The IPOX® Week #752

CEG, APP propel IPOX® 100 U.S. to huge week, Index closes near 5000 mark.

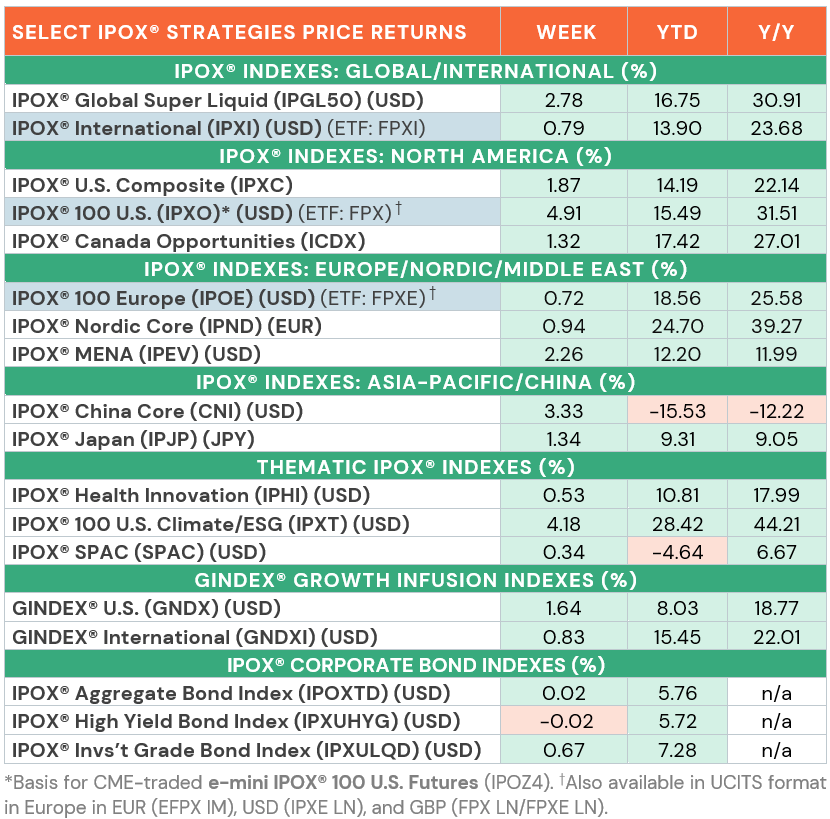

IPOX U.S. ETF: +4.91%,

IPOX E.U. ETF: +0.72%,

IPOX INT’l ETF: +0.79%

Equity sentiment propelled by big relative strength in IPOX® Corporate Bonds.

3 sizable U.S. IPOs this week. Japan to triple YTD IPO volume in October.

OVERVIEW: The IPOX® Equity Strategies soared during U.S. Futures and Expiration week, topping all benchmarks anew and remaining the main beneficiary of the powerful mix of 1) a mute inflationary and economic outlook amid the 0.50 bps. Fed interest rate cut, 2) notable relative strength in IPOX® Corporate Bonds (IPOXTD) across Investment Grade (IPXULQD) and High Yield (IPXUHYG) helping to drive Momentum in our heavily weighted Spin-off component, 3) gains in select equities amid the ongoing AI and Energy Revolution with M&A potential for many firms adding to Momentum, 4) the broadening out of the rally in U.S. equities with mega-cap U.S. Technology stocks clearly range-bound and 4) quarterly Index inclusion and re-balancing effects.

