The IPOX® Week #706

“Everything Rally” propels IPOX® 100 U.S. to largest weekly gain since 3/22.

All our indexes gain, IPOX® Health Innovation reverses trend with 8.88% surge.

Indian IPO market in focus as October listings out-number U.S. and China.

IPOX® SPAC (SPAC) gains 6.90%. No SPAC launches in the U.S. last week.

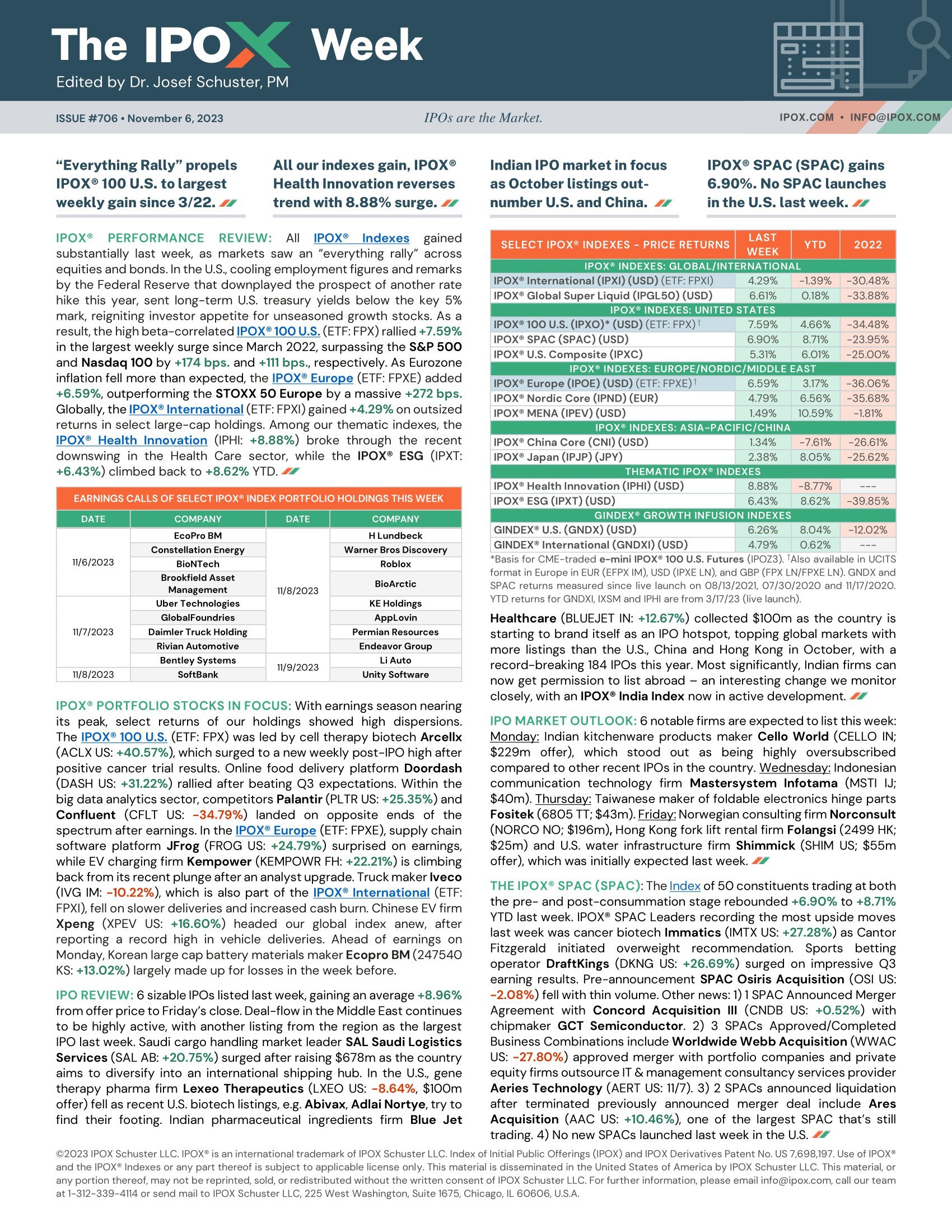

IPOX® PERFORMANCE REVIEW: All IPOX® Indexes gained substantially last week, as markets saw an “everything rally” across equities and bonds. In the U.S., cooling employment figures and remarks by the Federal Reserve that downplayed the prospect of another rate hike this year, sent long-term U.S. treasury yields below the key 5% mark, reigniting investor appetite for unseasoned growth stocks. As a result, the high beta-correlated IPOX® 100 U.S. (ETF: FPX) rallied +7.59% in the largest weekly surge since March 2022, surpassing the S&P 500 and Nasdaq 100 by +174 bps. and +111 bps., respectively. As Eurozone inflation fell more than expected, the IPOX® Europe (ETF: FPXE) added +6.59%, outperforming the STOXX 50 Europe by a massive +272 bps. Globally, the IPOX® International (ETF: FPXI) gained +4.29% on outsized returns in select large-cap holdings. Among our thematic indexes, the IPOX® Health Innovation (IPHI: +8.88%) broke through the recent downswing in the Health Care sector, while the IPOX® ESG (IPXT: +6.43%) climbed back to +8.62% YTD.

