SchusterWatch #772 (1/27/2025)

IPOX Indexes add to YTD gains as New Generation of Stocks takes charge.

IPOX® China leads IPOX® Indexes weekly ranking with +5.28% jump.

IPOX® Growth Infusion M&A Alts Strategy records fresh all-time high.

Venture Global heats up U.S. IPO market. Smithfield Foods lists on Tuesday.

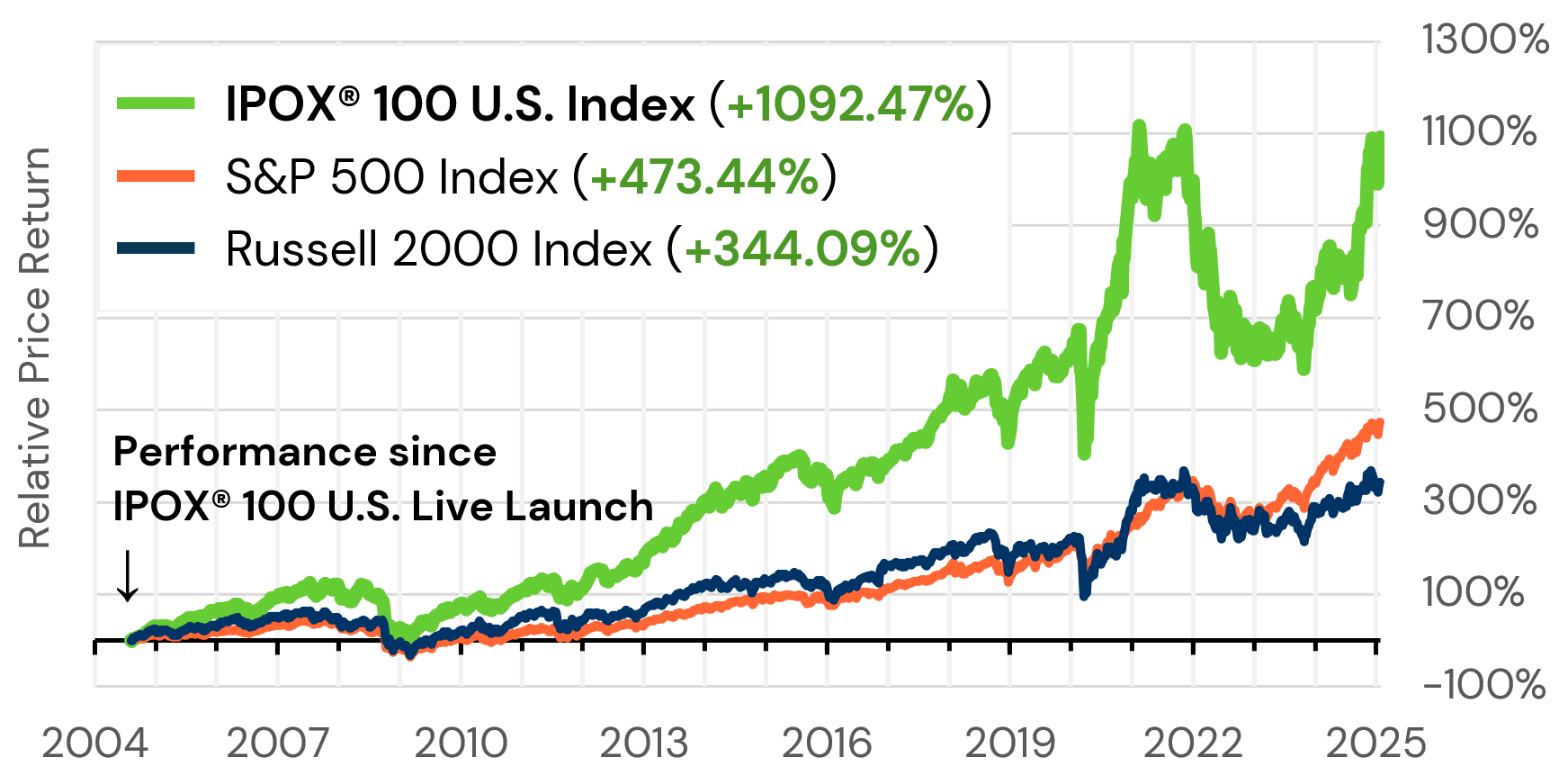

IPOX® WEEKLY REVIEW: The IPOX® Indexes continued to be the main beneficiary of the rotational trade into unseasoned equities during U.S. inauguration week, amid smooth U.S. bond markets, lower equity risk (VIX: -7.01%), solid U.S. earnings, corporate actions and China strength ahead of the Chinese New Year. In the U.S., the IPOX® 100 U.S. (IPXO) - tracked by the “FPX” ETF - e.g., added +3.30% to +10.39% YTD to close at a new weekly all-time high, extending its YTD lead vs. the S&P 500 (SPX) and Nasdaq 100 (NDX) to +666 bps. and +676 bps., respectively.

Firms with big upside included AI/Infra plays Palantir (PLTR US: +10.05%) and Constellation Energy (CEG US: +9.82%), as well as KY-based health care services provider Brightspring (BTSG US: +23.02%), specialty staple Vita Coco (COCO US: +11.71%), LV’s Sphere builder Spin-off Everus (ECG US: +10.16%), Financial de-SPAC Blue Owl (OWL: +9.88%) and LA-based LGBTQ dating app Grindr (GRND US: +5.92%), Space-focused de-SPAC Astera Labs (ALAB US: -13.32%) slumped after pricing a $400 million bond offering.

Big momentum extended to non-U.S. domiciled exposure, with the IPOX® International (IPXI), IPOX® Canada (ICDX), IPOX® 100 Europe (IPOE) and IPOX® China (CNI) all adding market-beating returns. Stocks across the market-cap spectrum drove the strength, such as U.K.-based sports betting platform operator Super Group (SGHC US: +33.45%), Sweden’s communications software firm Truecaller (TRUEB SS: +20.04%), Germany’s wind turbine maker Siemens Energy (ENR GY: +16.35%), U.K.’s semiconductor IP licensor ARM (ARM US: +8.88%) and Canada’s Financial Brookfield AM (BAM US: +7.90%). French Spin-off entertainment firm Canal+ (CAN LN: -4.59%) was a notable laggard.