With an active share of ca. 98%, e.g., the FANG-free, multi-cap IPOX® 100 U.S. Index (IPXO) - key performance benchmark for large and successful U.S. firms active in U.S. Equity Capital Markets (ECM) and underpinning ETFs (e.g., Ticker: FPX), SMA’s and Futures - rose by +4.91% to +15.49% YTD, closing out the week near the key 5000 index level and outpacing the S&P 500 (ETF: SPY) by a massive +355 bps. to cap the move since the recent Aug. 7th low to +21%. This was also well ahead of other benchmarks, including mega-cap Technology stocks tracked in the Nasdaq 100 (ETF: QQQ), the less FANG-centric S&P 500 Equal Weight Index (ETF: RSP) and gauges for illiquid pre-IPO Unicorn Investing. Gains extended to other global regions and to the IPOX® Thematic Strategies: The innovative IPOX 100 U.S. ESG Climate (IPXT), e.g., soared +4.18% to +28.42% YTD, while the IPOX® MENA (IPEV) gained +2.26% to +12.20% YTD. Amid the weekly decline in the European benchmarks, the IPOX® 100 Europe (ETF: FPXE) also trended higher, adding +0.72% to +18.56% YTD, with the strategy now doubling the performance of the European market YTD. With household appliances maker Midea’s (300 HK) debuting successfully in Hong Kong and the shortened trading week across Asia, China-linked IPOs recovered with the IPOX® China (CNI) adding +3.33% to -15.53% YTD.

On the back of (industry conference-driven) corporate updates, M&A rumors and options expiration, select stocks across the Industrial and Technology sectors heavily weighted in the respective top-heavy IPOX® Portfolios recorded huge gains: Foremost, this included Spin-off Constellation Energy (CEG US: +30.17%) which surged after announcing to revive a PA powerplant to supply all the output to technology behemoth Microsoft (MSFT US: +1.09%) earmarked for its data center needs. This was followed by best-in-class climate plays Spin-off Carrier Global (CARR US: +4.46%), de-SPAC Vertiv (VRT US: +10.26%), Spin-off GE Vernova (GEV US: +9.25%), AI-solutions provider AppLovin (APP US: +12.00%), while security software provider CrowdStrike (CRWD US: +15.71%) recovered more of its recent losses. With 450 million shares traded, software market Palantir (PLTR US: +4.52%) closed out S&P 500 (ETF: SPY) inclusion day at its highest level as a publicly traded company. European luxury carmaker Porsche (P911 GY: -2.31%) fell anew, while Poland’s online shopping platform operator Allegro (ALE PW: -4.33%) declined in tandem with Kaspi (KSPI US: -21.66%) which plunged after a short seller report.

IPOX® SPAC Index (SPAC): The Index added +0.34% last week to -4.64% YTD. Digital banking service provider Dave (DAVE US: +13.97%) surged as the neobank rose with the bank stocks sector on Fed rate cut. Former president’s social media company Trump Media & Technology Group (DJT US: -24.60%) spiraled down as lock-up expired and insiders are now free to sell stakes. 2 SPACs announced definitive target include Chenghe Acquisition II (CHEB US: +0.10%) with Indonesian B2B online grocery wholesale platform Polibeli Group. Pono Capital Two completed merger with Japanese beauty clinic and treatment center franchise management service company SBC Medical Group (SBC US: -49.78%). 2 new SPACs launched this week in the U.S.

ECM REVIEW AND OUTLOOK: 22 new listings launched globally, raising a total of $5.8 billion and gaining an average of +19.48% between offer price and Friday’s close. The largest listing, making up most of this amount, was the secondary Hong Kong H-Share IPO of Chinese household and air conditioning market leader Midea Group (300 HK: +16.79%), followed by Indian mortgage lender Bajaj Housing Finance (BAJAJHFL IN: +133.90%) raising $781 million. Inaccessible China A-Shares saw a spike of activity with three sizable listings raising $718 million.

No notable listing activity was seen in the U.S., however this week is set with at least 3 sizable IPOs expected on Thursday, including biopharma firm BioAge Labs (BIOA US, $135m), natural gas producer BKV Corp (BKV US, $300m) and pharmacy operator Guardian Pharmacy Services (GRDN US, $101m). In Japan, job platform operator ROXX (241A JP, $42m offer) is set for Wednesday.

In last week’s news, Tokyo Metro and testing firm Rigaku have announced late October IPOs raising a combined $3.1 billion, tripling Japan’s new listing proceeds for 2024 with the largest offer in six years. German chemicals giant BASF is gearing up for an IPO of its agrichemicals business, while media conglomerate Axel Springer is set to split with a possible IPO for its $11B classified business.

Follow our IPO Calendar and social media (e.g. Linkedin) for upcoming IPOs,

updates on our indexes and the latest IPO News.