SchusterWatch #764 (12/9/2024)

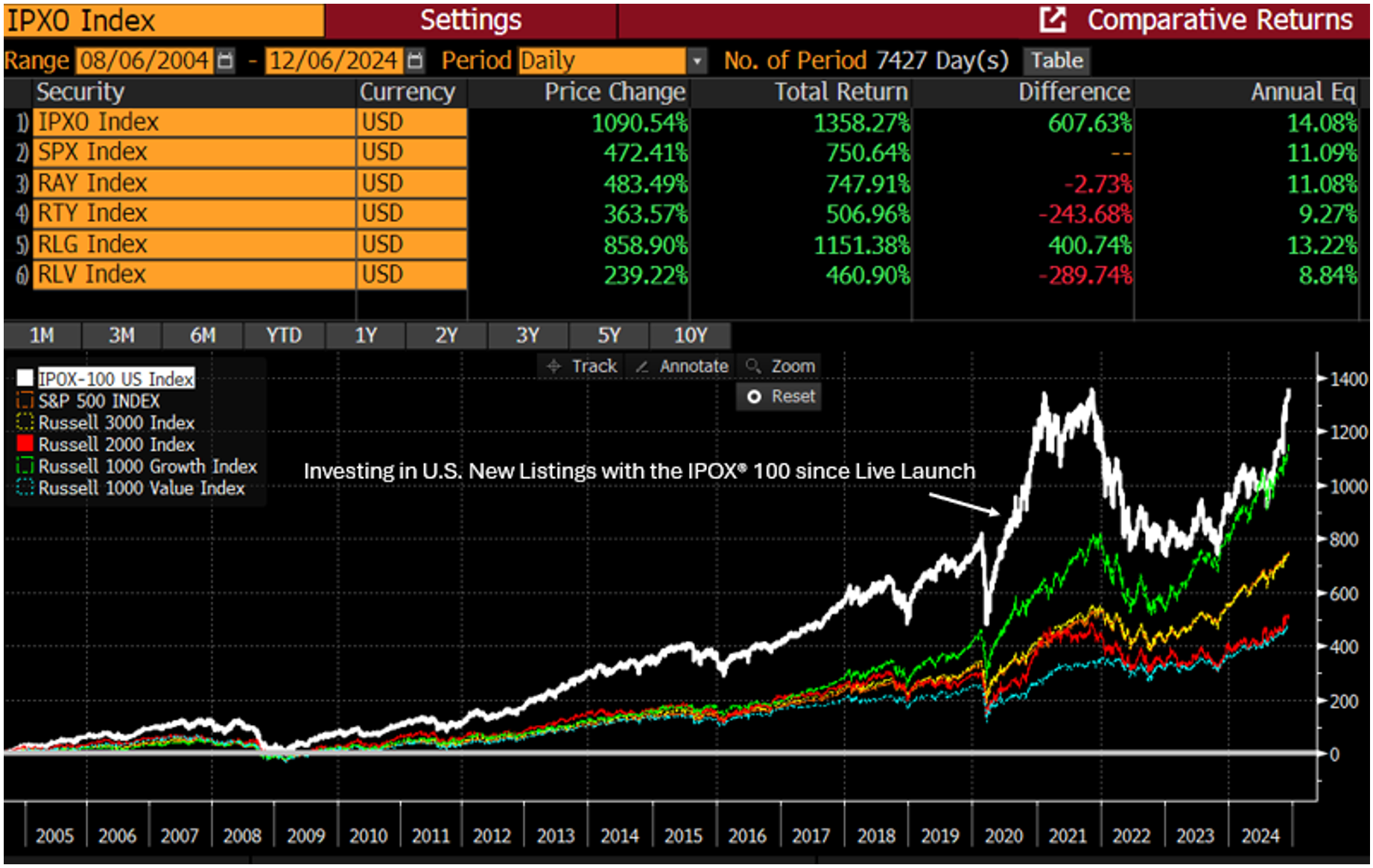

IPOX® continues historic run-up, leaves benchmarks trailing by big margin.

