The IPOX® Week #688

IPOX® 100 U.S. (ETF: FPX) soars past benchmarks towards mid-year end.

De-SPAC Moonlake leads IPOX® Europe (ETF: FPXE) to +4.67% gain.

Pre/Post IPOX® SPAC (SPAC) rockets +5.39%. 1 new SPAC launched.

U.S. IPOs get done as window open. Germany’s Nucera lined up.

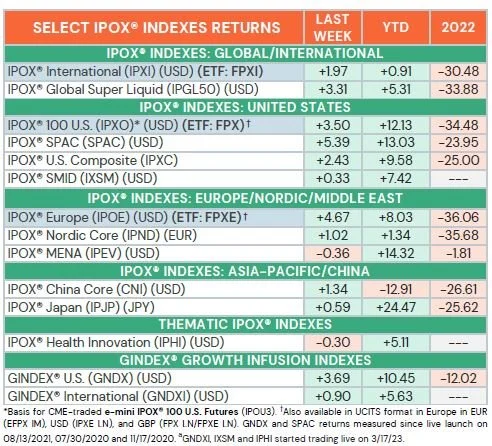

WEEKLY IPOX® PERFORMANCE REVIEW: The key IPOX® Indexes soared ahead of the shortened U.S. trading week, as risk appetite continued to increase amid further signs of decelerating U.S. inflation driving short covering across the broad-based derivatives-heavy benchmark indexes and big outsized moves across individual IPOX® Portfolio Holdings after corporate events and quarterly results. In the U.S., for example, the diversified IPOX® 100 U.S. (ETF: FPX), benchmark for the performance of the largest and typically best performing U.S. domiciled IPOs and Spin-offs, soared +3.50% to +12.13% YTD, a strong +115 bps. ahead of the S&P 500 (ETF: SPY), benchmark for U.S. stocks. (Relative) strength extended to markets abroad with the IPOX® 100 Europe (ETF: FPXE) adding +4.67% to +8.03% YTD, a massive +293 bps. ahead of its regional benchmark, while the broad-based IPOX® Japan (IPJP) rose while all other benchmarks fell on the back of a key corporate action in an IPO M&A, for example.

GINDEX® PERFORMANCE REVIEW: The select list of super liquid and diversified U.S.-domiciled and global acquirers of recent IPOs (IPO M&As) also rose sharply, with the large-cap focused GINDEX® U.S. (GNDX) and the GINDEX® International (GNDXI) adding +3.69% and +0.90%, respectively.

IPOX® PORTFOLIO STOCKS IN FOCUS: Electric car maker Rivian Automotive (RIVN US: b), recently added insurance distributor Fidelity National Spin-off F&G Annuities & Life (FG US: +19.19%) and software maker Unity Software (U US: +15.88%) ranked on top of the list of best performing IPOX® 100 U.S. (ETF: FPX) portfolio holdings, while IPOX® 100 Europe (ETF: FPXE) portfolio holding de-SPAC Swiss domiciled U.S. traded biotech MoonLake Immunotherapeutics (MLTX US: +97.06%) soared amid a positive drug update and USD 250 Million share offering. We also note strong gains in London-traded fintech IPOX® International (ETF: FPXI) holding Wise (WISE LN: +24.19%) on better-than-expected quarterly results, renewed gains in Norway-domiciled U.S.-traded web app development firm Opera (OPRA US: +15.12%) and a good week for beleaguered German alternative energy firm Siemens Energy (ENR GY: +10.44%). In the IPOX® Japan (IPJP), big gains in special chemicals maker IPO M&A heavyweight JSR (4185 JP: +27.09%) on a proposed government buyout drove the portfolios big outperformance. With the exception of all-star IPO M&A Eli Lilly (LLY US: +2.21%), biotech and health care stocks lagged, with Regeneron (REGN US: -7.85%), 06/20 IPO Legend Biotech (LEGN US: -7.07%), Swedens Bioartic (BIOAB SS: -12.53%) and H Lundbeck (HLUND DC: -8.47%) recording significant losses.

GLOBAL IPO DEAL FLOW REVIEW AND OUTLOOK: Amid the huge wave in Japan-domiciled micro-cap IPOs coming to market, ca. 10 significantly sized companies went public last week, with the average (median) equally weighted stock adding +30.20% (+6.76%) based on the difference between the final offering price and Friday’s close. Most upside focus was on Tokyo-traded AI IT Services producer small-cap GDEP ADANCE (5885 JP: +203.33%). Respective larger-sized U.S. deals traded mixed with thrift store operator Savers Value Village (SVV US: +31.67%) rising strongly, while energy firm Kodiak Gas Services (KGS US: +1.50%) and Fidelis Insurance Holdings (FIHL US: -2.50%) delivered a more muted debut. Across Europe and Asia, Italy’s luxury yacht maker, H.K.-traded Ferretti (YACHT IM: -4.00%) fell in its Milan debut, while all respective H.K. IPOs rose, including digital pharma platform operator YSB (9885 HK: +1.50%), biotech Laekna (2105 HK: +35.86%) and clinical lab services provider ADICON Holdings (9860 HK: +12.01%).

Amid the U.S. 4th of July holiday week, focus this week is on deals abroad with a number of companies set to debut. The largest deal of the week belongs to Germany’s alternative energy/green hydrogen electrolysis technology firm ThyssenKrupp Nucera AG (NCH2 GR), while Japan is lining up more high-tech AI small-cap deals. Monday: Redox Ltd. (redox.com) (RDX AU). Sector: Distribution/Wholesale. Country: Australia. Offer Size: AUD million. 402.23. Final offer price: AUD 2.55. Wednesday: Bleach Inc. (Bleach.co.jp) (9162 JP). Sector: Advertising. Country: Japan. Offer Size: JPY bn 8.31. Final offer price: JPY 1340 (Top of Range). Friday: 1) Grid Inc. (gridpredict.jp) (5582 JP). Sector: IT/AI Systems. Country: Japan. Offer Size: JPY bn 2.46. Final offer price: JPY 2140 (Top of Range). 2) Thyssenkrupp Nucera AG (thyssenkrupp-nucera.com) (NCH2 GR). Sector: Alternative Energy. Country: Germany. Offer Size; EUR ml 566. Offer range: EUR 19-21.50.

THE IPOX® SPAC (SPAC): The Index of a select list of 50 companies trading at both the pre- and post-consummation rallied +5.39% to +13.03% YTD, closing out the last trading day of the month, quarter and first half strong. IPOX® SPAC Leaders recording upside moves last week included Swiss biotech MoonLake Immunotherapeutics (MTLX US: +97.06%), while last week’s big winner biotech Disc Medicine (IRON US: -15.38%) fell after reported insider (Novo Nordisk-affiliated) sell. Other SPAC news from last week: 1) 5 SPACs Announced Merger Agreement include Semper Paratus Acquisition (LGST US: +0.75%) with biotech Tevogen Bio. 2) 2 SPACs Approved/Completed Business Combinations include GSR II Meteora Acquisition (GSRM US: -53.49% approved merger with bitcoin AUM provider Bitcoin Depot (BTM US: TBD). 3) 4 SPACs announced liquidation. 4) 2 deSPACs received buyout offers including communication services provider Kaleyra (KLR US: +67.25%) and health food firm Whole Earth Brands (FREE US: +28.85%). 5) 1 new SPAC launched last week in the U.S.

For the latest IPO News follow us on Twitter @IPOX_Schuster