We are pleased to note the fresh all-time high in the IPOX® Growth Infusion/GINDEX® U.S. Index (IPXUGNT) which invests in the most attractive and promising U.S. firms pursuing M&A as defined by IPOX®.

THE IPOX® SPAC INDEX: The Index gained 4.21% last week, raising its year-to-date performance to +4.64%. Aforementioned online sports betting and gaming company Super Group (SGHC US: 33.45%) surged on strong preliminary earnings and analyst upgrades. Money transfer service provider International Money Express (IMXI US: -6.89%) declined following downgrades, driven by uncertainty surrounding recent U.S. immigration policy affecting Latin America. Additionally, one new SPAC launched in the U.S. this week with no other SPAC news on business combination announcements or deal completions.

GLOBAL ECM REVIEW AND OUTLOOK: 27 companies went public this past week, raising a total of $3.1 billion and achieving an average performance of +47.38% from offer price to Friday’s close, with a median gain of +19.92%. The largest IPO was U.S. LNG shipping firm Venture Global (VG US: -4.00%), which raised a substantial $1.75 billion after significantly downsizing their IPO. Looking ahead, the IPO calendar is set to remain active with several notable U.S. debuts expected this week, including pork giant Smithfield Foods (SFD US, $940 million), medical device company Beta Bionics (BBNX US, $113 million), software firm Redcloud (RCT US, $66 million), and energy producer Infinity Natural Resources (INR US, $258 million).

In recent IPO news, Voyager Technologies (space & defense, $2-3B valuation) and cybersecurity firm SailPoint are preparing for US listings. Biotech Metsera is IPO-bound to fund weight loss drug trials, joining cardiac device makers Kestra and Heartflow. British fintech neobank Monzo considering a US IPO. Read more in The IPOX® Update.

Visit the IPOX® Calendar for this week’s listing overview and visit our Linkedin Page to follow the latest developments.