IPOX® PORTFOLIO STOCKS IN FOCUS: With earnings season nearing its peak, select returns of our holdings showed high dispersions. The IPOX® 100 U.S. (ETF: FPX) was led by cell therapy biotech Arcellx (ACLX US: +40.57%), which surged to a new weekly post-IPO high after positive cancer trial results. Online food delivery platform Doordash (DASH US: +31.22%) rallied after beating Q3 expectations. Within the big data analytics sector, competitors Palantir (PLTR US: +25.35%) and Confluent (CFLT US: -34.79%) landed on opposite ends of the spectrum after earnings. In the IPOX® Europe (ETF: FPXE), supply chain software platform JFrog (FROG US: +24.79%) surprised on earnings, while EV charging firm Kempower (KEMPOWR FH: +22.21%) is climbing back from its recent plunge after an analyst upgrade. Truck maker Iveco (IVG IM: -10.22%), which is also part of the IPOX® International (ETF: FPXI), fell on slower deliveries and increased cash burn. Chinese EV firm Xpeng (XPEV US: +16.60%) headed our global index anew, after reporting a record high in vehicle deliveries. Ahead of earnings on Monday, Korean large cap battery materials maker Ecopro BM (247540 KS: +13.02%) largely made up for losses in the week before.

IPO REVIEW: 6 sizable IPOs listed last week, gaining an average +8.96% from offer price to Friday’s close. Deal-flow in the Middle East continues to be highly active, with another listing from the region as the largest IPO last week. Saudi cargo handling market leader SAL Saudi Logistics Services (SAL AB: +20.75%) surged after raising $678m as the country aims to diversify into an international shipping hub. In the U.S., gene therapy pharma firm Lexeo Therapeutics (LXEO US: -8.64%, $100m offer) fell as recent U.S. biotech listings, e.g. Abivax, Adlai Nortye, try to find their footing. Indian pharmaceutical ingredients firm Blue Jet Healthcare (BLUEJET IN: +12.67%) collected $100m as the country is starting to brand itself as an IPO hotspot, topping global markets with more listings than the U.S., China and Hong Kong in October, with a record-breaking 184 IPOs this year. Most significantly, Indian firms can now get permission to list abroad – an interesting change we monitor closely, with an IPOX® India Index now in active development.

IPO MARKET OUTLOOK: 6 notable firms are expected to list this week: Monday: Indian kitchenware products maker Cello World (CELLO IN; $229m offer), which stood out as being highly oversubscribed compared to other recent IPOs in the country. Wednesday: Indonesian communication technology firm Mastersystem Infotama (MSTI IJ; $40m). Thursday: Taiwanese maker of foldable electronics hinge parts Fositek (6805 TT; $43m). Friday: Norwegian consulting firm Norconsult (NORCO NO; $196m), Hong Kong fork lift rental firm Folangsi (2499 HK; $25m) and U.S. water infrastructure firm Shimmick (SHIM US; $55m offer), which was initially expected last week.

THE IPOX® SPAC (SPAC): The Index of 50 constituents trading at both the pre- and post-consummation stage rebounded +6.90% to +8.71% YTD last week. IPOX® SPAC Leaders recording the most upside moves last week was cancer biotech Immatics (IMTX US: +27.28%) as Cantor Fitzgerald initiated overweight recommendation. Sports betting operator DraftKings (DKNG US: +26.69%) surged on impressive Q3 earning results. Pre-announcement SPAC Osiris Acquisition (OSI US: -2.08%) fell with thin volume. Other news: 1) 1 SPAC Announced Merger Agreement with Concord Acquisition III (CNDB US: +0.52%) with chipmaker GCT Semiconductor. 2) 3 SPACs Approved/Completed Business Combinations include Worldwide Webb Acquisition (WWAC US: -27.80%) approved merger with portfolio companies and private equity firms outsource IT & management consultancy services provider Aeries Technology (AERT US: 11/7). 3) 2 SPACs announced liquidation after terminated previously announced merger deal include Ares Acquisition (AAC US: +10.46%), one of the largest SPAC that’s still trading. 4) No new SPACs launched last week in the U.S.