The IPOX® Week #735

Multi-thematic IPOX® International, IPOX® 100 Europe rise strongly.

AI-heavy IPOX® 100 U.S. ESG jumps +2.45 to +17.57% YTD last week.

Ahead of the shortened U.S trading week, IPOX® Bonds steady.

Bowhead Specialty soars on debut. Little deal flow lined up.

SUMMARY: Amid range-bound U.S. yields on mixed economic signals, more AI-Momentum on Nvidia’s (NVDA US: +15.13%) earnings, flat equity risk (VIX: -0.50%) and big gyrations in regional (local) equity indexes spreads, the IPOX® Indexes traded mixed ahead of the shortened U.S. trading week.

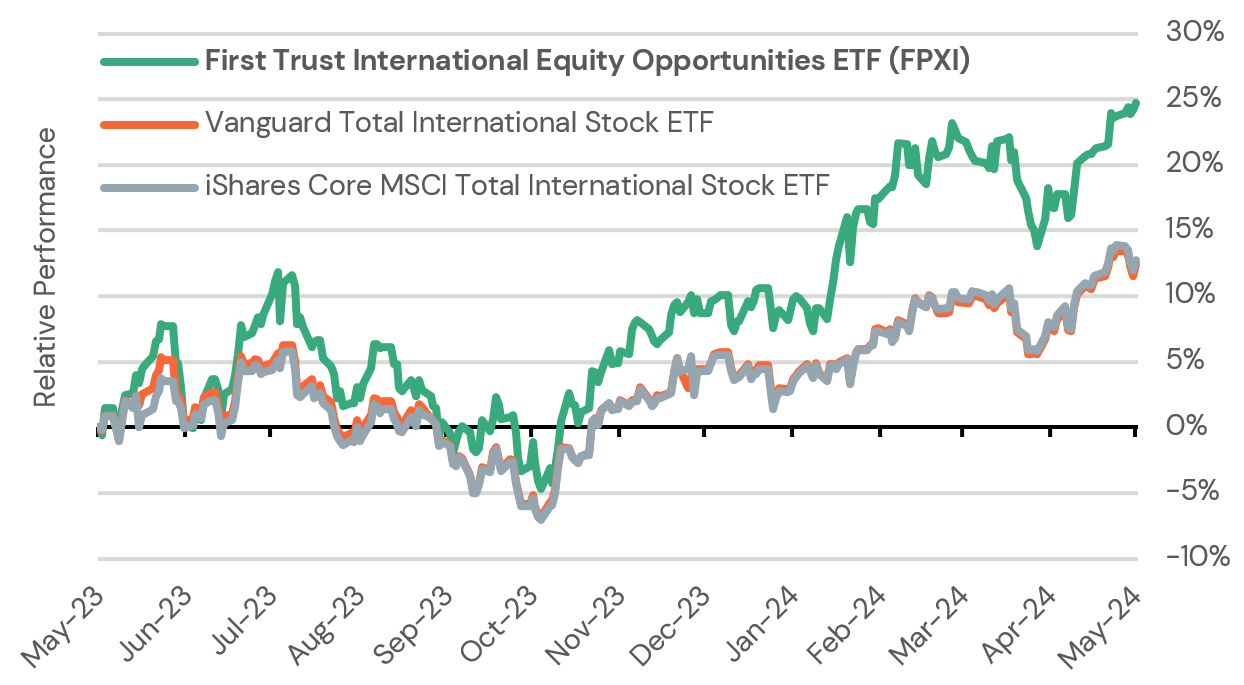

Big (relative and absolute) upside focus was on European (including Nordic) and Canadian exposure, which propelled the multi-thematic IPOX® International ETF (Ticker: FPXI) to a gain of +0.76% to 12.80% YTD, extending the Y/Y lead versus the hard-to-beat international benchmark ETFs (VXUS, IXUS) to ca. +919 bps.

