SchusterWatch #783 (4/14/2025)

IPOX® 100 U.S. (ETF: FPX) Tops Indexes Rankings with +8.66% weekly gain.

Relative Upside: IPOX® Canada, IPOX® Nordic, IPOX® Global China.

Defense & Miners in Focus: Renk, Hensoldt, Theon, Agnico, Triple Flag.

Amid the Market Volatility, Select Deals are lined up in Hong Kong and the US.

IPOX® WEEKLY REVIEW: Ahead of the shortened April equity options expiration week, the IPOX® Indexes traded mixed. Select exposure ended the week significantly ahead of their respective benchmarks as the surge in US yields on the long-end failed to negatively impact equities and much media news flow shifted to the first set of reported US earnings towards the week-end, which came in solid.

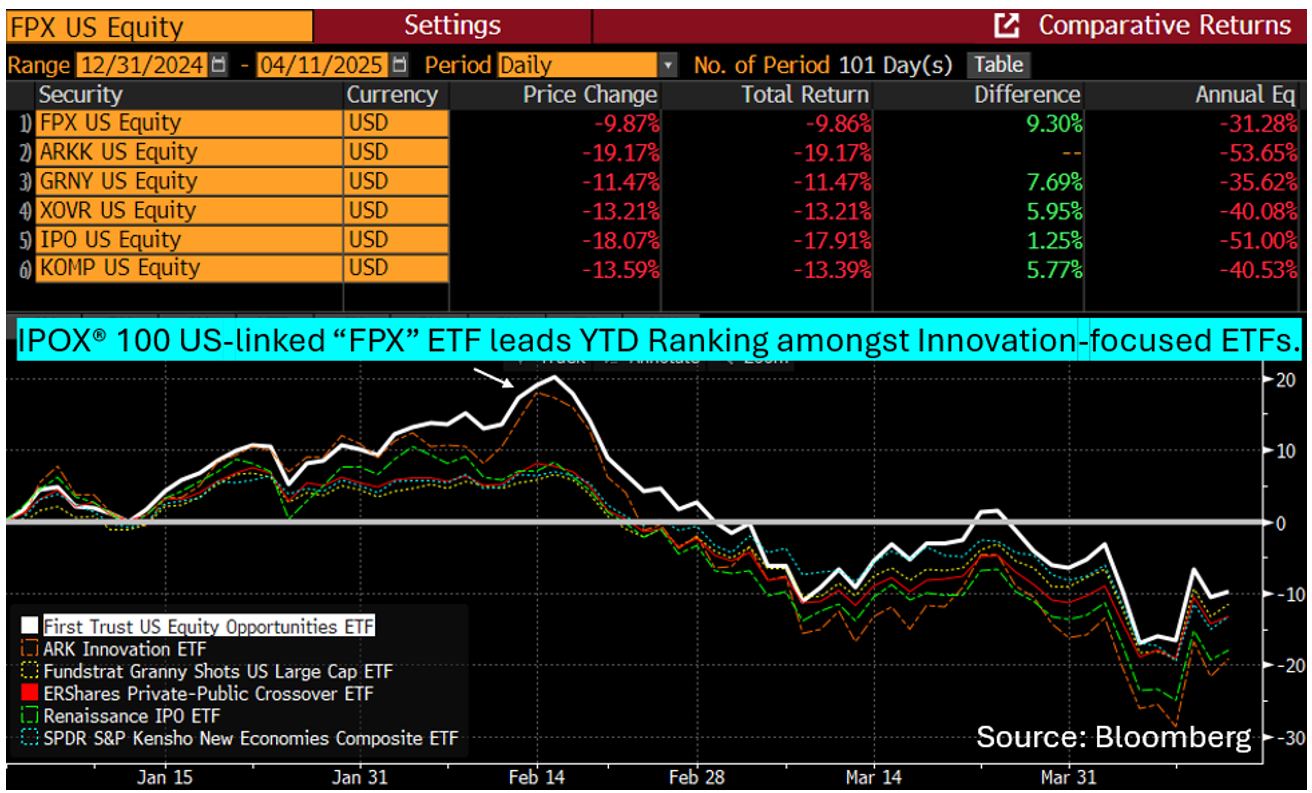

In the US, the IPOX® 100 US (ETF: FPX) more than recouped last week’s losses, adding +8.66% to -9.77% YTD (+7.14% Y/Y), well ahead of the passive benchmarks and other Innovation-focused active/index ETFs.

