The IPOX® Week #745

Economic fears weigh on IPOX® Equity Indexes as equity risk spikes.

Bullish Illinois: Ryan Specialty (RYAN), UL Solutions (ULS) soar.

IPOX® Corporate Bonds (IPOXTD) surge on jump in Investment Grade.

2 sizable IPOs in the U.S. this week: YXT.COM and Actuate Therapeutics.

OVERVIEW: The IPOX® Equity Indexes started August with significant losses as investors scaled back equity exposure across the board, with the universe of unseasoned stocks tracked by IPOX® being particularly affected on average. Driving forces behind the selloff included 1) the regime shift in central bank policy with the Bank of Japan raising interest rates while other central banks, including the U.S. Federal Reserve, are on course of cutting interest rates which in turn drove big JPY/USD moves and liquidation selling in Japanese stocks, 2) lackluster U.S. economic numbers indicative of a faster-than-expected slowdown in economic activity, 3) mixed corporate earnings, 4) technical selling and profit taking after the big run-up and 5) the renewed flare-up in Middle Eastern tensions. Amid the broad declines, equity risk spiked (VIX: +40.14%) and interest rates fell.

In the U.S., e.g., the IPOX® 100 U.S. ETF (FPX) shed -5.64% to -1.56% YTD, leading U.S. small-caps by +103 bps., however, lagging the S&P 500 (SPX) by a large -358 bps. Across non-U.S. domiciled exposure, the IPOX® International ETF (FPXI) fell to +5.19% YTD, while the IPOX® 100 Europe (ETF: FPXE) declined to +8.90% YTD, both lagging the respective benchmarks. Last week’s benchmark-adjusted returns amongst IPOX®’s best performing regional equity strategies YTD, however, were mixed: For example, while the IPOX® Nordic (IPND) and IPOX® Canada (ICDX) lagged their benchmarks by just -63 bps. and -85 bps. respectively, the IPOX® MENA (IPEV) added +22 bps. of relative returns.

ILLINOIS IN FOCUS: Amid the broad declines, strong earnings drove select IPOX®-held and IL-based exposure to fresh post-IPO highs. Foremost, this included $20 billion insurance play, Chicago-based 07/2021 IPO Ryan Specialty Holdings, Inc. (RYAN US: +13.13%), as well as 04/2024 IPO, Northbrook, IL-based safety science services provider UL Solutions Inc. (ULS US: +11.69%).

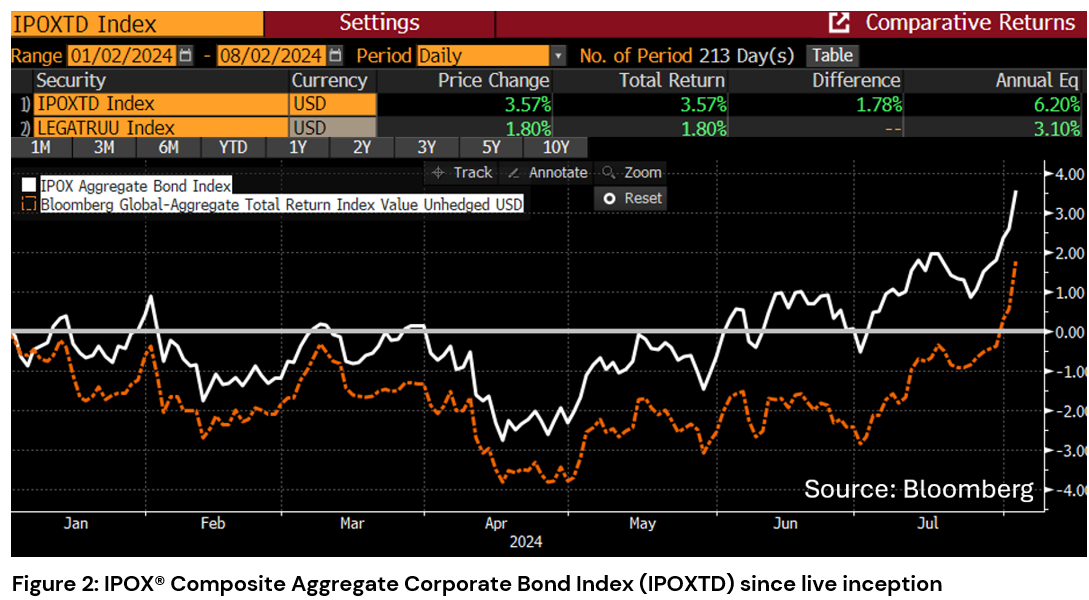

IPOX® BOND INDEXES: Turning to the analysis of corporate bonds issued by IPOX® Holdings, we note the big jump in the IPOX® Composite Aggregate Corporate Bond Index (IPOXTD) last week (Figure 2). Amid the surge in government bonds with the yields on the long-end declining from +4.45% to +4.11%, e.g, rocketing equity risk caused a significant divergence in the cross-section with bonds tied to Investment Grade-rated companies rising significantly, while High-Yield reversed course late in the week to close lower.

IPOX® SPAC Index (SPAC): The Index fell -5.39% last week to -6.20% YTD. Liquefied natural gas (LNG) company NextDecade (NEXT US) rose +6.82% on insider buys. Telehealth platform Hims & Hers Health (HIMS US) -19.25% plunged as Eli Lilly expects its weight-loss drug to be off shortage, which may dampen Him’s copycat drug sales future. No SPAC announced definitive target, however, PowerUp Acquisition (PWUP US) and early-stage drug delivery mechanism-focused biopharmaceutical startup Aspire Biopharma signed non-binding Letter of Intent for potential business combination. Armada Acquisition Corp I (AACI US) announced deal approval with AI-powered retail engagement platform Rezolve AI (RZLV US: TBD). 2 new SPACs launched this week in the U.S.

ECM REVIEW AND OUTLOOK: Amid the annual summer lull in the IPO market, 3 companies started trading publicly in accessible markets last week, gaining an average/median of +20.10%/+7.94% between offer price and Friday’s close. In the U.S., New Orleans-based Fifth District Bancorp (FDSB US: +1.50%) started trading on Nasdaq after raising $54.6 million through its mutual-to-stock conversion. Australian off-shore vessel operator Bhagwan Marine (BWN AU: +7.94%) raised $53 million, while the largest IPO last week was the $191 million offer of South Korean power convertor and power supply equipment manufacturer Sanil Electric (062040 KS), which surged +50.86%.

At least 5 sizable firms are expected to debut this week. In Hong Kong, auto chip firm Black Sesame International (2533 HK, $138m offer) debuts Thursday, under the city's relaxed listing rules for non-profitable hi-tech firms. Chinese insurer Zhongmiao Holdings (1471 HK) is set to go public on Tuesday, raising $38m after pricing at bottom. In the U.S., Chinese cloud corporate education provider YXT.COM (YXT US, $33.6m offer) debuts Friday, while pancreatic cancer biotech Actuate Therapeutics is aiming for a $26.6m IPO on Thursday. India is expecting it’s largest IPO so far this year, with the $734m debut of Softbank-backed EV scooter leader Ola Electric on Friday.

Read the latest IPOX® Update for a summary of last week’s news, including the upcoming $4 billion U.S. IPO of AI chipmaker Cerebras and the new Nasdaq filing for Nvidia-backed Chinese selfdriving tech firm WeRide.

Follow our IPO Calendar and social media (e.g. Linkedin) for upcoming IPOs,

updates on our indexes and the latest IPO News.