The IPOX® Week #739

IPOX® 100 U.S. gains on quarterly U.S. Futures & Options expiration.

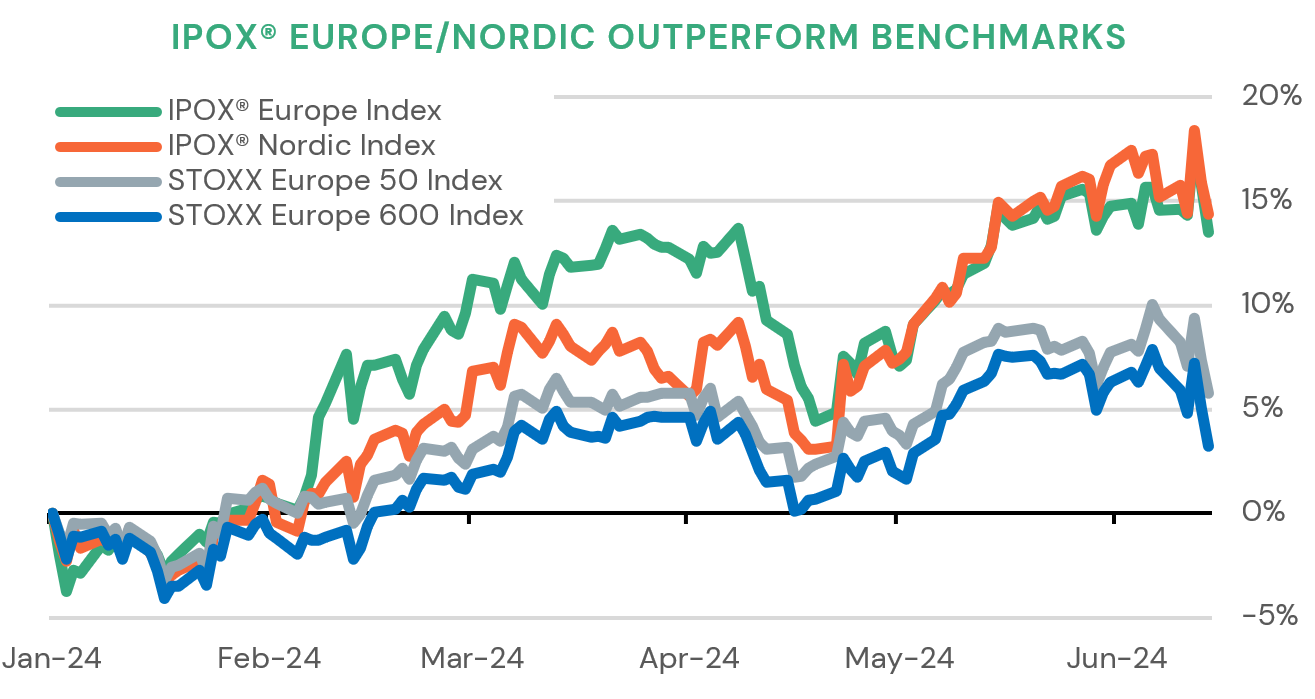

IPOX® Europe and IPOX® Nordic continue strong run over benchmarks.

IPOX® Holding UCB (UCB US) big volume outlier towards the weekend.

IPO Preview: 3 large listings set to launch in the U.S. this week.

SUMMARY: Most IPOX® Indexes gained during quarterly U.S. Futures and Options expiration week, as the "triple witching" event saw $5.5 trillion worth of derivatives contracts expire amid significant turnover in the major indexes as select benchmarks re-balanced and re-positioned.

In the U.S., macroeconomic indicators were mixed, as services activity picked up to the fastest pace in more than two years, while home sales fell for the third straight month. The IPOX® Bond Indexes followed U.S. treasury prices somewhat higher with yields pressured by weak auctions and rumored sales of U.S. government debt by foreign institutions, also reflecting ongoing concerns about the path of U.S. debt as the ratio of inflation-adjusted interest rate payments over Gross Domestic Product (GDP) continues to climb.

Amid the broader market volatility (VIX: +4.27%), the IPOX® 100 U.S. (ETF: FPX) gained +0.75% to +3.57% YTD, outperforming the hard-to-beat S&P 500 (ETF: SPY) and Nasdaq 100 (ETF: QQQ) by 15 bps. and 55 bps., respectively. Here, Chicago-based insurer Ryan Speciality (RYAN US: +13.54%) jumped to an all-time post-IPO high on S&P Midcap 400 (ETF: MDY) inclusion. Conversely, Maryland quantum computing firm IonQ (IONQ US: -12.21%) fell sharply, amid an executive reshuffle and its exclusion from select indexes, including IPOX®.