IPOX® INTERNATIONAL ETF (TICKER: FPXI) SOARS TO FRESH YTD HIGH

Asian listed/traded exposure disappointed anew, with most focus on the renewed slump in the IPOX® MENA (IPEV). Pressured by profit-taking ahead of more IPOs, lackluster earnings and big secondary share sales overhang, the portfolio sank another -3.04% to +2.67% YTD. Higher rates and weakness amongst biotechs also pressured the IPOX® China (CNI) and IPOX® Japan (IPJP), respectively.

AI-HEAVY IPOX® 100 ESG (IPXT) BEATS ALL BENCHMARKS YTD / Y/Y

We note with interest the performance of the IPOX® U.S. ESG (IPXT). The portfolio, composed of ESG-aware and AI-heavy IPOs, Spin-offs and SPACs traded on a U.S. marketplace and providing IPOX®-Style rotational exposure to emerging themes in process, added a massive +2.45% to +17.57% YTD, handily outpacing the performance of the U.S. benchmarks anew.

Performance of the conventional IPOX® 100 U.S. ETF (Ticker: FPX) was more muted last week, with the portfolio closing out the week in between the performance of the Russell 2000 ETF (IWM) and S&P 500 ETF (SPY). Here, the average (median) equally-weighted stock shed -0.83% (-0.82%) with companies representing the electrification/alternative energy theme gaining significantly, including integrated solar tracker Nextracker (NXT US: +28.44%), electrical power equipment maker de-SPAC Vertiv (VRT US: +9.67%), Spin-off energy solutions provider Constellation Energy (CEG US: +8.22%) and IPO M&A NRG Energy (NRG US: +4.50%) leading the way. Social media stock Reddit (RDDT US: -11.80%) followed U.S. Meme-stock Momentum to close sharply lower last week.

Across the list of non-U.S. domiciled stocks, the story of the week belonged to U.S.-traded, Utrecht-NL based biotech Merus (MRUS: +36.62%). The IPOX® 100 Europe ETF (Ticker: FPXE) Portfolio holding soared into the weekend on drug optimism. The company ranks high in the long list of innovative European IPOs listed exclusively in the United States, with the IPOX® 100 Europe ETF (Ticker: FPXE) being accommodative to capture the respective exposure through its forward-looking rulebook design. More gains in previously featured firms in the electrification/alternative energy theme including U.K.’s electrical components maker Nvent Electric (NVT US: +6.77%), Indonesia’s energy behemoth Barito Renewables (BREN IJ: +4.65%) and Saudi-traded ACWA Power Co. (ACWA AB: +4.48%) contributed strongly to the great week for the IPOX® International ETF (ticker: FPXI).

IPOX® SPAC Index (SPAC): The Index fell -0.52% to +0.04% YTD. Top performers included fintech Moneylion (ML US: +20.74%) and OTC online drug seller Hims & Hers (HIMS US: +15.85%). Laggers included digital banking service Dave (DAVE US: -15.37%) and LiDAR sensor maker Ouster (OUST US: -11.33%).

In other SPAC news, Distoken Acquisition Corporation (DIST US: -0.46%) is to combine with Shanghai-based APAC-focused staffing firm Youlife International. to trade on the Nasdaq under the symbol “YOUL.” In upcoming SPAC listings, Centurion Acquisition Corp. (ALFUU) filed for a $250 million IPO, while Perceptive Capital Solutions (PCSC) filed for a $75 million listing.

ECM REVIEW AND OUTLOOK: 7 sizable international IPOs had their debut last week, gaining an average (median) of +20.69% (+10.42%). Notable listings included the U.S. launches of speciality insurer Bowhead Speciality (BOW US: +51.18%), which surged after raising $128 million. The second largest listing in New York was alternative investment management firm Kayne Anderson BDC (KBDC US: -3.19%, $100m offer). Italian offshore construction support service provider Next Geosolutions Europe (NXT IM: +10.42%) climbed after raising $61m in Milan.

Follow our IPO Calendar and social media (e.g. Linkedin) for upcoming IPOs, updates on our indexes and the latest IPO News.