SchusterWatch #784 (4/21/2025)

IPOX® Equities look beyond tariffs, extend lead vs. Active & Passive.

IPOX® 100 US dodges Nasdaq/S&P decline, adds +1.03% last week.

What’s behind the surge in the IPOX® Global High Dividend 8% Strategy?

Solid Chagee (CHA US) debut underlines China IPO case. More IPOs line up.

IPOX® WEEKLY REVIEW: The IPOX® Indexes rose across the board during April US option expiration week and recorded significant relative gains. More tariff-related disturbances across US tech, declines in the US dollar and somewhat firmer US bonds did little to derail relative strength ahead of earnings season for many of our portfolio stocks.

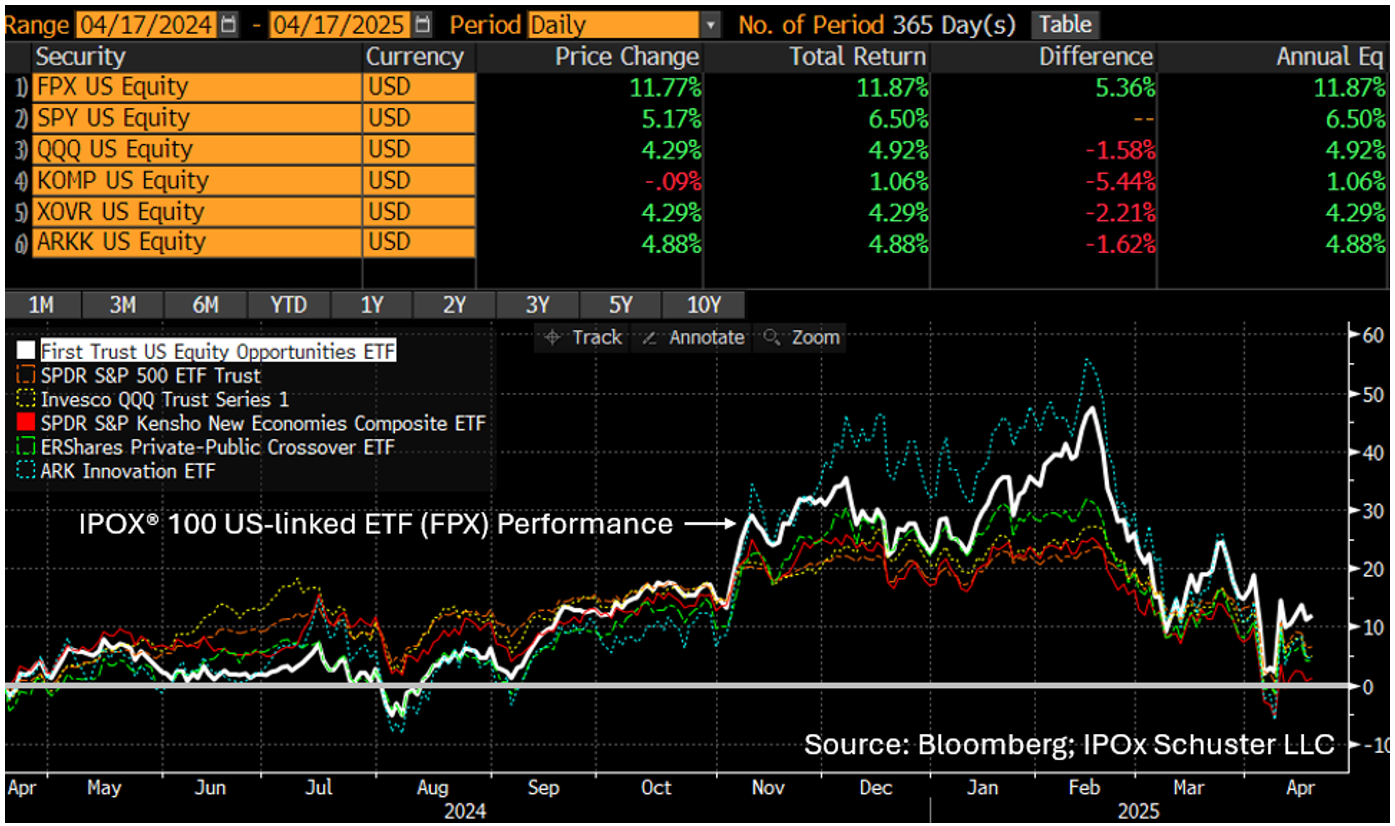

In the US, the IPOX® 100 US (ETF: FPX) rose for a 2nd week in a row, adding +1.03% to -8.84% YTD (+13.96% Y/Y), well ahead of Passive and Active, including ETFs capturing exposure to pre-IPO companies. The IPOX® 100 US is a diversified portfolio of the largest, most liquid and best performing US IPOs, including Spin-offs, trading within a ca. 4-year post-IPO rotational cycle and was started in August 2004, providing institutional and retail investors with an efficient turnkey solution to address the dispersion in long-run IPO returns, whereby few successful firms drive the performance of the sample as a whole. Based on the 987-member-strong $19.4 trillion IPOX® US Composite (BBG: IPXC, TR: .IPXC), the index also serves as an innovative benchmark for the performance of firms trading in the Private Markets (VC, P/E, pre-IPO), without the illiquidity premium. The index currently includes firms across emerging themes, ranging from key defense stock Palantir (PLTR US: +5.91%) to food delivery platform operator DoorDash (DASH US: +0.42%), restaurant operator Dutch Bros (BROS US: +1.15%) and handman B-B service platform ServiceTitan (TTAN US: +18.83%), to energy firm Landbridge (LB US: +5.11%) and LGBT community Grindr (GRND US: +8.24%).

