The IPOX® Week #689

IPOX® 100 U.S. (ETF: FPX) drops as market expects further Fed hikes.

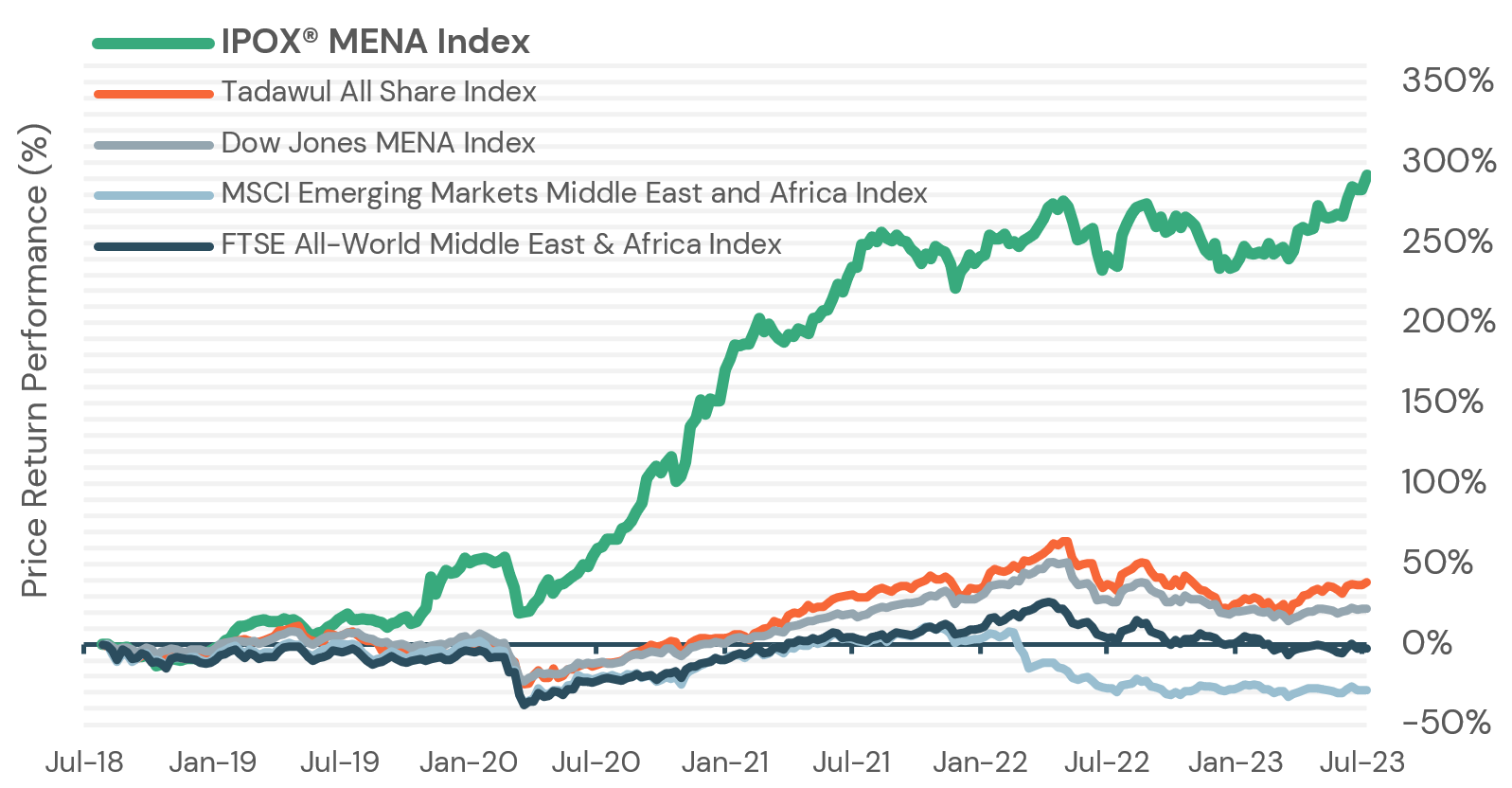

IPOX® MENA (IPEV) surges to weekly all-time high as momentum continues.

IPOX® SPAC (SPAC) drops

-0.90%. No SPAC launched in U.S. last week.

Nucera surges on debut, European market opens up with largest offer YTD.