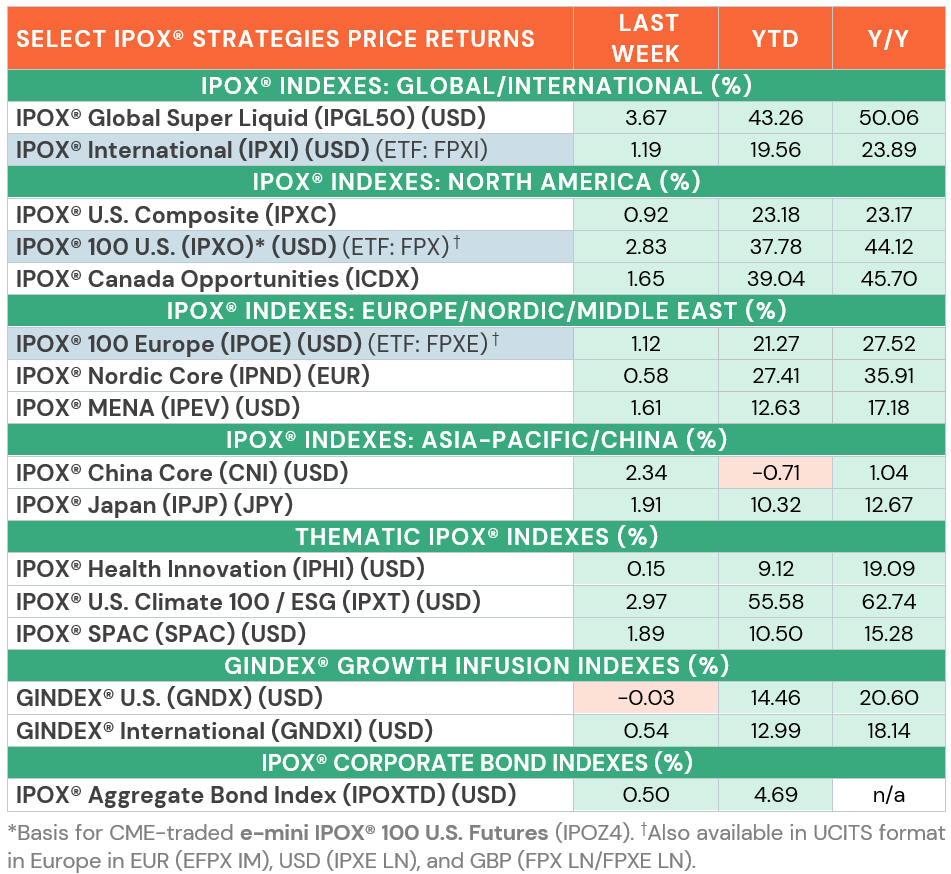

IPOX® Global 50 leads last weeks performance ranking with +3.67% jump.

Credo Technologies adds to list of firms with explosive gains after earnings.

Upcoming: Talabat ($2b) and ServiceTitan ($480m) set to debut this week.

IPOX® INDEXES: The first week of December kicked off more gains for the IPOX® Indexes, which again benefited most from the 1) the big risk shifting rally in global equities away from conventional benchmark exposure to unseasoned equities tracked by IPOX® amid 2) lower equity risk (VIX: -5.48%), 3) smooth sailing for U.S. government and corporate bond markets on expectations of a December rate cut and 4) strong earnings with some of our key holdings ranking amongst top index inclusion candidates.

IPOX® 100 U.S.: In the United States, the MAG7 / FANG-free, diversified IPOX® 100 U.S. - tracked by the world’s largest New Listings IPO-focused ETF (Ticker: FPX) and CME listed IPOX® 100 U.S. emini Futures (IPOZ4) – rose +2.83% to +37.78% YTD, extending its relative lead vs. hard-to-beat benchmark S&P 500 (SPX) by +179 bps. to +1010 bps. YTD. Amid more explosive gains amongst select stocks, just 55% of firms rose last week, with the average (median) equally-weighted portfolio holding adding only +1.00% (-0.57%), trailing the applied market-cap weighted IPOX® 100 U.S. by a huge margin. 01/22 IPO CA-based Communications equipment maker Credo Technologies (CRDO US: +51.61%) led the list of best performing portfolio holdings after reporting strong earnings, followed by 04/24 IPO CA-based infrastructure software maker Rubrik (RBRK US: +27.17%). Amongst the non-tech exposure recording strong gains, we note the exceptional week for 04/20 IPO biotech Keros Therapeutics (KROS US: +21.23%) and defense contractor 11/22 New Listings Leonardo DRS (DRS US: +6.56%). Select health care exposure fell sharply, including Chicago-based 06/24 IPO Tempus AI (TEM US: -19.41%). “IPXT”, the ESG-tiled version of the IPOX® 100 U.S. had another excellent week, adding +2.97% to +55.58% YTD.

