The IPOX® Week #664

IPOX 100 U.S. (ETF: FPX) surges +4.95%, massively outperforming S&P 500.

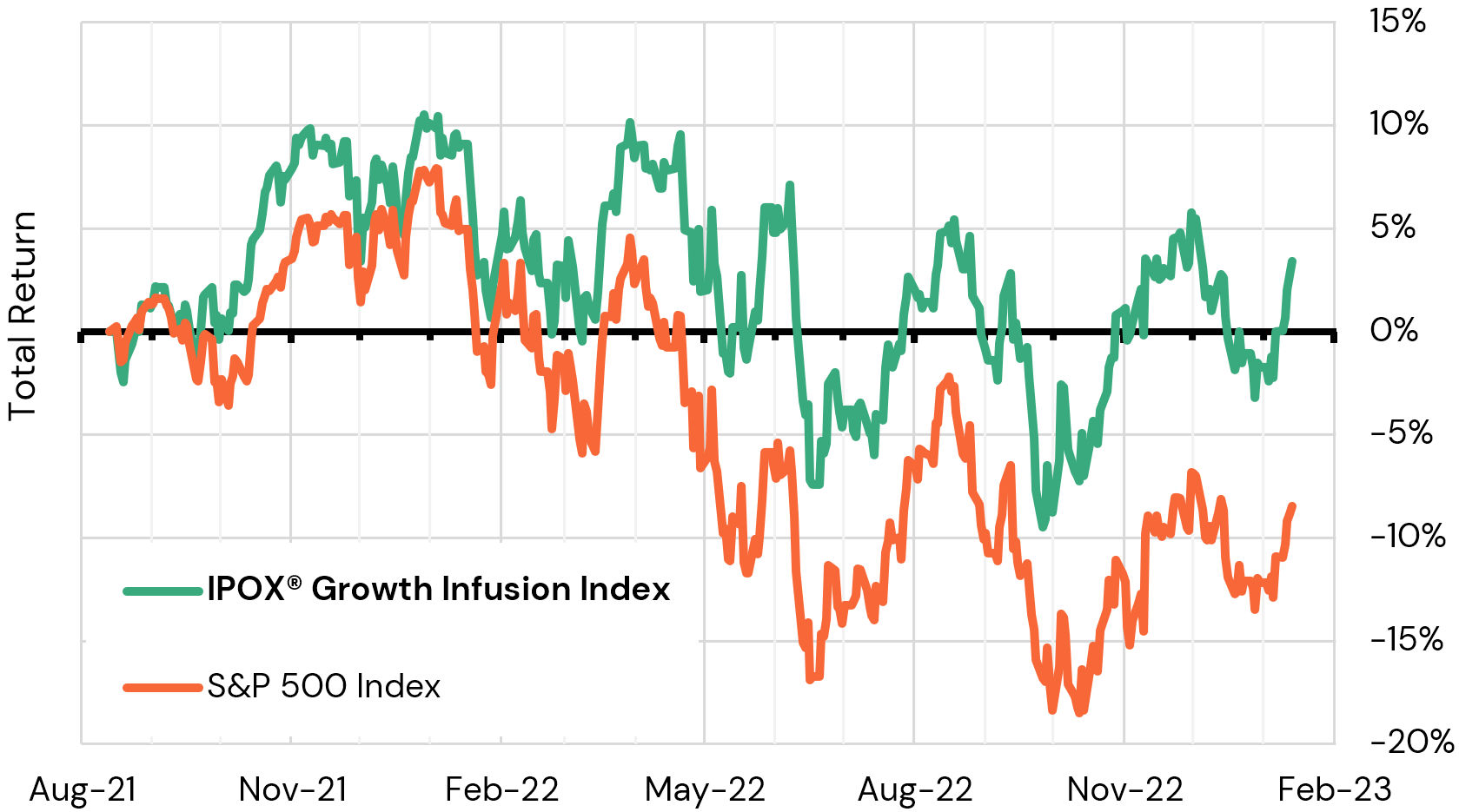

IPOX® Growth Infusion (GNDX) outperforms S&P 500 Index anew.

IPOX® SPAC (SPAC) climbs

+3.86%. 1 U.S. SPACs

launched last week.

IPO deal flow set for resurgence; large European listings are lining up.

WEEKLY IPOX® PERFORMANCE REVIEW: Ahead of this year’s first equity options expiration week, all IPOX® Indexes gained substantially. Amid cooling inflation numbers, new University of Michigan survey data suggesting rising consumer confidence and moderate inflation expectations, the continuing drop in U.S. 30-year bond yields and plummeting volatility (VIX: -13.16%), our growth-focused IPOX® 100 U.S. (ETF: FPX) performed best among the IPOX® Indexes, surging +4.95% (+4.78% YTD). The index took a massive +228 bps. from the S&P 500 (ETF: SPY), which gained as it surpassed its 200-day moving average. Internationally, the IPOX® International (ETF: FPXI) surged yet again (+2.88% to +6.30% YTD) amid the continued rise in Chinese stocks, as the IPOX® China (CNI) added +4.21% to +12.79% YTD. Amid a strengthening Euro and news of economic growth in the United Kingdom, the IPOX® Europe (ETF: FPXE) gained +4.13% as several large IPOs line up. The super-liquid IPOX® Growth Infusion (GNDX) also rose, adding +3.35%, furthering the outperformance gap to the S&P 500 by a further +68 bps., now taking a big +1188 bps. from the benchmark since launch in August 2021 (see below).

