The IPOX® Week #693

IPOX® 100 U.S. and IPOX® Europe beat benchmarks amid market pullback.

IPOX® MENA continues to shine as Middle East defies summer listing lull.

Large-cap holdings in focus after earnings. Symbotic maintains momentum.

IPOX® SPAC (SPAC) adds +0.97% to another new high. No SPACs debut.

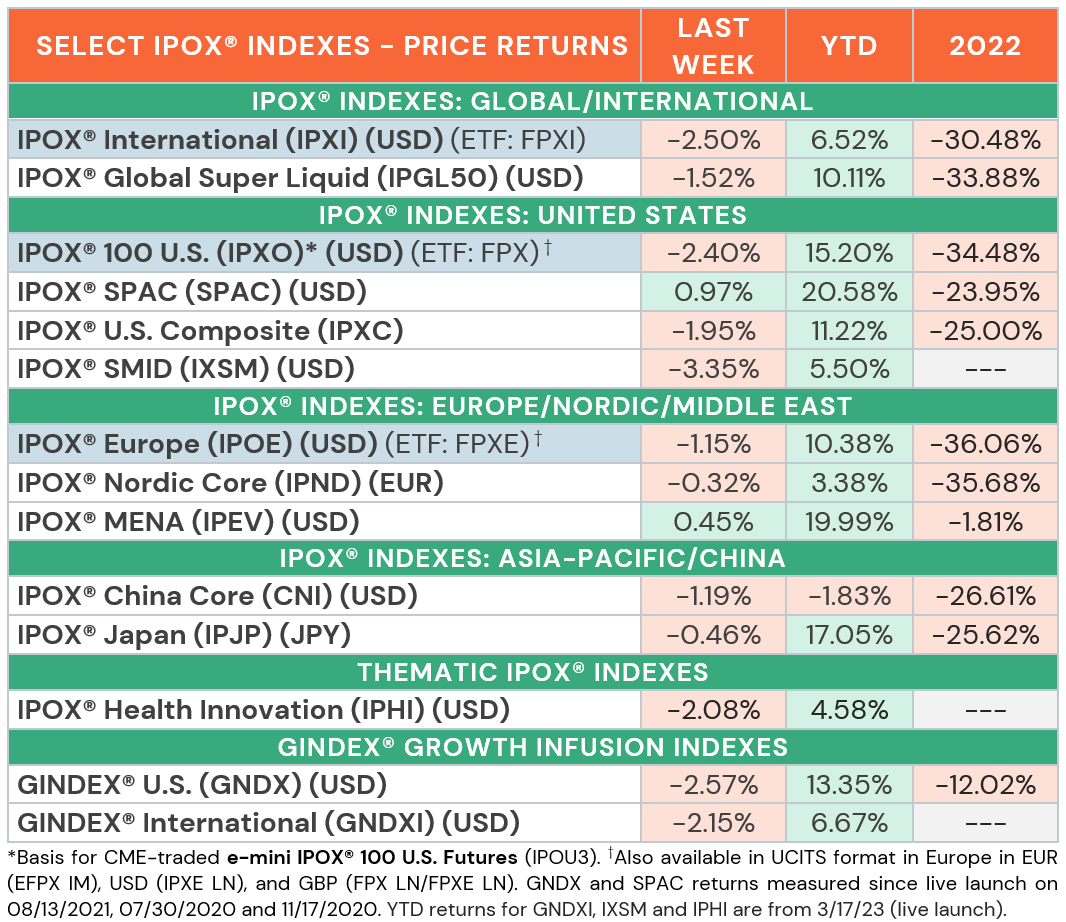

WEEKLY IPOX® PERFORMANCE REVIEW: Most of the IPOX® Indexes traded lower last week, with key indexes showing relative strength over respective benchmarks after some of our largest holdings reported earnings. In the U.S., markets reacted strongly after credit agency Fitch downgraded the country’s rating from AAA to AA+, sending long-term treasury yields above 4.2%. Conversely, the U.S. Dollar weakened as short-term yields fell after U.S. job market data showed lower unemployment and firm wage growth. Amid a surge in volatility (VIX: +28.51%), equities came under pressure across the board. The IPOX® 100 U.S. (-2.40%, ETF: FPX) descended from its recent 1-year high to +15.20% YTD, still taking 62 bps. from the Nasdaq 100 and trading in line with the S&P 500. In Europe, markets moved lower as investors digested U.S. data., amid a newly announced 25 bps. rate hike by the Bank of England. Regardless, the IPOX® Europe (-1.15%, ETF: FPXE) showed relative strength, taking a massive 142 bps. from the STOXX Europe 50 (SX5L), further closing in on the benchmark’s YTD performance. Internationally, the IPOX® MENA (IPEV) remained steady and gained +0.44% to yet another new weekly all-time high. The ongoing momentum comes as IPO activity in the Middle East is defying the current summer listing lull and Citigroup predicts Dubai and Saudi Arabia as IPO hotspots for 2024. As the IPOX® China (CNI: -1.21%) dropped following extraordinary strength in the week before (+8.88%), the IPOX® International (ETF: FPXI) fell -2.49% to +6.52% YTD.

