The IPOX® Week #724

IPOX® 100 U.S. (ETF: FPX) extends YTD gains as IPOX® Bonds rally.

Heavyweight Samsara soars, IPOX® MENA sets fresh historic high.

New Product Launch:

IPOX® proudly launches the IPOX® Bond Indexes.

Read about the IPOs set to commence trading this week below.

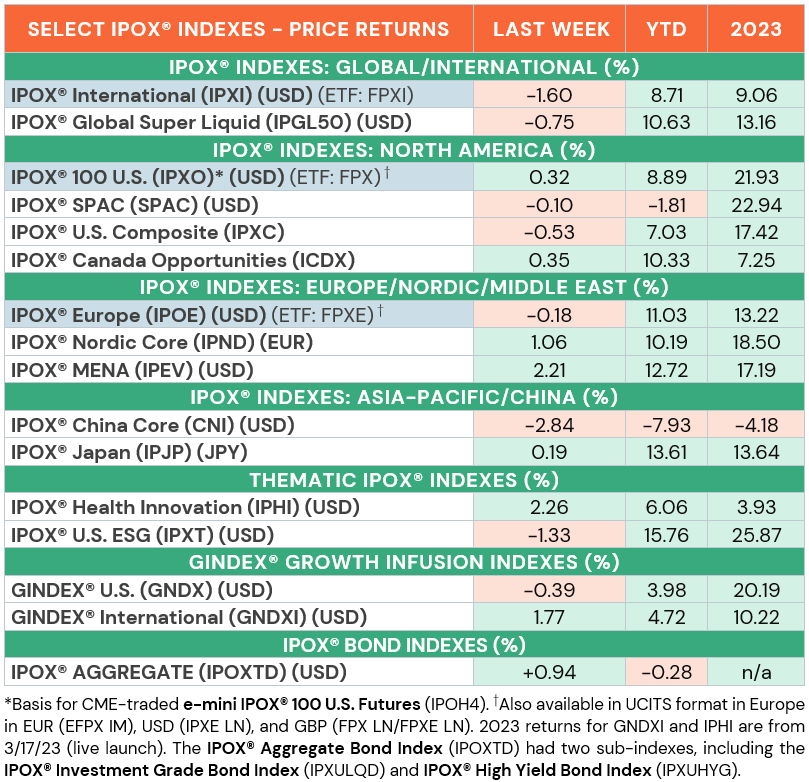

IPOX® PERFORMANCE REVIEW: Amid lower yields issued by IPOX® Universe stocks pooled in the IPOX® Aggregate Bonds Index (IPOXTD), generally supportive earnings and the spike in U.S. equity risk towards the weekend (VIX: +12.33%), the IPOX® Indexes traded mixed ahead of Futures and Options expiration week. In the U.S., e.g., the IPOX® 100 U.S. (ETF: FPX) - key benchmark for U.S. IPO performance - advanced +0.32% to +8.89% YTD, outperforming the S&P 500 (SPX) and Nasdaq 100 (NDX) by +58 bps. and +187 bps., respectively. Abroad, the story of the week belonged to yet another round of gains for the IPOX® MENA (IPEV). Propelled by strength across a number of old economy stocks listed in Saudi Arabia and the U.A.E., the semi-active IPOX® portfolio added +2.21% to +12.72% YTD, while key benchmarks recorded notable declines. We also note the fresh multi-year high in the broad IPOX® Japan (IPJP). Despite the sharply higher JPY on the week, the all-cap benchmark for Japanese innovation and incumbent domestic firms active in corporate actions, added +0.19% to +13.64% YTD. Big gains in select holdings also propelled the IPOX® Health Innovation (IPHI) to a new high, while benchmarks fell. After weeks of gains, the IPOX® International (ETF: FPXI) and IPOX® 100 U.S. Europe (ETF: FPXE) fell and lagged as YTD spreads vs. the international benchmarks narrowed.

