share. 4)

No SPAC launched last week in the U.S.