The IPOX® Week #703

Middle East tensions move IPOX® Indexes as investors seek safe havens.

IPOX® Nordic gains +2.45% as Sweden is set for first 2023 listing this week.

Birkenstock loses footing. ADES surges +34% in largest Saudi IPO YTD.

IPOX® SPAC (SPAC) dips 2.03%. No SPAC launches in the U.S. last week.

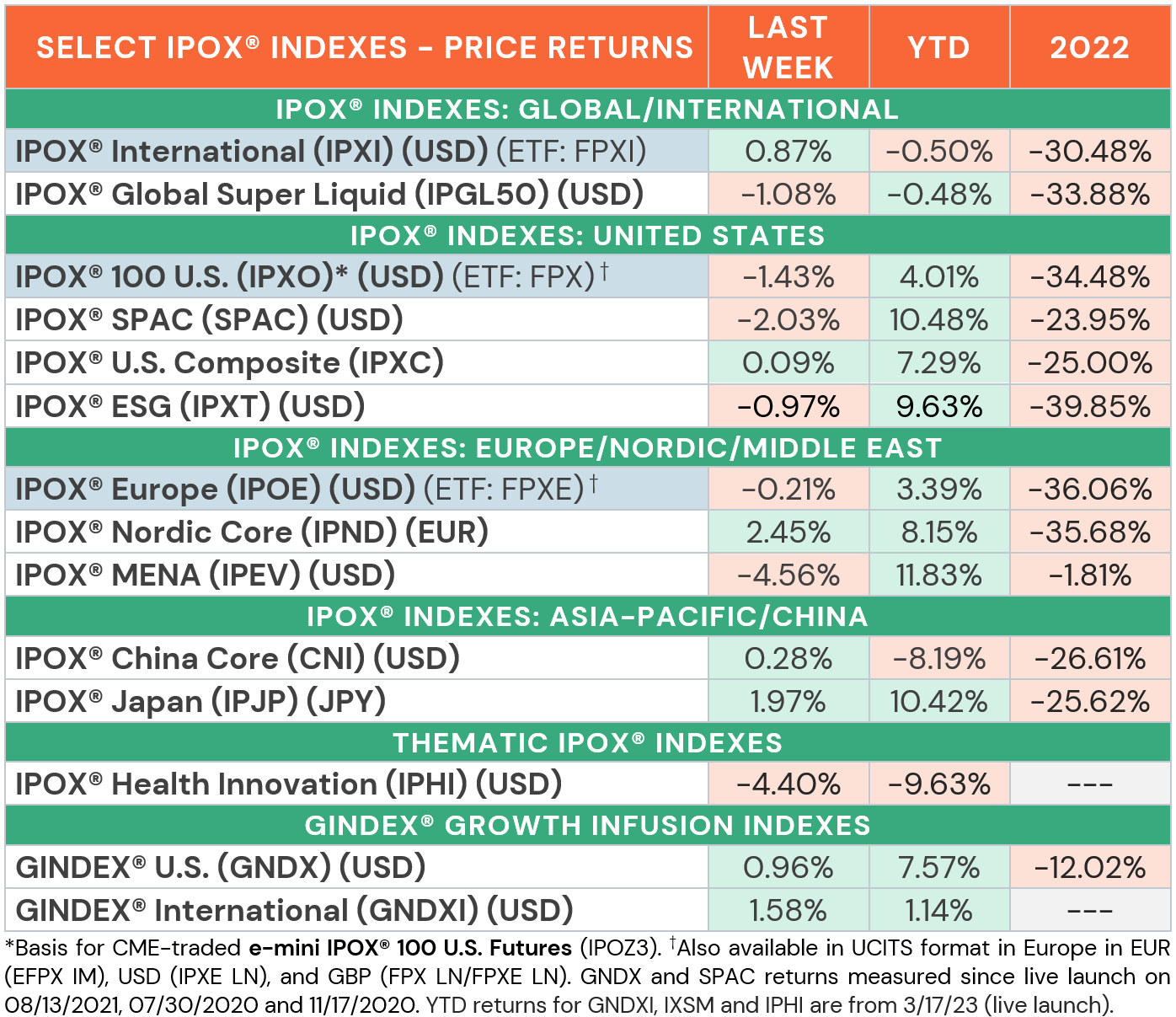

IPOX® PERFORMANCE REVIEW: Amid heightened geopolitical tensions due to the Israel-Hamas conflict, the IPOX® Indexes saw varied performances across global markets. In the U.S., earnings season kicked off with Q3 reports from major banks such as JPMorgan Chase and Wells Fargo, offering a positive note on Friday, while inflation expectations hit a five-month peak with the WTI crude oil price climbing to $87. Meanwhile, risk-averse investors sent yields lower across the board, seeking stability in traditional safe-haven assets such as Gold and U.S. treasury bonds, moving away from small caps, e.g., Russell 2000 (RTY: -1.48%), and unseasoned growth stocks. This led the IPOX® 100 U.S. (ETF: FPX) lower by -1.43% to +4.01% YTD. Globally, the IPOX® MENA (IPEV) declined -4.56% amid the conflict in the Middle East, as analysts warned of soaring oil prices and a dip in global growth if the conflict expands to involve Iran. Still, Citibank maintains an optimistic outlook for the region’s IPO market, which saw Saudi Arabia’s largest YTD listing last week. The IPOX® International (ETF: FPXI) secured gains, adding +0.87% to -0.50% YTD, while in Europe, the IPOX® Europe (ETF: FPXE) experienced a minor decline of -0.21% to +3.39% YTD. The IPOX® Nordic (IPND) continued its momentum to a new 12-month high, climbing +2.45% to +8.15% YTD.