GINDEX® PERFORMANCE REVIEW: The GINDEX® U.S. (GNDX: -2.57%) and GINDEX® International (GNDXI: -2.16%), our innovative portfolios with focus on acquirers of recent IPOs (IPO M&As) both traded lower last week.

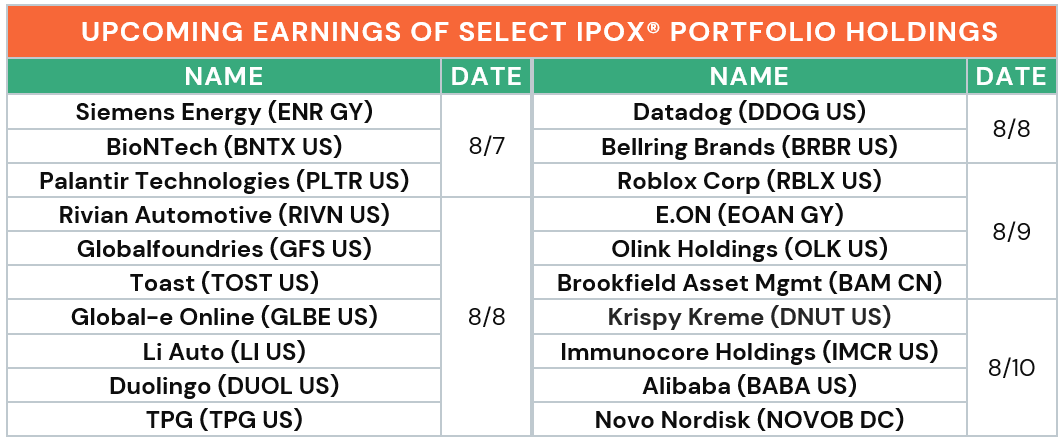

IPOX® PORTFOLIO STOCKS IN FOCUS: The IPOX® 100 U.S. (ETF: FPX) was led by Walmart-backed AI warehouse automation de-SPAC Symbotic (SYM US: +27.10%), which surged to a new weekly post-IPO high on strong sales, now having gained a massive +349% YTD. Network equipment company Extreme Networks (EXTR US: +11.75%) climbed after beating earnings estimates. Digital advertisement tech firm Integral Ad Science (IAS US: -25.34%) plunged on Friday on reports of negative operating income. Italian multinational transport vehicle manufacturing firm Iveco Group (IVG IM: +13.08%) topped the IPOX® Europe (ETF: FPXE) after raising revenue guidance and announcing plans to sell German fire engine manufacturer Magirus. Israeli solar energy equipment firm SolarEdge (SEDG US: -22.86%) fell after adjusting forecasts amid demand challenges. In the IPOX® International (ETF: FPXI), Japanese chipmaker Socionext (6526 JP: +19.06%) re-gained for the second week, following the exit from Panasonic and Fujitsu. Chinese EV maker Li Auto (LI US: +7.30%) climbed ahead of their earnings call on Tuesday. Canadian information management firm OpenText (OTEX US: -13.03%) dipped on cloud revenue growth miss.

GLOBAL IPO DEAL FLOW REVIEW AND OUTLOOK: 4 sizable IPOs started trading last week, gaining +4.19% from offer price to Friday’s close. Australia’s Abacus Storage King (ASK AU: -12.06%, $152m offer), the self-storage REIT spin-off from Abacus Property Group was the largest offer last week, followed by Indonesia’s Nusantara Sejahtera Raya (CNMA IJ: +12.59%, $149m offer), owner of the country’s largest cinema chain. The other debuts were Turkish REIT ASCE GYO (ASGYO TI: +20.95%, $77m) and Thai dairy foods producer KCG Corp (KCG TB: -4.71%, $38m). The direct listing of SharkNinja (SN US) fell -10.15% after it launched on Tuesday, giving the household and kitchen appliances maker a valuation of about $4 billion after Hong Kong-listed parent JS Global Lifestyle (1691 HK) opted for the spin-off without an IPO.

3 sizable offers are expected this week: Monday: South Korean solid-state drive (SSD) computer storage maker Fadu (440110 KS, $147m), the first fabless chip unicorn startup in the country. Tuesday: Indonesian operator of foreign retail brand stores (e.g. Garmin, DJI) Sinar Eka Selaras (ERAL IJ, $27m). Wednesday: Japanese manufacturer of conveyor belt systems JRC Co. (6224 JP, $47m).

THE IPOX® SPAC (SPAC): The Index of 50 constituents trading at both the pre- and post-consummation stage added +0.97% to +20.58% YTD. The largest moves were seen in Ohio-based data center infrastructure provider Vertiv (VRT US: +37.61%) as it soared on strong earnings and boosted projections. Southeast single-family home builder United Home Group (UHG US: -16.25%) fell. Other SPAC news from last week: 1) 5 SPACs Announced Merger Agreement include Churchill Capital VII (CVII US: +0.19%) with UK-based private equity firm CorpAcq. 2) 5 SPACs Completed Business Combinations include Compute Health Acquisition completed merger with weight-loss swallowable gastric balloon maker Allurion Technologies (ALUR US: -46.52%). 3) 1 SPAC announced liquidation. 4) No new SPAC launched last week in the U.S.

For the latest IPO News follow @IPOX on Linkedin or @IPOX_Schuster on 𝕏.