The IPOX® Week #715

IPOX® Indexes face profit-taking pressure after 2023 growth momentum.

International holdings out-perform U.S. amid early-year tech rout.

Analysts see strong M&A momentum in 2024 with focus on biopharma.

IPOX® SPAC (SPAC) loses -3.42%. No U.S. SPACs launched last week.

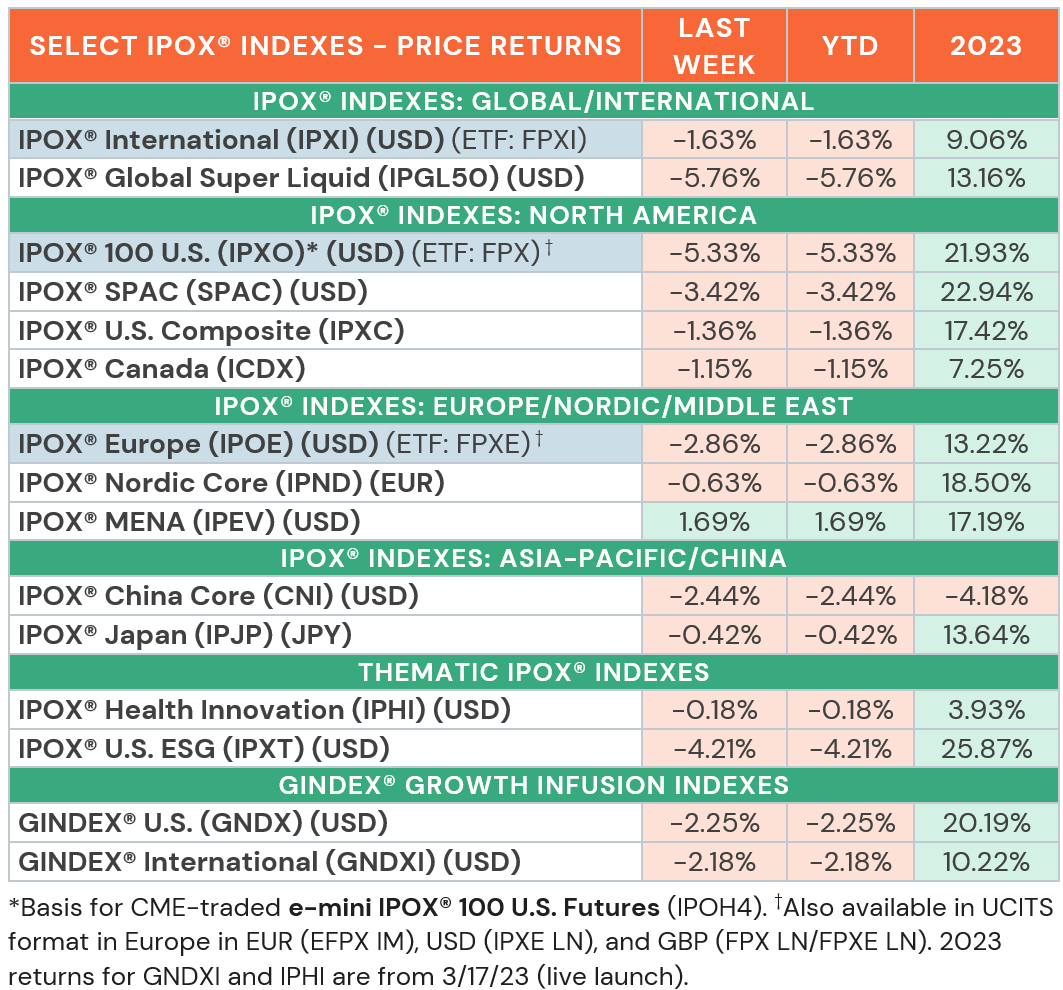

IPOX® PERFORMANCE REVIEW: Following a strong showing in 2023, most IPOX® Indexes fell amid weak performances across the board, as global equity markets digested the recent Q4 bull run. In the U.S., volatility increased (VIX: +7.23%) and long term treasury rates rose above the key 4% level, sending the broader market lower. After the impressive performance of the Nasdaq 100 (NDX) in 2023 (+55.13%), growth-focused profit taking caused the benchmark’s worst start in decades, pressuring the IPOX® 100 U.S. (ETF: FPX), which dropped -5.33% on lackluster showings in select tech holdings. Sentiment extended to markets abroad, which still largely performed better than U.S. growth exposure e.g., the IPOX® Europe (ETF: FPXE) fell -2.86% amid USD/EUR moves and relative strength in Scandinavia-domiciled exposure (i.e. IPOX® Nordic, IPND: -0.63%). The Middle East-focused IPOX® MENA (IPEV: +1.69%) gained as commodity prices climbed on continuing tensions in the region. The IPOX® International (ETF: FPXI) traded -1.63% lower as the IPOX® China (CNI: -2.44%) fell amid developing Europe-China trade feuds. Within our thematic indexes, the biotech-focused IPOX® Health Innovation (IPHI: -0.18%) weathered the New Year sell-off as the sector remains active, with two pharma firms having filed for new U.S. IPOs on Friday and expectations of a strong M&A market continuing into 2024.

