The IPOX® Week #681

IPOX® 100 U.S. (ETF: FPX) declines as select large-caps fall after earnings.

IPOX® SMID and IPOX® Health Innovation gain anew, outperform.

IPOX® SPAC (SPAC) sheds -1.45%. No new SPACs launched last week.

Italian Design Brands (IDB IM) set to commence trading Monday in Milan.

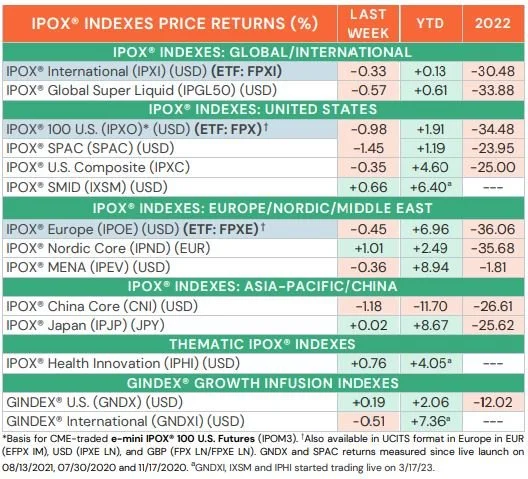

WEEKLY IPOX® PERFORMANCE REVIEW: The IPOX® Indexes traded mixed last week, pressured by higher U.S. rates across the board, stagflationary U.S. economic numbers towards the weekend and mixed earnings amongst some of the top holdings amid continued stalemate in U.S. debt ceiling talks. In the U.S., e.g., the IPOX® 100 U.S. Index (ETF: FPX) reversed last week’s (relative) strength, declining by -0.98% to +1.91% YTD, trading broadly in line with U.S. small-caps (IWM: -1.08%), while lagging the S&P 500 Index (SPX: -0.29%), benchmark for U.S. stocks and AI-frenzy-driven Nasdaq 100 (NDX: +0.61%). With the exception of the IPOX® Japan (IPJP: +0.02%) and IPOX® Nordic (IPND: +1.01%), weakness extended to non-U.S. domiciled exposure, with declines in the IPOX® China (CNI: -1.18%) pressuring the IPOX® International (IPXI: -0.33%) anew. We note continued gains in the specialty-focused IPOX® Portfolios including the U.S. small- and mid-cap driven IPOX® SMID (IXSM: +0.66%) and biotech and health-care M&A-specialized IPOX® Health Innovation (IPHI: +0.76%), which have both recently benefited overproportionally from good earnings and contineud (perceived) corporate action activity. The large-cap/mega-cap heavy IPO M&A-focused GINDEX® Growth Infusion Portfolios - which invest selectively in acquirers of IPOs in the U.S. (GNDX: +0.19%) and Internationally (GNDXI: -0.51%) – traded mixed and displayed relative strength for yet another week.

IPOX® PORTFOLIO STOCKS IN FOCUS: Returns of individual portfolio holdings continued to be widely distributed. In the U.S., e.g., top of the list of best performing stocks ranked alternative energy related firms, including recent 02/2023 IPO Nextracker (NXT US: +27.48%), renewable energy equipment maker 01/2021 IPO Shoals Technologies (SHLS US: +27.00%) and solar tracking systems maker 01/2021 IPO Array Technologies (ARRY US: +19.60%), while AI-software solutions provider 06/2021 IPO Intapp (INTA US: +16.19%) and foreign language learning software maker Duolingo (DUOL US: +14.48%) also recorded strong gains. The great portfolio impact arriving from these firms was, however, more than mitigated by big declines in Financial 09/2021 IPO Jackson Financial (JXN US: -16.38%), energy explorer Highpeak Energy (HPK US: -12.45%), online vacation rental platform operator IPOX® Heavyweight 12/2020 IPO Airbnb (ABNB US: -12.20%) and factory automation equipment maker 03/2021 IPO Symbotic (SYM US: -9.52%), which fell after profit taking, e.g. Across the list of non-U.S. IPOX® Portfolio Holdings, select Saudi-traded firms reached fresh post-IPO highs, such IT services and digital solution provider 02/2022 IPO Elm Company (ELM AB: +7.40%) and energy firm 12/2022, 8.01% yielding Saudi Aramco Base Oil (LUBEREF AB: +7.03%). IPO M&A biotech Solna, Sweden, based Swedish Orphan Biovitrum (SOBI SS: -7.89%) plunged after announcing the buy-out of U.S. cancer drug maker 02/2018 IPO CTI BioPharma (CTIC US: +82.76%) for USD billion 1.7. Across Asia-Pacific, we note with interest the volume spike in 03/2022 IPO H.K.-traded USD billion 1 Ferretti (9638 HK: +0.40%), an Italy-domiciled maker and marketer of luxury powerboat and yachts. Amid the expiration of lock-up and ahead of a potential June listing of its shares on the Milan Stocks Exchange, traction of the stock has recently been increasing on good earnings, a strong outlook, competitive fundamentals in relation to other luxury brands as well as expectations that China’s Weichai Group, which currently owns 64% of the firm, could sell roughly half of its stake in the company shortly. Ferretti (9638 HK) is an IPOX® Global Composite Index member and portfolio holding of the Rakuten Global IPO Fund, a Japan listed and distributed fund sub-advised by IPOX®.

*Basis for CME-traded e-mini IPOX® 100 U.S. Futures (IPOM3). †Also available in UCITS format in Europe in EUR (EFPX IM), USD (IPXE LN), and GBP (FPX LN/FPXE LN). GNDX and SPAC returns measured since live launch on 08/13/2021, 07/30/2020 and 11/17/2020. aGNDXI, IXSM and IPHI started trading live on 3/17/23.

GLOBAL IPO DEAL FLOW REVIEW AND OUTLOOK: 4 notable deals launched across the accessible global markets last week, with the average (median) equally-weighted company declining by -17.51% (-14.93%) based on the difference between the final offering price and Friday’s close. The string of weak first day/week returns for H.K. traded and Chinese domiciled deals (2486 HK and 2480 HK) continued. Set to commence trading Monday, the most significant IPO of the week belongs to Italian luxury furnisher maker Italian Design Brands (IDB IM). With books fully covered, the firm raised EUR million 70 for a 27.5% stake in the company, valuing the firm at EUR million 293. For more deals, please visit www.ipox.com

THE IPOX® SPAC (SPAC): The Index of a selected 50 constituents trading at both the pre- and post-consummation stage fell -1.45% to +1.19% YTD. IPOX® SPAC Leaders recording notable upside moves last week included workforce lodging provider Target Hospitality (TH US: +22.92%) after surging on great earnings driven by government contracts. Insider Sales pressured wire transfer services provider International Money Express (IMXI US: -12.00%). Other SPAC news from last week: 1) 4 SPACs Announced Merger agreement include Black Spade Acquisition (BSAQ US: +0.97%) with Vietnamese conglomerate Vingroup’s EV maker spin-off VinFast. The deal gives VinFast an equity value in excess of USD billion 23, making it the highest SPAC valuation since 2021 and the third largest deal at announcement following Medicare, Medicaid payer reimbursement recovery company MSP Recovery (LIFW US: -74.38% YTD) and Southeast Asia’s super-app operator Grab (GRAB US: -1.55% YTD). 2) No SPAC Approved/ Completed Business Combination. 3) 4 SPACs announced and/or completed liquidation. 4) No SPAC launched last week in the U.S.

For the latest IPO News follow us on Twitter @IPOX_Schuster