The IPOX® Week #725

IPOX® Indexes waver as jump in rates trumps post-earnings Momentum.

Temporary weakness draws big buyers for IPOX® MENA stock.

IPOX® International sets two year high as China, Europe rally.

Douglas, Galderma, Reddit amongst IPOs lined up to debut this week.

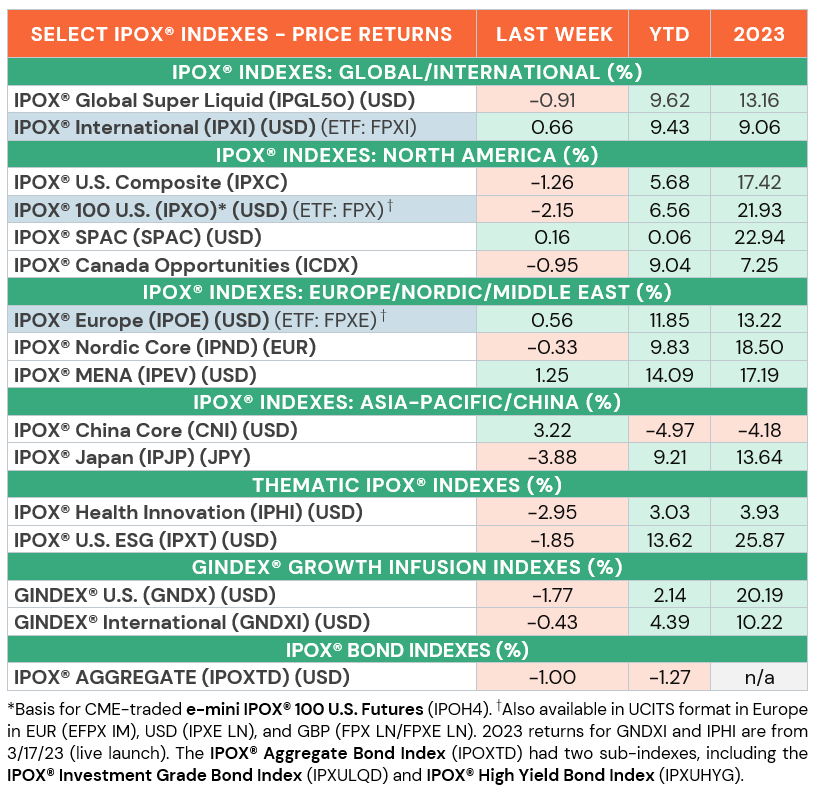

IPOX® PERFORMANCE REVIEW: The big jump in U.S. sovereign and corporate yields (IPOXTD: -1.00%) amid stronger-than-expected U.S. inflation numbers trumped post-earnings Momentum during Futures and Options expiration week with the IPOX® Indexes trading mixed across global regions. In the U.S., e.g., the IPOX® 100 U.S. (ETF: FPX) reversed the previous week’s gains to shed -2.15% to +6.56% YTD, in line with the performance of U.S. small-caps. Most IPOX® Portfolios investing across non-U.S. domiciled exposure, however, recorded gains last week. Renewed strength amongst top holdings on upgrades and short covering propelled the IPOX® China (CNI) by +3.22% to -4.97% YTD, e.g., while the IPOX® Europe (ETF: FPXE) added +0.56% to +11.85% YTD, driven by continued strength in European small-caps, strong earnings and takeover enthusiasm. This also benefited the IPOX® International (ETF: FPXI) which added +0.66% to +9.43% YTD, outpacing its (declining) benchmark last week. Amid renewed investor interest for European IPOs with at least two significant deals lined up in Europe, we highlight the superior long-run returns of post- vs. pre- IPO strategies (Exhibit).

The IPOX® MENA (IPEV) portfolio focusing on Middle Eastern deal flow recorded big swings during the week: While muted earnings across a number of companies reporting drove declines towards the beginning of the week, bargain hunting and asset allocation-flows across select IPOX® exposure drove the portfolio to yet another record high towards the weekend, adding +1.25% to +14.09% YTD. Expectations for higher interest rates and some significant declines in key portfolio holdings pressured the IPOX® Japan (IPJP) last week.