WEEKLY IPOX® PERFORMANCE REVIEW: The IPOX® Indexes traded mixed in the shortened U.S. trading week. Ahead of the upcoming July 12 CPI numbers, the U.S. market reacted strongly to Thursday’s hotter-than-expected ADP National Employment Report. Equities fell after the new job numbers showed that hiring increased, leading traders to expect that the Fed will lift rates at its meeting later this month. This led long term U.S. treasury bond yields higher, above the key 4% level. In the U.S., the IPOX® 100 U.S. (-1.34%, ETF: FPX) fell alongside the broader market to +10.63% YTD. In Europe, the IPOX® Europe (ETF: FPXE) slid -1.52% to +6.40% YTD, taking +184 bps. from the STOXX Europe 50 (SX5L: -3.35%). Outside the U.S., the IPOX® International (ETF: FPXI) gained slightly to +0.98% YTD, supported by the outperformance in select large-cap holdings (e.g. Alibaba, Ecopro BM) as well as the continued stellar showing of our Middle East exposure. Here, the IPOX® MENA rose +2.35% to +17.01% YTD, a new all-time high after exchanges in the region returned from the week-long Eid Al-Adha holiday.

IPOX® PORTFOLIO STOCKS IN FOCUS: The IPOX® 100 U.S. (ETF: FPX) was led by EV maker Rivian (RIVN US: +48.26%), which rallied to its highest price in 2023 after posting strong deliveries and an analyst upgrade. Business software maker C3.ai (AI US: +7.74%) climbed amid continued momentum in AI firms. Swedish web browser firm Opera (OPRA US: +23.30%) led the IPOX® Europe (ETF: FPXE) after making headlines that it could bypass Twitter’s new controversial view limit. Compatriot air conditioning firm Munsters Group (MTRS SS: +11.04%) surged on receiving a $88m order from a US data center company. Renewables firm Siemens Energy (ENR GR: -7.85%) fell on news about wind turbine defects. In the IPOX® International (ETF: FPXI), Dubai property developer Emaar Development (EMAARDEV UH: +17.88%) rallied to a fresh high, while South Korean battery maker Ecopro BM (247540 KS: +12.45%) climbed on positive EV sentiment. Chinese e-commerce giant Alibaba (BABA US: +8.64%) rose on news that former IPO candidate Ant Group is to pay a hefty fine, sparking hopes that the probe into the firm’s fintech affiliate may be over. In Japan, record-breaking chipmaker Socionext (6526 JP: -16.24%) plunged as Fujitsu & Panasonic announced their exit from the former JV.

GLOBAL IPO DEAL FLOW REVIEW AND OUTLOOK: 6 sizable international IPOs started trading last week, dropping -3.90% from offer price to Friday’s close. The largest IPO was Indonesian miner Amman Mineral International (AMMN IJ: +3.54%, $715m), the country’s biggest listing in YTD 23. The European IPO market saw the busiest week YTD, with German hydrogen firm Thyssenkrupp Nucera (NCH2 GR: +16.00%, $659 offer size, read The IPOX® Watch for more information), British B2B payments processor Cab Payments (CABP LN: -6.94%, $372m) and Italian medical device distributor IMD (IMD IM: -4.39%, $39m). Chinese cobalt miner Huayou Cobalt (HUAYO SW, $583m) listed GDRs in Switzerland, which however didn’t see any trading volume by the end of Friday. Australian chemicals distributor Redox (RDX AU: -5.88%, $276m) and Thai clinic operator Patrangsit Healthcare Group (PHG TB: -25.71%, $33m) fell on debut.

7 sizable offers are expected this week: Monday: Chinese building heating firm Wise Living Technology (2481 HK, $35m offer) and Malaysian property developer SkyWorld Development (SKYWLD MK, $69m). Tuesday: Chinese generic drug maker Sichuan Kelun-Biotech Biopharmaceutical (6990 HK, $174m). Wednesday: Romania’s largest energy producer Hidroelectrica (H2O RO, $1.75b), largest ever IPO in the country and largest in Europe in 2023, and SoftBank-backed Chinese fitness app Keep (3650 HK, $85m). Thursday: Italian digitalization consultancy Maggioli (Ticker pending, $146m) and consumer healthcare retail holding firm Star Plus Legend Holdings (6683 HK, $102m).

THE IPOX® SPAC (SPAC): The Index of 50 constituents trading at both the pre- and post-consummation stage slid -0.90% to +12.01% YTD. IPOX® SPAC Leaders recording the most upside moves last week was Italian luxury menswear brand Zegna (ZGN US: +4.97%). While single-family home construction services provider United Homes Group (UHG US: -5.56%) fell on negative housing market outlook and new selling shareholders filing. Other SPAC news from last week: 1) No SPAC Announced Merger Agreement. 2) 3 SPACs Approved/Completed Business Combinations include Galata Acquisition (GLTA US: +39.75%) approved merger with Turkey’s e-bike and e-scooter company Marti Technologies (MRT US: expected to begin trading on 7/11). 3) 3 SPACs announced liquidation. 4) No new SPAC launched last week in the U.S.

For the latest IPO News follow us on Twitter @IPOX_Schuster