GINDEX® PERFORMANCE REVIEW: Our innovative large-cap focused and super liquid portfolios which focus on acquirers of IPOs (IPO M&As) gained last week, with the U.S.-focused GINDEX® U.S. (GNDX) reaching +0.96% to +7.57% YTD, beating the U.S. benchmarks, while the non-U.S.-focused GINDEX® International (GNDXI) gained +1.58% to +1.14% since its 3/17 live launch.

IPOX® PORTFOLIO STOCKS IN FOCUS: The IPOX® 100 U.S. (ETF: FPX) was led by two biotech firms. Revolution Medicines (RVMD US: +19.45%) soared on encouraging cancer drug data, while Apellis Pharmaceuticals (APLS US: +18.06%) climbed as inflammation side effects, initially attributed to its drug Syfovre, have now also been seen with Astellas Pharma’s eye drug Izervay. Amid Middle East tensions, we noted gains in Exxon takeover target Permian Resources (PR UN: +12.18%) and a new post-IPO high in military drone maker Leonardo DRS (DRS US: +12.04%), while Israel-headquartered Intel self-driving AI spin-off Mobileye (MBLY US: -16.70%) may see disruptions given the call up of military reservists, Citi reported. In the IPOX® Europe (ETF: FPXE), German automotive firm Vitesco (VTSC GR: +19.71%) surged on a $3.8b takeover bid by competitor Schaeffler. Newly-added Finnish life insurance spin-off Mandatum (MANTA FH: +17.66%) soared as investor Altor bought 8%. Other gainers included German defense firm Hensoldt (HAG GR: +16.00%) and Norwegian oil and gas firm Vår Energi (VAR NO: +13.67%), which also led the IPOX® International (ETF: FPXI). Polish logistics company InPost (INPST NA: -16.70%) fell amid a downgrade at JPMorgan on weaker growth estimates. Danish pharma juggernaut Novo Nordisk (NOVOB DC: +11.03%) surged to another post-IPO high as positive Ozempic/Wegovy trial data on kidney outcomes sent shockwaves through dialysis-related firms. New IPOX® holding, Novartis generics spin-off Sandoz (SDZ SW), added +11.00% as Bank of America initiated analyst coverage with a Buy rating.

IPO REVIEW: 5 sizable IPOs listed last week, gaining an average +52.69% from offer price to Friday’s close. The U.S. IPO of German shoe maker Birkenstock (BIRK US: -20.91%) was the largest last week, raising $1.48b for private equity owner L Catterton. Read more in the latest edition of The IPOX® Watch. The second largest IPO was by Saudi oil & gas firm Ades (ADES AB: +33.93%). The country’s largest listing this year surged on rising commodity prices and continued investor appetite in the MENA region. Indonesian geothermal energy producer Barito Renewable Energy (BREN IJ: +202.56%) skyrocketed amid the country’s recent push for green firms to go public. Stable food producer Shiyue Daotian (9676 HK; +45.83%) and EV motorbike maker Luyuan (2451 HK: +2.04%) launched successful debuts in Hong Kong, sparking hopes of a market revival in the region.

IPO MARKET OUTLOOK: 3 sizable firms are expected to list this week. Monday: Australian childcare group Nido Education (NDO AU, $64m) is set to return to the stock market at up to $148m market cap after being taken private by UK childcare firm Busy Bees in 2021 at a valuation of $123m. Thursday: Rusta (RUSTA SS, $207m), Swedish operator of more than 200 non-food discount stores across Scandinavia and Germany is Sweden’s first IPO in 2023. Fabless maker of Bluetooth/Wi-Fi chips Airoha Technology (6526 TT, $235m offer), subsidiary of MediaTek, the 5th largest semiconductor firm, plans to list in Taipei. After the last minute cancellation of French software maker Planisware, which was planned to list last week, German fleet manager DKV Mobility, owned by private equity firm CVC Capital Partners, has announced to put its IPO plans on hold until market conditions improve.

THE IPOX® SPAC (SPAC): The Index of 50 members trading at both the pre- and post-consummation stage fell -2.03% to +10.48% YTD last week. Warehouse robotic provider Symbotic (SYM US: +12.53%) as grinded back from previous week’s weakness. Bitcoin miner Bitdeer Technologies (BTDR US: -42.53%) continued to fall as crypto market is under pressure. Other SPAC news from last week: 1) 1 SPAC Announced Merger Agreement include Plutonian Acquisition (PLTN US: -0.19%) with Chinese feminine hygiene products producer Big Tree Cloud. 2) 1 SPAC Approved/Completed Business Combinations as Peter Thiel-backed Bridgetown Holdings completed merger with Singapore and Hong Kong-based personal finance platform MoneyHero/formerly known as Hyphen Group (MNY US: -48.62%). 3) 1 SPAC announced liquidation. 4) No new SPACs launched last week in the U.S.