The IPOX® Week #671

IPOX® 100 U.S. (ETF: FPX) soars on big rally in small- and mid-cap picks.

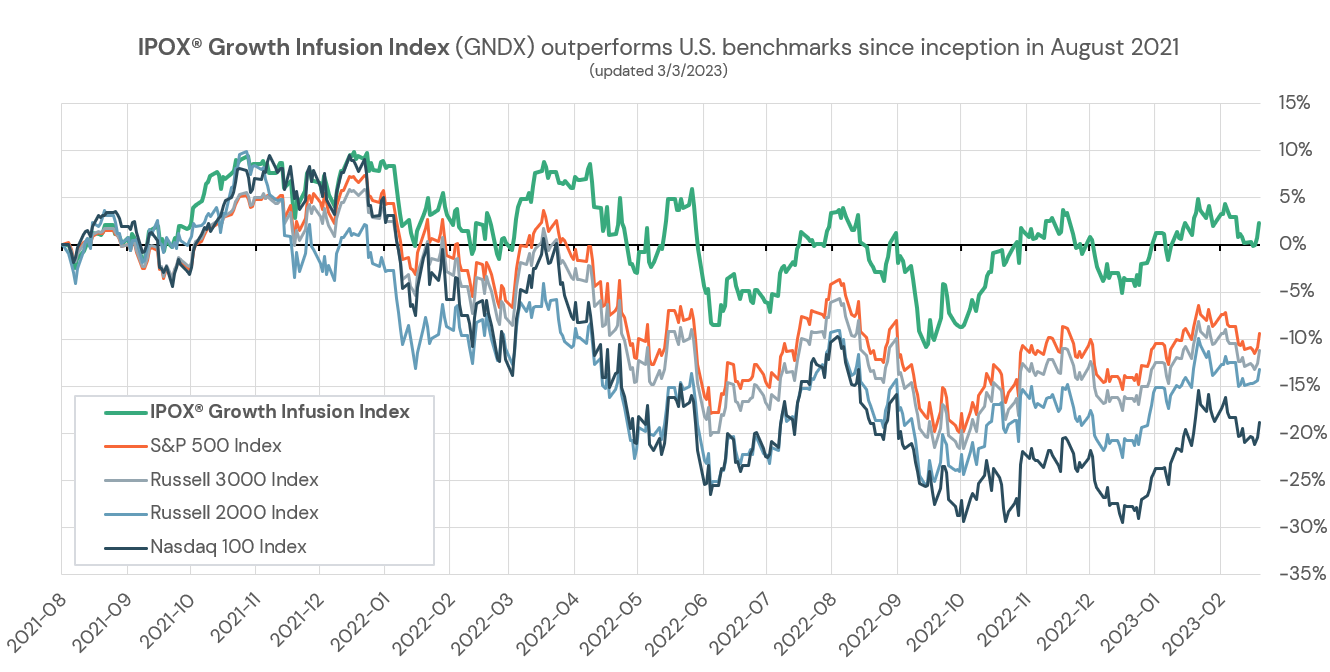

IPOX® Growth Infusion continues outperformance over key U.S. benchmarks.

IPOX® SPAC (SPAC) gains

+1.69%. 1 U.S. SPAC

launched last week.

SoftBank’s Arm picks New York over London, confirms U.S. as best IPO Market.

WEEKLY IPOX® PERFORMANCE REVIEW: U.S. equities saw the best week since late January after surging on Friday, as yields on the benchmark 10-year U.S. Treasury notes dipped back below the key 4% level. The IPOX® Indexes started the month with strong performances, outperforming major benchmarks anew. In the U.S., e.g., the IPOX® 100 U.S. (ETF: FPX) surged +2.54% to +9.16% YTD as big post-earnings rallies in select small- and mid-cap holdings pushed our index past the S&P 500 (ETF: SPY) for the 5th week, taking another +61 bps. from the U.S. benchmark. Globally, the IPOX® Europe (ETF: FPXE) climbed +2.42% to +7.62%, overtaking the STOXX Europe 50 YTD to +56 bps. outperformance. Backed by strong showings in Europe as well as the rebounding IPOX® China (CNI: +4.88%) and IPOX® Japan (IPJP: +3.14%), the IPOX® International (ETF: FPXI) gained +1.94% to +2.04 YTD. The unique IPO M&A portfolio strategy of our super-liquid large cap IPOX® Growth Infusion (GNDX: +2.20%) continues to pay off well against key benchmarks (see below).

