The IPOX® Week #721

IPOX® Indexes rally anew as good earnings trump spike in rates.

International exposure far outpaces U.S. domiciled IPOX® Holdings.

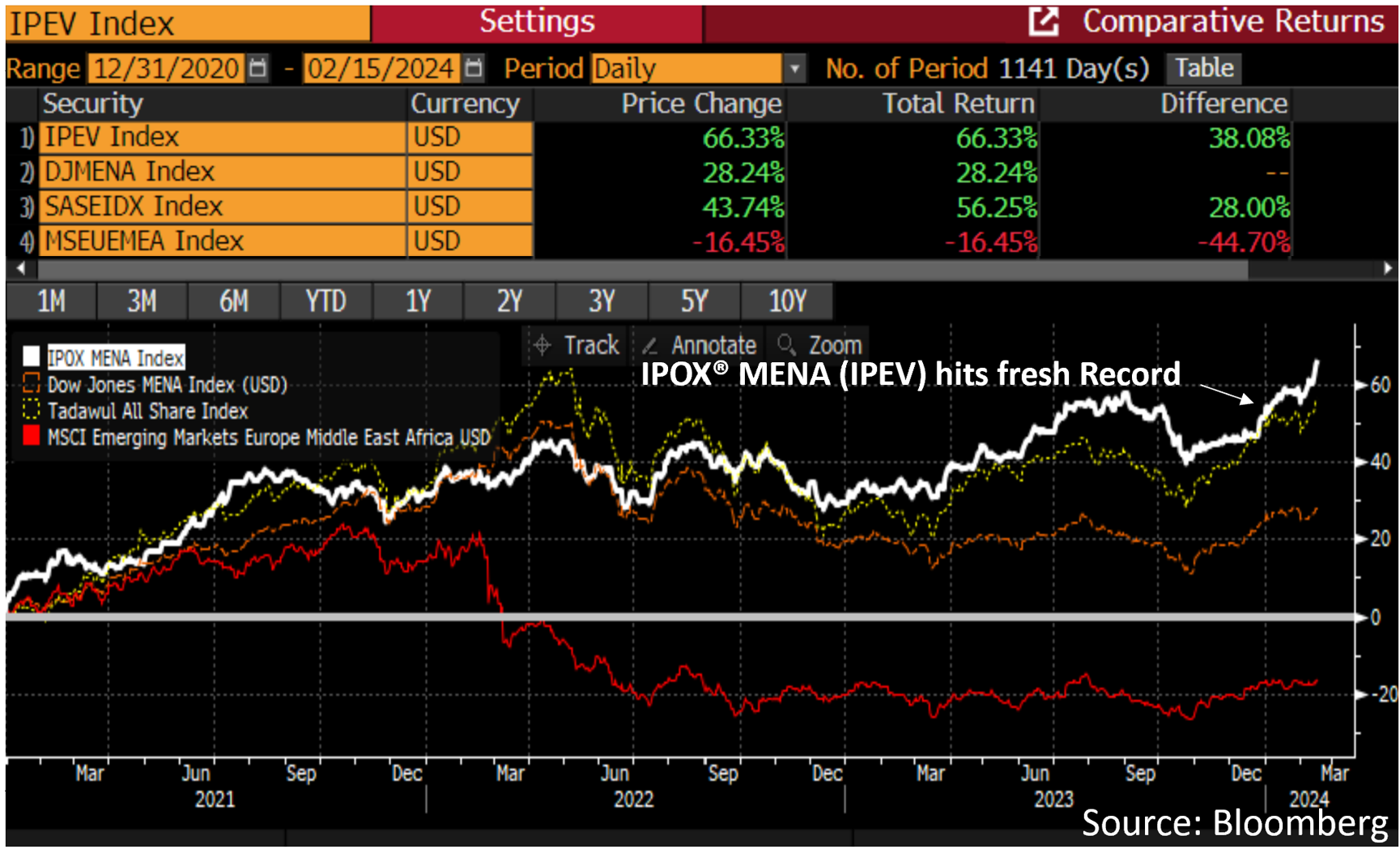

Middle East-focused IPOX® MENA hits fresh record amid IPO enthusiam.

New Product Launch: IPOX® proudly launches the IPOX® Bond Indexes.