GINDEX® PERFORMANCE REVIEW: After a slew of acquisitions within the IPOX® Indexes universe in 2023, we expect to see the wave of buy-to-grow acquisitions to continue this year. Still, the innovative and super-liquid GINDEX® U.S. Growth Infusion Index (GNDX: -2.44%) and GINDEX® International (GNDXI: -2.44%) fell in week 1 of 2024.

IPOX® PORTFOLIO STOCKS IN FOCUS: Within the holdings of our indexes, we note relatively strong showings in large cap pharma/health care, while technology stocks lagged.

The IPOX® 100 U.S. (ETF: FPX) was led by two firms that both reached new post-listing highs: Broad biopharma firm IPO M&A acquirer Regeneron Pharmaceuticals (REGN: +3.97%) gained on momentum in the biotech sector, while AIG insurance spin-off Corebridge Financial (CRBG: +7.43%) rose amid buying interest by institutional investors. Conversely, a profit warning by former Intel autonomous driving unit Mobileye (MBLY US: -29.62%) spooked investors in the automotive tech sector, sending rival Aurora Innovation (AUR US: -24.71%) and EV maker Rivian (RIVN US: -18.67%) lower as well.

The IPOX® Europe (ETF: FPXE) saw most gains in Norwegian vehicle shipping firm Höegh Autoliners (HAUTO NO: +9.16%), which climbed to a new all-time high as conflict in the Red Sea increases shipping costs. Generics pharma maker Sandoz (SDZ SW: +5.88%) climbed amid plans together with GINDEX® U.S. Growth Infusion Index member CVS Health (CVS US: +3.12%) to replace AbbVie’s arthritis blockbuster drug Humira with a cheaper biosimilar made by the Novartis spin-off. British sportwear retailer JD Sports (JD/ LN: -27.63%) tumbled after issuing a profit warning, blaming mild winter weather for a lack of demand in seasonal offerings.

The IPOX® International (ETF: FPXI) headed our main indexes on surges in Korean EV battery-related stocks, as Morgan Stanley analysts chose material sciences firm SK IE Technology (361610 KS: +7.98%) as top pick, sending large cap battery materials provider Ecopro BM (247510 KS: +9.38%) higher as well, despite a price target cut. Worst performer was British chipmaker and 2023 mega-IPO performer Arm (ARM US: -10.77%) amid profit taking in the tech industry.

IPO MARKET REVIEW/OUTLOOK: The only sizable IPO this year so far has been Shenzhen-based LiDAR sensor technology maker Robosense Technology (2498 HK) in Hong Kong. Amid weakness in the autonomous driving space, the firm with partners such as BYD, Geely and Toyota traded unchanged from their offer price after raising $128m.

4 firms are planning listings for this week, the largest being U.S. housing developer Smith Douglas Homes (SDHC US, $162m offer) on Thursday. Other international offerings include vehicle monitoring firm Changjiu Holdings (6959 HK, $51m) and cancer treatment specialist Concord Healthcare Group (2453 HK, $83m) in Hong Kong, as well as Indonesian nickel mining firm Adhi Kartiko Pratama (NICE IJ, $34m), which launches on the back of a slew of Indonesian nickel firms that surged in 2023.

Follow our IPO Calendar and social media channels (e.g. Linkedin) for the latest IPO News.

IPOX® SPAC INDEX (SPAC): The Index of 50 constituents trading at both the pre- and post-consummation stage retreated on first week of the new year falling -3.42%. IPOX® SPAC Leaders was private aviation hangar space provider Sky Harbour Group (SKYH US: +17.60%) as the niche market operator climb back from its last year-end’s profit taking sell-off. Personal finance and online banking fintech SoFi Technologies (SOFI US: -17.39%) fell after last year’s +115% rally. Other SPAC news from the first week of 2024: 1) 3 SPACs Announced Merger Agreement last week including Twelve Seas Investment Company II (TWLV US: +4.25%) with turquoise-water and idyllic beach-like artificial lagoons developer Crystal Lagoons. 2) 1 SPAC Approved/Completed Business Combinations include Pono Capital Three (PTHR US: +22.60%) with hybrid electric Vertical TakeOff and Landing/eVTOL company Horizon Aircraft (HOVR US: TBA). 3) No SPAC announced to liquidate. 4) No new SPAC launched last week in the U.S.