IPOX® PORTFOLIO STOCKS IN FOCUS: The IPOX® 100 U.S. (ETF: FPX) upside performance was driven by outliers with large swings after earnings, e.g. “Internet of Things” firm Samsara (IOT US: +21.45%), payment processor Shift4 (FOUR US: +24.97%) and DevOps firm GitLab (GTLB US: +20.53%). Quarterly reports also impacted health care providers Agilon Health (AGL US: +19.41%) and industry peer Alignment Healthcare (ALHC: -18.02%). Cloud-based education provider Powerschool (PWSC: -13.89%) dropped after announcing a secondary offering. The IPOX® Europe (ETF: FPXE) was led by Italian pharmaceutical glass ampule maker Stevanato (STVN US: +18.91%), while compatriot chip testing firm Technoprobe (TPRO IM: -13.37%) fell on weak outlooks. The biggest movers in the IPOX® International (ETF: FPXI) included resurging Chinese agri-food e-commerce firm Pinduoduo (PDD US: +14.30%), Israeli solar power equipment developer SolarEdge (SEDG US: +10.35%) and Chinese online education firm Koolearn (1797 HK: -11.27%).

Several IPOX® Holdings reached new post-IPO highs this week, e.g., our most recent IPOX® Watch feature, organ transplantation firm TransMedics (TMDX US: +4.73%), Danish pharma giant and Wegovy maker Novo Nordisk (NOVOB DC: +1.21%), Belgian vehicle glass repair firm D’Ieteren (DIE BB: +5.25%), Austrian hydropower technology specialist Andritz (ANDR AV: +2.00%), German radar maker Hensoldt (HAG GR: +7.70%), Swedish steel maker Alleima (ALLEI SS: +3.53%) and medical imaging spin-off GE Healthcare (GEHC US: +1.81%), among others.

GLOBAL IPO DEAL FLOW REVIEW AND OUTLOOK: Indonesian mining services firm Hillcon (HILL IJ: +20.80%) was the only sizable IPO last week. 5 large IPOs are expected to start trading this week. Monday: Taiwanese solar power generator HD Renewable Energy (6873 TT, $46m offer). Thursday: U.S. fracking sand producer Atlas Energy (AESI US, $414m offer). Friday: Hong Kong online finance education provider JF Wealth (9636 HK, $143m) and Indonesian palm oil farm operator Nusantara Sawit Sejahtera (NSSS IJ, $30m).

OTHER IPO NEWS: 1) Abu Dhabi’s Adnoc Gas $2.5b IPO draws in $124B in orders. Country’s largest ever IPO starts trading March 13. 2) SoftBank ditches London for Arm IPO, picks New York for higher liquidity. Valuation of up to $70b expected. 3) Swedish private equity firm EQT plans $3.2b IPO for Swiss skincare business Galderma. 4) Chinese Xiaomi/Bain-backed energy start up Newlink Group picks U.S. over Hong Kong for upcoming $400m IPO. 5) German gearbox maker Renk eyes IPO at $3b valuation. 6) Japanese digital bank SBI Sumishin Net Bank set to re-open Japanese IPO market with $440m offer on March 29. 7) Italy lottery operator Lottomatica files for $1b IPO. 8) Olam Group’s food ingredients unit ofi plans London/Singapore listing by the end of 2023.

THE IPOX® SPAC (SPAC): The Index currently composed of a selected 50 high conviction plays trading at both the pre- and post-consummation stage rose +1.69% to +5.24% YTD. IPOX® SPAC Leaders recording upside/downside moves last week include Swiss inflammation-focused biopharmaceutical company MoonLake Immunotherapeutics (MLTX US: +22.28%) continued to climb amid strong momentum. Cruise ship spas operator OneSpaWorld (OSW US: -6.97%) retrieved from last week’s all-time-high. Other SPAC news from last week: 1) 7 SPACs Announced Merger Agreement include Plum Acquisition I (PLMI US: +0.20%) with solid-state battery maker Sakuu. 2) 2 SPACs Approved Business Combination include European Biotech Acquisition with Swiss eye drop company Oculis (OCS US: +1.30%) and Israeli cyber security firm Hub (HUBC US: -82.22%) with Mount Rainier Acquisition Corp. 3) 8 SPACs announced or commenced liquidation. 4) 1 SPAC launched last week in the U.S.