IPOX® PORTFOLIO HOLDINGS IN FOCUS: The story of the week belonged to renewed optimism for select Chinese equities, underlined by big gains in hard-hit retailer Miniso Group (MNSO US: +15.47%) and e-commerce behemoth Pinduoduo (PDD US: +12.14%), for example. Amid the strong momentum for European IPOs, we note more gains for a slew of the most recent deals, including German defense contractor RENK Group (R3NK GR: +13.01%), Sweden department store operator Rusta AB (RUST SS: +12.44%), German pharmaceutical glass maker Schott Pharma (1SXP GR: +6.71%) and Italy’s lottery operator P/E-backed Lottomatica (LTMC IM: +8.87%). Amid attractive valuations and declining momentum for EV firms (TSLA US: -6.71%), the traditional European car- and truck makers continued to be bought, including Italian truck maker and European luxury RV/Morelo-linked Iveco Group (IVG IM: +9.38%), sports car maker Porsche (P911 GY: +7.60%), truck makers Daimler Trucks (DTG GY: +7.04%) and Traton SE (8TRA GY: +4.64%), all IPOX® Portfolio Holdings (ETF: FPXE and FPXI). In the IPOX® 100 U.S. (ETF: FPX), just 35/100 portfolio holdings rose, with the average (median) stock declining by -2.06% (-1.29%), slightly outperforming the applied market cap weighted IPOX® 100 U.S. Index (ETF: FPX).

LIVE LAUNCH OF THE IPOX® BOND INDEXES: The IPOX® Bond Indexes are now live, offering access to U.S. dollar-denominated corporate debt from the IPOX® Universe. Designed for both passive and active financial products, these indexes aim to capture the unique returns and potential outperformance of new listings. For more information, contact info@ipox.com.

IPO ACTIVITY AND OUTLOOK: While no sizable international IPOs listed in accessible markets, next week is set to be very active with several large profile deals, totaling $12 billion – the highest deal flow volume since September 2022.

In the U.S., deals include Intel-backed connectivity chip maker Astera Labs (ALAB US, $534m) on the Nasdaq on 3/20, while long-awaited social media platform Reddit (RDDT US, $6.5b) and LATAM-focused healthcare services company Auna (AUNA US, $420m) will list on the NYSE 3/21.

In Europe, German beauty retailer Douglas (DOU GR, $1.06b) is set to list in Frankfurt on 3/21, while Swiss dermatology company Galderma (GALD SW, $2.62b) will list on the SIX Swiss Exchange on 3/22 – the largest European IPO since carmaker Porsche (P911 GR, $9b) in September 2022.

Asia will see Chinese pharmaceuticals company Qyuns Therapeutics (2509 HK, $31m) and chemicals fertilizer company Migao Group (9879 HK, $124m), both listing in Hong Kong on 3/20 and 3/21, respectively. Japanese retail company Trial Holdings (141A JP, $258m) will list in Tokyo on 3/21, the largest Japan IPO since Kokusai Electric (6525 JP, $844m) in 9/2023.

Lastly, in the Middle East, Dubai's parking business Parkin (PARKIN UH, $429m), will list on the Dubai Financial Market on 3/21. The offer has been oversubscribed 165 times, signaling the continuing enthusiasm in the region.

Last week, several firms released details on their upcoming IPO plans, e.g.:1) European private equity giant CVC Capital seeks May listing. 2) Vista Equity plans IPO for U.S. software firm Solera by year end. 3) Tech firm Ingram Micro seeks $8b valuation. 4) U.S. healthcare startup Tempus hires Morgan Stanley for IPO. 5) Intel-backed Horizon Robotics plans $500m raise in Hong Kong. 6) Messaging service Telegram and trading platform eToro mull U.S. listings.

Follow our IPO Calendar and social media channels (e.g. Linkedin) for Updates.