Internationally, the IPOX® Europe (ETF: FPXE) added +0.44% to +15.95% YTD, continuing to massively outperform the main European benchmarks, including the broad Stoxx Europe 600 (SXXP). Despite weak macroeconomic numbers for Germany, German-domiciled stocks ranked at the top of the best-performing portfolio holdings. Notable performers included the recently added tank gearbox maker Renk (R3NK GR: +14.07%) and air radar maker Hensoldt (HAG GR: +8.33%). Both benefitted from the German Army’s $8.5b order to large defense player Rheinmetall (RHM GY: +2.46%). Additionally, Europe-based health care/biotech stocks continued to perform well, including IPO M&A Belgium-based UCB SA (UCB BB) with perceived takeover interest driving the stock higher by +0.91% to +76.30% YTD amid a spike in volume towards the weekend. Moreover, we continue to note significant strength in the IPOX® Nordic (IPND), which focuses on providing semi-passive exposure to the most liquid and innovative new listings domiciled across Europe's Nordic region and traded globally. The portfolio added +1.29% to +19.75% YTD, as last week's big winner, Swedish retailer Rusta (RUSTA SS: -11.04%), saw a pullback and Norwegian car carrier Hoegh Autoliners (HAUTO NO: +10.40%) surged after securing funding for new vessels. Both companies are also portfolio holdings in the IPOX® Europe (ETF: FPXE).

The IPOX® International (ETF: FPXI) traded flat last week, as geopolitical tensions caused fluctuations in commodity prices, e.g. with WTI crude rising and gold falling, while the portion of the portfolio dedicated to New Listings across MENA was untraded due to the Eid al-Adha holiday. Still, several individual holdings stood out with strong performances. Japanese dealmaker M&A Research Institute (9552 JT: +20.30%) rebounded after regulatory worries had significantly pressured its share price recently, while Indonesian green energy firm Barito Renewables (BREN IJ: +15.93%) also continued to bounce back following the U-turn of a major index provider not to add stock to its global index. Despite Japan posting accelerating inflation numbers in May, the IPOX® Japan (IPJP: +0.39%) gained, taking 50 bps. from the TSE Growth 250 Index.

IPOX® SPAC INDEX (SPAC): The Index fell -0.76% last week to -3.73% YTD. Secure data management and data governance platform AvePoint (AVPT US) soared +11.30% as the company picked up on momentum. Former President Donald Trump’s social media platform Truth Social’s parent company Trump Media & Technology Group (DJT US) continued to spiral down -30.73% as sell-off accelerated amid dilution. 2 SPACs announced merger targets, including Hennessy Capital Investment IV (HCVI US: 0.00%) with African gold producer Namib Mineral. 2 merger approvals this week with deals anticipated to close on next Monday, including Feutune Light Acquisition (FLFV US: -75.17%) with EV maker Thunder Power (AIEV US). 3 new SPACs launched this week in the U.S., making June the month of most SPAC IPO activities since 2023 February.

ECM REVIEW AND OUTLOOK: International IPOs raised about $720 million across accessible markets last week, including 6 sizable listings (e.g. +$25m offer), which gained +0.78% (average) / +0.00% (median) between their offer price and Friday’s close.

After the $600m IPO of Italian luxury sneaker maker Golden Goose was surprisingly cancelled on missing valuation targets, the largest listing belonged to $222m Sydney IPO of food chain Guzman Y Gomez Mexican Kitchen (GYG AU: +31.82%). Sweden also saw two sizable deals with retail real estate development firm Prisma Properties (PRISMA SS: 0.00% after raising $147m), and clinical stage pharma company Cinclus Pharma (CINPHA SS: -22.37%, $68m) leading the way. Japan saw a resurgence with 6 listings, the largest being infectious disease diagnostics firm Tauns Laboratories (197A JP: -7.83%), raising $62m.

4 large listings are planned for this week, including 3 U.S. IPOs. Wednesday: Australian gas and production firm Tamboran Resources (TBN AU, $176m) on the NYSE and South Korean Naver-owned comics website Webtoon Entertainment (WBTN US, $315m) on Nasdaq. Thursday: Texas landowner LandBridge (LB US, $319m), leasing land to oil and gas producers, and Japanese IT solutions provider Mamezo Digital Holdings (202A JP, $38m).

Read the IPOX® Update for a summary of last week’s most important news.

Follow our IPO Calendar and social media (e.g. Linkedin) for upcoming IPOs,

updates on our indexes and the latest IPO News.