IPOX® PORTFOLIO HOLDINGS IN FOCUS: The divergence of returns amongst portfolio holdings across the IPOX® portfolios remained wide. In the IPOX® 100 U.S. (ETF: FPX), e.g., just 46/100 companies rose, with the average (median) equally weighted portfolio stock declining by -0.94% (-0.16%), significantly lagging the applied market-cap weighted index. Companies recording big jumps, included crypto exchange Coinbase (COIN US: +24.71%), electric car maker Rivian (RIVN US: +12.60%) and IPOX® application software maker Samsara (IOT US: +11.92%), while software maker Gitlab (GTLB US: -21.29%), biotech BridgeBio (BBIO US: -18.66%) and auto parts maker Aurora Innovation (AUR US: -14.06%) fell sharply. At the same time, a positive trial result propelled biotech Apogee Therapeutics (APGE US: +81.36%), an IPOX® Health Innovation (IPHI) Core Holding. Across non-U.S. domiciled exposure, we note the good week in a number of European specialty stocks and potential takeout targets including German truck maker Traton SE (8TRA GY: +20.92%), Sweden biotech Bonesupport (BONEX SS: +11.55%), biotech IPO M&A Swedish Orphan (SOBI SS: +7.67%) and high dividend energy play Norway’s Var Energi (VAR NO: +3.83%) which all closed out the trading week at/towards its all-time high, respectively. Big momentum for the MENA region continued to propel respective local IPOX® exposure, including Saudi-traded utility Alkhorayef Water & Power Technologies (AWPT AB: +13.69%) and U.A.E-traded energy firm Adnoc Drilling (ADNOCDRI DH: +5.68%) with exchange operator Saudi Tadawul Group (TADAWULG AB: +5.79%) seeing as a big beneficiary from the equitization across the region. Chinese exposure disappointed anew last week, highlighted by the big U-turn in the share price of electric car makers Li Auto (LI US: -16.54%), Xpeng (XPEV US: -4.32%) and Zhejiang Leapmotor Technology (9863 HK: -10.00%), online retailer Pinduoduo (PDD US: -13.02%) and key education stock New Oriental Education (EDU US: -5.66%).

LIVE LAUNCH OF THE IPOX® BOND INDEXES: The IPOX® Bond Indexes are now live, offering access to U.S. dollar-denominated corporate debt from the IPOX® Universe. Designed for both passive and active financial products, these indexes aim to capture the unique returns and potential outperformance of new listings. For more information, contact info@ipox.com.

IPO ACTIVITY AND OUTLOOK: 14 accessible New Listings started trading last week, with the average (median) equally-weighted deal (non-direct listings and de-SPAC) adding +31.40% (+21.96%) based on the difference between the final offering price and the Friday’s close. The week was dominated by smaller deals, with Turkish renewable energy firm Mogan (MOGAN TI: +20.92%) being the exception, raising $94 million. Two firms listed in the U.S., including Singapore-based ride sharing app Ryde (RYDE US: +31.79%, $12m offer) and Chinese human resources consulting services firm Lucas GC (LGCL US: -19.75%, $6m offer). One large IPO is slated to debut next week: California-based cancer biotech Neonc Technologies (NTHI US, $82.5m) is expected on March 13.

Last week, three major firms have announced upcoming U.S. listings: 1) Intel-backed data center connectivity firm Astera Labs (ALAB US) plans to raise up to $534 million, positioning its focus on AI and machine learning. 2) Razor maker Harry’s Inc. filed confidentially for a NYSE listing following a $1.7 billion valuation in 2021. 3) Bayer-backed cancer pharma Boundless Bio (BOLD US) filed for a Nasdaq listing, after raising $100 million in Series C financing last May. In other news, Abu Dhabi’s wealth fund has picked banks to take Etihad Airways public. Luxury sneaker firm Golden Goose targets $3.3 billion valuation in a Milan IPO this May/July.

Follow our IPO Calendar and social media channels (e.g. Linkedin) for Updates.

IPOX® SPAC INDEX (SPAC): The Index fell -1.81% last week to the negative territory -0.10% YTD. Fintech mobile banking app MoneyLion (ML US) soared +45.58% after strong earnings and better than expected guidance, while industrial and commercial trucks and equipment specialist Custom Truck One Source (CTOS US) tanked -19.30% after missed Q4 earnings.