77/100 portfolio holdings rose, with the average (median) equally-weighted firm adding +5.28% (+3.92%), lagging the applied market-cap weighted IPOX® 100 US (ETF: FPX). Defense stock 04/24 IPO Loar Holdings (LOAR US: +27.20%) ranked on Top, followed by trading platform 07/21 IPO Robinhood (HOOD US: +26.57%), Spin-off data center play Constellation Energy (CEG US: +21.81%) and recent portfolio addition handyman platform ServiceTitan (TTAN US: +18.60%). Higher yields pressured real estate plays Compass (COMP US: -9.30%) and target Mr. Cooper (COOP US: -18.04%) which fell below the Rocket Cos. (RKT US: -22.73%) deal announcement price.

Non-U.S. domiciled stocks pooled in the respective IPOX® Indexes traded mixed last week: Amongst the universe of Canada-domiciled stocks, e.g., the 30-member-strong IPOX® Canada Opportunities (ICDX) added +2.98% to -4.38% YTD (+20.18% Y/Y), now leading the Canadian benchmarks on the back of another big week for 05/21 IPO gold miners Triple Flag Precious Metals (TFPM CN: +16.14%) and IPO M&A Agnico-Eagle Mines (AEM US: +18.26%), both portfolio holdings in the IPOX® International (ETF: FPXI). In Europe, we note another good relative week for the 30-member strong IPOX® Global Nordic (IPDN) which extended its relative YTD (Y/Y) lead vs. the Nordic market to +400 bps. (+2240 bps.) with Financials Nordnet (SAVE SS: +5.60%) and 6% yielder Mandatum (MANTA FH: +7.00%) leading the way. In the broader IPOX® 100 Europe (ETF: FPXE), US-only traded firms recovered, while homegrown European defense stocks surged anew, including recently IPO’ing Renk Group (R3NK GY: +9.56%), Hensoldt (HAG GY: +7.36%) and Theon International (THEON NA: +5.20%), while biotechs declined anew. Across Asia, the IPOX® MENA (IPEV) recovered from Lows, while recent Japan key IPO IPOX® Pick Tokyo Metro (9023 JP: +6.28%) soared to a post-IPO High and select IPO M&As helped the IPOX® Global China (CNI) to extend its YTD (Y/Y) lead vs. benchmark MSCI China (MXCN) to +918 bps. YTD (+18 bps.).

THE IPOX® SPAC INDEX: The Index rose +5.29% to –17.63% YTD last week. Quantum computing firm IonQ (IONQ US: 26.16%) rebounded following the tariff-induced sell-off, while biotech MoonLake (MLTX US: -6.21%) declined despite securing additional funding from Hercules Capital to support clinical trials and its commercial launch. OTC-traded International Media Acquisition (IMAQ US) announced a merger with Vietnamese ethanol producer VCI Biofuels. Three SPACs completed business combinations, including SK Growth Opportunities Corporation with trading platform Webull (BULL US). One new SPAC launched in the U.S. during the week.

GLOBAL ECM REVIEW AND OUTLOOK: 15 firms raised a total of $367 million last week. Performance was mixed, with the average (median) debut gaining +29.67% (+7.80%). Amid dampened investor appetite for larger deals in the US and Europe for now, there were no sizable deals (>$25m). Highlighting this caution, German tech startup 1Komma5 joined Sweden's Klarna in delaying its US IPO plans. IPOX® Analyst Dr. Lukas Muehlbauer was interviewed by Bloomberg, providing insights into European investor sentiment (read more here). Looking ahead, Zenergy Battery Tech (3677 HK), an EV battery maker, aims to raise $129 million in Hong Kong on Monday, followed by biotech Duality Biotherapeutics (9606 HK, $200m) on Tuesday. Activity is expected to pick up in the US later in the week, with Chinese premium tea chain Chagee Holdings (CHA US) planning a sizable $396 million NASDAQ IPO on Thursday, joined by aerospace firm AIRO Group (AIRO US, $75m) and Singapore-based oilfield equipment manufacturer OMS Energy Technologies (OMSE US, $50m).

Visit the IPOX® Calendar for this week’s listing overview and read

The IPOX® Update for the latest IPO News.