IPOX® PORTFOLIO STOCKS IN FOCUS: The IPOX® 100 U.S. (ETF: FPX) was led by health care sector firms Revolution Medicines (RVMD US: +34.33%) and Agilon Health (AGL US: +28.85%). General Electric medical imaging spin-off GE Healthcare (GEHC US) gained +11.01% after addition to the index. Entertainment firm Warner Music Group (WMG US: -14.06%) fell amid news of a planned $1B music catalog sale. The IPOX® Europe (ETF: FPXE) was topped by Swedish biomarker firm Olink (OLK US: +22.28%) and Italian truck maker Iveco (IVG IM: +16.92%). Crude oil tanker firm Euronav (EURN BB: -10.58%) fell after abandoning an all-share merger offer with rival Frontline (FRO US). The IPOX® International (ETF: FPXI) was led by this week’s IPOX® Week feature, newly added education firm Koolearn Technology (1797 HK: 27.83%) and British pharma firm Immunocore (IMCR US: +16.46%), while Chinese restaurant chain Jiumaojiu (9922 HK: -6.77%) fell.

GLOBAL IPO DEAL FLOW REVIEW AND OUTLOOK: 5 sizable IPOs started trading internationally last week, gaining +47.42% on average, based on the difference between the final offer price and Friday’s close. In Hong Kong, education platform Fenbi (2469 HK: +9.90%) gained, while hydrogen fuel cell firm SinoHytec (2402 HK: +0.00%) traded flat. Turkish wheat flour maker Söke (SOKE TI: +20.93%) hit daily price limits twice, while Malaysian semiconductor contract manufacturer Nationgate (NATGATE MK: +178.95%) surged. In the U.S., Houston-based casualty insurance company Skyward Speciality Insurance (SKWD US: +27.33%) climbed after raising $134m in the largest U.S. IPO YTD. The micro-cap IPO of MGO Global (MGOL US), clothing firm with rights to soccer player Lionel Messi, more than doubled after opening, but finally closed -7.00% below offer price after plunging -72% from its intraday high.

This week, at least 3 firms are expected to launch sizable offers, all of which are expected in Hong Kong. Monday: Wellness service provider Beauty Farm (2373 HK, $100m offer) and fruit wholesaler Pagoda (2411 HK, $57m offer). Thursday: Chinese K-Pop and Mandopop talent agency Yuehua Entertainment (2306 HK, $78m offer).

UPCOMING IPO NEWS: 1) Vietnamese EV firm Vinfast sets $1b U.S. IPO for Q2 2023. 2) Tencent-backed telemedicine firm WeDoctor plans listing in U.S. or Hong Kong. 3) Agricultural firm Olam Agri plans secondary listing on Saudi Tadawul after Saudi PIF investment, alongside $1b raise in Singapore. 4) German HR software unicorn ($8.5b valuation) Personio schedules IPO for 2024. 5) Spanish Uber rival Cabify sets its IPO at a €2b valuation in early 2024. 6) Italian gambling firm Lottomatica mulls $1b Milan IPO. 7) Chinese EV firm WM Motor plans Hong Kong listing through $2b reverse merger with Apollo Future Mobility Group. 8) South Korean grocery delivery app Oasis seeks $167m in domestic IPO, subscription ends Feb. 15. 9) Ionos, web hosting unit of German internet giant United Internet aims for $5b valuation in share sale as soon as this week. 10) Car part maker Euro Group plans $500m Milan IPO in February. 11) German glass maker Schott picks banks for $4b pharma unit in Summer 2023. 12) Chinese Lidar firm Hesai to file for U.S. IPO, could raise $150m.

THE IPOX® SPAC (SPAC): The Index, composed of a selected 50 high conviction plays trading at both the pre- and post-consummation stage rose to +4.03% YTD. IPOX® SPAC Leaders recording upside/downside moves last week include beaten-down biotech ProKidney (PROK US: +38.20%), the company surged on positive data publication for late stage 4 diabetes-related chronic kidney disease. Payment and data processor Priority Technology (PRTH US: -8.82%) fell. Other SPAC news from last week: 1) 4 SPACs Announced Merger Agreement include TKB Critical Technologies 1 (USCT US: +0.39%) with struggled connected vehicle data start-up Wejo Group (WEJO US: +6.37%) in an unconventional second-time SPAC merger under stock-for-stock term. Wejo merged with Virtuoso Acquisition in November 2021 and has since lost more than 90% in value. 2) No SPAC Approved or Completed Business Combination. 3) 4 SPACs announced liquidation. 4) 1 new SPAC launched last week in the U.S.