IPOX® PERFORMANCE REVIEW: The impact of strong earnings trumped soaring rates last week as most IPOX® Indexes continued their big rally. Amid the spike in U.S. risk (VIX: +10.13%), most upside focus was for stocks domiciled outside the United States. For example, the IPOX® International, tracked by multiple Financial Products, including an ETF from First Trust (Ticker: FPXI), added a strong +2.32% to +5.84% YTD, extending its lead vs. its benchmark by +99 bps. to a massive +507 bps. YTD (+298 bps. Y/Y). Here, ahead of the Tadawul-sponsored Saudi Capital Markets Forum taking place in Riyadh this week, the IPOX® MENA (IPEV) added +3.68% to +9.69% YTD as the enthusiasm for the region continues. Big strength also extended to the IPOX® Europe (ETF: FPXE) and IPOX® Nordic (IPND), as well as the Asia-focused IPOX® exposure pooled in IPOX® Japan (IPJP) and notably IPOX® China (CNI). Ahead of the shortened U.S trading week, the IPOX® 100 U.S. (ETF: FPX) added +0.27% to +4.99% YTD for a 6th week of gains in a row, now outpacing the declining S&P 500 (SPX), benchmark for U.S. stocks. The spike in rates last week had little impact on Momentum as 91% of IPOX® 100 U.S. portfolio holdings exceeded analyst estimate during this earnings season, exceeding the S&P 500. Acquirers of IPOX® holdings tracked in the IPOX® Growth Infusion Indexes (GNDX and GNDXI), as well as debt issued by IPOX® Holdings pooled in the IPOX® Bond Indexes (IPOXTD, IPXULQD and IPXUHYG) traded in line with the respective benchmarks last week.

IPOX® PORTFOLIO HOLDINGS IN FOCUS: Recently added New Listings from Europe were one of the most notable stand-outs last week, with defense plays Frankfurt 02/06 IPO Renk Group (R3NK GY: +29.39%) and Amsterdam 02/09 IPO Theon International (THEON NL: +18.34%) leading the way. Both are portfolio holdings in the IPOX® 100 Europe (ETF: FPXE). Amid huge swings in the stock and ahead of the expiration of lock-ups set from March 12, we also note another stellar week for U.K. chipmaker ARM (ARM US: +11.40%). Heavily weighted across multiple IPOX®-run portfolios, including the long-only Rakuten Global IPO Fund - an alternative actively managed mutual fund available in Japan – the stock added to the previous week’s explosive gains. Internet-based wealth management platforms and robo advisors did extremely well last week, including Sweden-based Nordnet (SAVE SS: +7.02%), as well as Japan-traded WealthNavi (7342 JP: +42.68%) which received an investment from MUFG, while a buy-out proposal for French-based internet music group Believe (BLF FP: +19.15% added to the string of deals for innovative European small-caps. Stand-outs in the U.S. last week included interest rate-insensitive firms, including P/E-backed AI solutions provider App Loving (APP US: +29.17%), crypto exchange Coinbase (COIN US: +26.99%) and online trader Robinhood (HOOD US: +21.21%), which leaped after reporting stellar quarterly number. Across our MENA portfolio, we note fresh high in software play ELM (ELM AB +8.23%). Weak earnings and higher rates pressured Carrier Global (CARR US: -3.59%), alternative energy play Fluence Energy (FLNC US: -14.58%) as well as fintech Affirm (AFFM US: -13.04%), while Chinese biotech Wuxi XDC Cayman (2268 HK: -19.24%) remained heavily offered as U.S. lawmakers sought further probes into Chinese biotechs.

LIVE LAUNCH OF THE IPOX® BOND INDEXES: The IPOX® Bond Indexes are now live, offering investors access to U.S. dollar-denominated corporate debt from companies in the IPOX® Universe, including IPOs, Spin-offs, SPACs, Direct Listings, and IPO M&A. Designed for both passive and active management, these indexes serve as benchmarks for financial products like ETFs. For more information, contact info@ipox.com.

IPO ACTIVITY AND OUTLOOK: Amid a lack of listings in East Asia due to Lunar New Year holidays, last week saw 19 debuts with focus on smaller firms ($23.6m average offer size) and highest activity in India and Indonesia. From offer price to Friday’s close, the average (median) equally-weighted deal (excluding direct listings, REITs and de-SPACs) added +21.05% (+1.35%). Two micro-cap IPOs debuted in the U.S. on NYSE American, aspiring drone maker Unusual Machines (UMAC US: -25.25%) and analgesic pharma firm Chromocell Therapeutics (CHRO US: -20.00%). In IPO News, Inspire Brands, owner of food chains Arby’s Dunkin’ Donuts, Buffalo Wild Wings, Jimmy John’s and more, announced plans for a listing at a $20 billion valuation. Switzerland-domiciled cruise ship operator Viking Cruises plans a $500m U.S. IPO. Euronext CEO signals a rebound in the European IPO market, echoing U.S.-centric remarks from Nasdaq and others.

IPOX® SPAC INDEX (SPAC): The Index saw a slight increase of +0.52%, reaching +1.63% YTD. Notably, Roivant Sciences (ROIV US) surged +7.22% after a profitable deal with Roche, while warehouse automation firm Symbotic (SYM US) fell -7.88% amid earnings volatility. In SPAC activity, 99 Acquisition Group (NNAG US) announced a merger with Nava Health MD. Five SPACs completed business combinations, including Semper Paratus Acquisition's merger with Tevogen Bio (TVGN US), which soared +104.52%. Two SPACs announced liquidation. Whole Earth Brands (FREE US) accepted a buyout at $4.875/share, a +38.89% premium, from Orzark/Sweet Oak after an initial lower offer. There were no new U.S. SPAC launches last week.

Follow our IPO Calendar and social media channels (e.g. Linkedin) for Updates.