Non-U.S. domiciled IPOX® Equities also recorded strong gains. Top of the list ranked the IPOX® Global Nordic (BBG: IPND, TR: .IPND) which extended its YTD (Y/Y lead) vs. the Nordic Market to +444 bps. (+2406 bps). Nordic strength also propelled the IPOX® 100 Europe (BBG: IPOE, TR: .IPOE) to a great week, adding +4.65% to +0.95% YTD (+11.40% Y/Y) with IPOX® Heavyweight wind turbine maker Siemens Energy (ENR GY: +18.72%) leading the way. Across Asia, the IPOX® MENA (BBG: IPEV, TR: .IPEV) recouped more of its YTD losses, amid a good week in Saudi-traded IT services provider Arabian Internet & Communications Services (SOLUTION AB: +4.11%), while IPOX® Pick transit provider Tokyo Metro (9023 JP: +3.12%) set another fresh post-IPO High.

Amid repatriation buying into key European, MENA and US REIT exposure, we note the big week in the IPOX® Global High Dividend, adding +4.05% (+2.09% YTD.) The portfolio currently yields +8.19%.

ECM REVIEW & OUTLOOK: 12 firms debuted last week, raising a combined $1.01 billion. IPOs, on average, gained +70.60% from offer to Friday’s close (median: +15.43%). The largest deal was U.S.-listed Chinese tea chain Chagee (CHA US), which raised $411 million and added +15.86% ($6.2 billion market cap). Other IPOs included HK’s Zenergy Battery (3677 HK: +1.57%; $129m) and Duality Bio (9606 HK), raising $211 million (+111.42% gain). Amid the success of Chagee’s IPO, and the leading performance of the IPOX® Global China YTD, IPOX® CEO J. Schuster noted in Reuters: "Many China-linked IPOs we have seen recently are plays on the growth of the Chinese consumer and therefore are relatively insulated from any tariff-linked disturbances”. Read the article here. Notable IPOs this week include JP electricity trading platform Digital Grid (350A JP, $57 million).

Visit the IPOX® Calendar for this week’s listing overview and read

The IPOX® Update for the latest IPO News.