OTHER IPOX® INDEXES: Most upside focus amongst other IPOX® Indexes last week was on the IPOX® Global 50 (IPGL50), which pools 50 of the largest, best performing and most liquid portfolio holdings in the underlying IPOX® Global Composite into a separately tradeable equity sector. Amid the good week for European and Asian equity markets, the super liquid index added +3.67% to +43.26% YTD, extending its YTD lead vs. benchmark MSCI World (MXWD) to a massive +2156 bps. London-traded IPO M&A life insurance provider Just Group (JUST LN: +12.71%), 12/20 IPO Sweden-based housing platform operator Hemnet Group (HEM SS: +8.87%) and de-SPAC innovative computer hardware maker Yubico (YUBICO SF: +7.78%) recorded strong gains in the IPOX® 100 Europe (ETF: FPXE), while 12/23 IPO miner Amman Mineral (AMMN IJ: +5.83%) and 04/21 life insurer Caixa Seguridade (CXSE3 BZ: +5.16%) stood out amongst our Indonesian and Brazilian stock exposure and 12/23 IPO electrical components maker Riyadh Cables (RIYADHCA AB: +10.40%) contributed to a good week for the IPOX® MENA (IPEV). Firms recording notable losses included 12/21 IPO Brazil fintech Nu Holdings (NU US: -3.99%), 03/21 IPO South Korean online marketplace Coupang (CPNG US: -5.76%), while sizable secondary activity contributed to profit taking in 01/24 IPO Helsinki-based sports apparel and fitness equipment maker Amer Sports (AS US: -5.01%) after the big post-IPO run-up in the stock.

IPOX® SPAC INDEX (SPAC): The Index gained +1.89% in last week, bringing its year-to-date performance to +10.50%. Nvidia-backed voice AI company SoundHound AI (SOUN US: +61.22%) saw another significant weekly increase, driven by a new partnership with Torchy’s Taco to deploy voice AI for phone orders. Meanwhile, Netherlands-based late-stage biopharmaceutical company NewAmsterdam Pharma (NAMS US: -7.56%) declined due to sector weakness. Three SPACs announced merger agreements, including Target Global Acquisition I (TGAA US: 0.00%), which is merging with 24/7 fully autonomous retail smart store developer VenHub Global. One SPAC completed a business combination: Blue Ocean Acquisition finalized its merger with Tokyo and Taipei-based digital media group TNL Mediagene (TNMG US). Two new SPACs were launched in the U.S. this week.

GLOBAL ECM REVIEW AND OUTLOOK: 29 firms started trading internationally last week, raising a total $1.75 billion and gaining a median +29.10% from offer price to Friday’s close. The largest listings included Indonesian coal mining firm Adaro Andalan (AADI IJ: +43.69%; $273m offer), Saudi consumer finance firm United International (UIHC AB: +26.67%; $264m offer) and Swedish online pharmacy Apotea (APOTEA SS: +44.83%; $145m offer).

This week's upcoming notable listings include German food delivery giant Delivery Hero’s Middle Eastern platform Talabat on the Dubai Financial Market ($2b offer) on December 10, cloud-based trade service software provider ServiceTitan (TTAN US, $480m) on December 12, and Cosmetics firm Mao Geping (1318 HK, $270m) on December 10.

IPOX IN THE MEDIA: Last week, IPOX® CEO Josef Schuster featured in two media appearances, discussing the IPO market and the debut of ServiceTitan:

First, in an interview on Money Life with Chuck Jaffe, he highlighted the IPO market's strong performance amid low interest rates and exceptional earnings, with most of our holdings beating expectations: Listen to the episode here.

In an article with Reuters, he commented on ServiceTitan's upcoming IPO at $5.16 billion valuation, noting once more that "excellent U.S. stock market conditions and very good earnings of IPOs overall during the previous reporting season make it a favorable environment for companies to go public."

Visit www.ipox.com or our social media (Linkedin) for the latest updates.