The IPOX® Week #740

Indexes trade mixed towards quarter-end as U.S. yields spike anew.

Select IPOX® Regional Portfolios surge in 1st half, double benchmarks.

IPOX® MENA has great week as Middle Eastern markets re-open.

U.S. deals debut strongly. More IPOs lined up as U.S. readies July 4th holiday.

SUMMARY: The IPOX® Indexes traded mixed post-expiration and ahead of calendar quarter-end as more upside for equities was capped by muted earnings amid macro overhang involving pending elections in France and the United Kingdom, the renewed plunge in the Japanese Yen, and big selling in U.S. Treasuries towards the weekend, which was driven by rumored foreign liquidations after rising expectations of a Trump victory in November heightened U.S. debt fears.

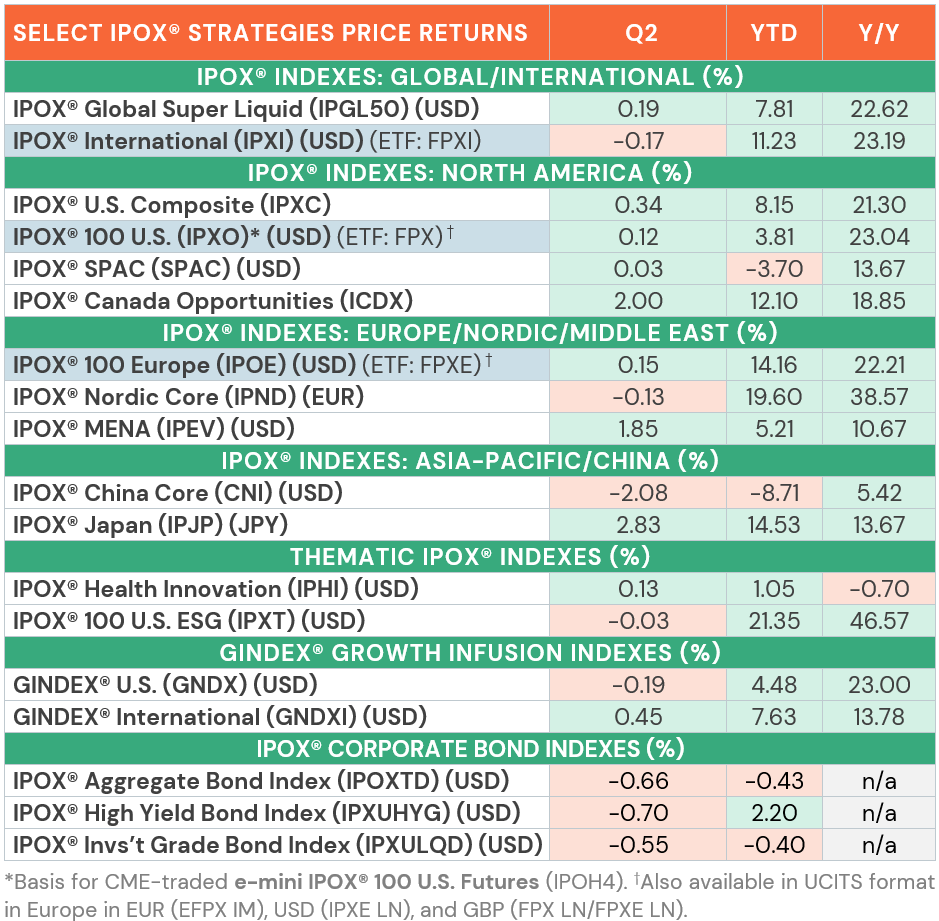

The slump in U.S. Treasuries towards the weekend also pressured corporate debt, including the IPOX® Aggregate Corporate Bond Index (IPOXTD). The unique and highly liquid portfolio tracking the price of fixed income of U.S.-traded IPOX® Holdings declined to -0.43% YTD, 28 bps ahead of its benchmark YTD.

Moving to equities, the IPOX® 100 U.S. (ETF: FPX) – key performance benchmark for U.S. domiciled IPOs - added +0.12% to +3.81% YTD, outperforming both the S&P 500 (ETF: SPY) and Nasdaq 100 (ETF: QQQ) on the week. Notable companies building on recent momentum included IPO M&A takeover target glaucoma-focused Glaukos (GKOS US: +4.72%), tax management solutions provider application software maker Vertex (VERX US: +2.50%) and social network Reddit (RDDT US: +11.50%). Industrials/Energy companies generally weakened on profit-taking, highlighted by declines in heavyweight spin-offs Constellation Energy (CEG US: -8.19%) and GE Vernova (GEVC US: -2.40%).

Unabated positive relative performance continued to drive the IPOX® Regional Portfolios. This included the IPOX® Canada (ICDX), which pools Canada-domiciled firms IPOX®-Style. Amid gains in Financial Definity Financial (DFY CN: +3.67%) and Space/Defense-play MDA Space (MDA CN: +13.17%), the portfolio added +2.08% to +12.19% YTD (+23.29% Y/Y), almost tripling the performance of the Canadian market YTD.

Strong first half 2024 returns also extended to other portfolios pooling non-U.S. domiciled IPOX® Holdings, including the IPOX® 100 Europe (ETF: FPXE), which added +0.15% to +14.16% YTD (+22.65% Y/Y) last week, +770 bps YTD (+1111 bps Y/Y) ahead of the European market. Significant drivers of the strong performance were European firms trading exclusively in North America, including semiconductor maker ARM Holdings (ARM US: +2.07%) and Swiss-based sneaker maker On Holding (ONON US: -2.32%). Moreover, Nordic companies trading within the IPOX® Nordic (IPND) Portfolio and jumping a massive +19.60% YTD contributed strongly. Highlighted here are innovative Swedish firms including digital wealth management platform operator Nordnet (SAVE SS: -1.33%) and online property platform operator Hemnet Group (HEM SS: +2.04%).

Amid the renewed decline in the JPY, we also note a good week for the IPOX® Japan (IPJP), with the 40-holdings-strong diversified portfolio, including some of the most attractive Japan-traded small-cap growth firms, adding +2.83% to +13.67% YTD. With the overhang from Aramco's massive secondary offering subsiding, the IPOX® MENA (IPEV) had an excellent post-holiday trading week, adding +1.85% to +5.12% YTD, 973 bps YTD ahead of the market.

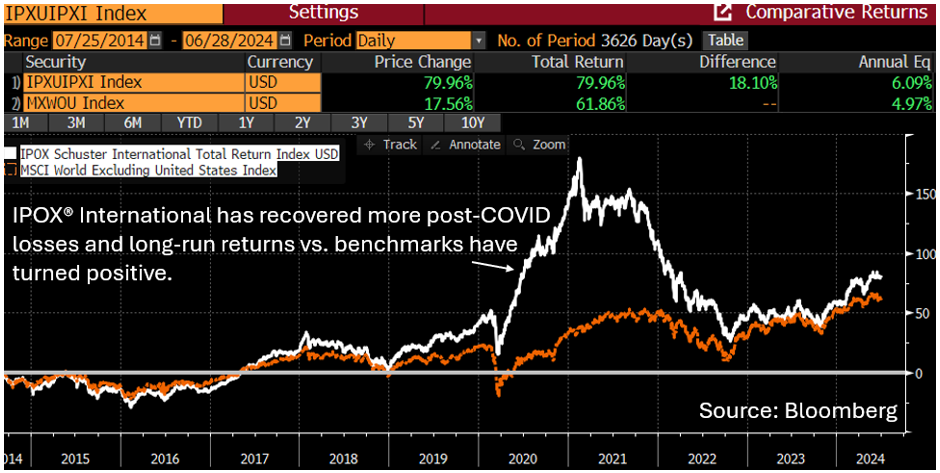

Big strength within the IPOX® Regional Indexes continued to propel relative gains in the IPOX® International (ETF: FPXI), with the fully rebalanced portfolio having made back a significant portion of post-COVID losses during the past months.

IPOX® SPAC Index (SPAC): The Index gained +0.03% to -3.70% in H1 2024. 16 SPAC IPOs launched in the first half (H1) of 2024, raising ca. US$2.4B in capital; while the number of SPACs is in line, the proceeds raised increased by 57% YoY, driven by an active Q2 pipeline led by experienced SPAC veterans including Michael Klein (Churchill Capital) and James Graf (who has sponsored another 6 SPACs). 44 SPACs announced merger targets, with SK Growth Opportunities Corp (SKGR US) and online brokerage trading platform Webull's US$7.3 billion deal being the largest transaction since 2023 VinFast Auto (VFS US) merger announcement, based on implied pro forma enterprise value. 46 SPACs approved and completed mergers, including Screaming Eagle Acquisition with Lionsgate's TV production and Motion Picture Group spin-off Lionsgate Studio (LION US). 10 deSPACs were acquired or are pending acquisition by either private equity firms or publicly traded companies in H1.

ECM REVIEW AND OUTLOOK: New listings raised about $3 billion last week, including 12 sizable firms that went public in accessible global markets, which gained +6.38% (average) / +10.16% (median) from offer price to Friday close.

The three largest listings debuted in the U.S., including South Korean online comics publisher Webtoon Entertainment (WBTN US: +8.71%, $315m offer), oil-rich Texas land owner Landbridge (LB US: +36.18%, $283m offer) and psoriasis-focused biotech Alumis (ALMS US: -16.88%, $210m offer). Other notable offers included jewelry retailer Laopu Gold (6181 HK), surging +72.84% after raising $116m in Hong Kong, and the $75m IPO of Bermuda-based oil-and-gas service provider Paratus Energy Services (PLSV NO: +11.61%) in Oslo.

In the shortened July 4th U.S. trading week, only one significant listing is expected globally: South Korean aerospace rocket firm Innospace (462350 KS, $42m offer).

Follow our IPO Calendar and social media (e.g. Linkedin) for upcoming IPOs,

updates on our indexes and the latest IPO News.

Click here to read the IPOX® H1 2024 Global IPO Market Review