SchusterWatch #765 (12/16/2024)

Most IPOX® Indexes decline as rates spike ahead of expiration.

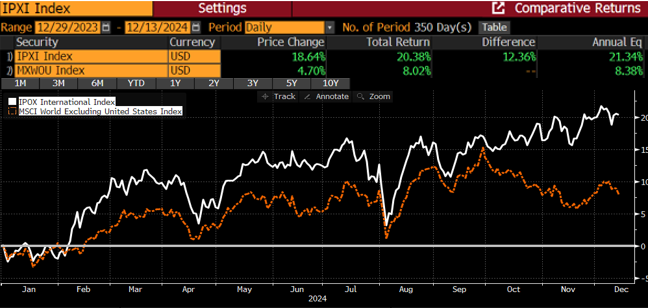

IPOX® International (ETF: FPXI) builds on big YTD relative gains.

Bullish U.K. IPOs as stocks record big gains and the defy the Critics.

Long-awaited debut of Japanese chipmaker Kioxia set for Wednesday.

IPOX® INDEXES: Select IPOX® Indexes fell sharply ahead of the FED meeting on U.S. interest rates and December Futures and Options expiration, mostly pressured by 1) profit taking and year-end-position squaring after the big post-election run up, 2) soaring yields across government and corporate bonds putting pressure on the more leveraged IPOX® Holdings and equity risk (VIX: +8.14%) and 3) continued weakness across U.S. healthcare.

IPOX® 100 U.S. (IPXO): In the United States, the MAG7 / FANG-free, diversified IPOX® 100 U.S. - tracked by the world’s largest New Listings IPO-focused ETF (Ticker: FPX) and CME listed IPOX® 100 U.S. emini Futures (IPOH5) – slumped by -5.27% to +30.51% YTD, significantly lagging the U.S. benchmarks, including the Russell 2000 (RTY). Big profit taking in index inclusion bound heavyweight AI-play Applovin (APP US: -19.19%), application software makers Samsara (IOT US: -11.84%) and Snowflake (SNOW US: -8.70%) as well as declines across biotechs and select Financials drove the weak showing, with three of this year’s significant IPOs (Rubrik, Waystar, Reddit) ranking amongst the top performing portfolio holdings last week.

IPOX® INTERNATIONAL (IPXI): The portfolio of 50 highly liquid innovative companies domiciled outside the U.S. as defined by IPOX® and tracked by the “FPXI” ETF, continued its good YTD 2024 showing and extended its YTD gain vs. benchmark MSCI World ex. U.S. (MXWOU) to a sizeable +1236 bps. (Source: Bloomberg). Amid bitterly cold weather across Chicagoland, high-end winter coat maker, Finland-based Amer Sports (AS US: +10.56%), Korean video games maker Krafton (259960 KS: +9.66%), U.K. Chipmaker Arm Holdings (ARM US: +7.82%) and Abu Dhabi-based growth/dividend play Adnoc Drilling (ADNOCDRI DH: +5.69%) led the relative strength of the portfolio, while health care relative exposure tended notably weaker.

IPOX® 100 EUROPE (IPOE): IPOX® 100 Europe, tracked by the “FPXE” ETF, remained a top relative trade YTD, with the portfolio now +1722 bps. ahead of the MSCI Europe (MSDUE15). Indicative of a possible revival of the beleaguered market for U.K. IPOs, we note the strength amongst our U.K.- based holdings, such as IT firm Raspberry Pi (RPI LN: +24.96%), Financial Petershill Partners (PHLL LN: +2.20%) and fintech Wise (WISE LN: +0.81%).

IPOX® SPAC INDEX (SPAC): The Index fell -1.95% last week, bringing its year-to-date performance to +8.34%. The biggest winner was Netherlands-based, late-stage biopharmaceutical company NewAmsterdam Pharma (NAMS US: +34.55%), which reversed its previous week’s decline after updated data on its heart drug showed positive results. Telehealth platform Hims & Hers Health (HIMS US: -12.30%) declined due to insider sales and concerns that Eli Lily’s partnership with rival telehealth platform Ro to deliver its weight-loss drug could hamper HIm’s competing knockoff product. Three SPACs completed business combinations, including Thunder Bridge Capital Partners IV, which finalized its merger with Amsterdam-based Japanese bitcoin wallet and cryptocurrency exchange Coincheck (CNCK US: -12.30%). Three new SPACs were launched in the U.S. this week. Other notable news includes: EQT completed its acquisition of the 2022 deSPAC Singapore-based PropTech company PropertyGuru. The 2021 deSPAC Indian renewable energy company ReNew Energy Global (RNW US: +15.47%) received a non-binding from major investors, including Canada Pension Plan Investment Board and Abu Dhabi Investment Authority, to take the company private at $7.07/share. Cybersecurity firm Gen Digital proposed to acquire the 2021 deSPAC fintech mobile banking platform MoneyLion (ML US) for $1 billion.

GLOBAL ECM REVIEW AND OUTLOOK: 24 global IPOs started trading last week, raising a total $5.6 billion. The median listing gained +8.42% from offer price to Friday’s close. The largest listings were German food delivery firm Delivery Hero’s Middle Eastern unit Talabat (TALABAT UH), which fell -6.25% after raising $2 billion in the region’s largest IPO this year. The second largest offer was by Australian server center REIT DigiCo Infrastructure (DGT AU: -9.00%), raising $1.3 billion in the country’s biggest listing since 2018. In the U.S., tradespeople software specialist ServiceGiant (TTAN US: +42.25%) surged after the firm priced above the already upwards-adjusted price range. In Hong Kong, cosmetics firm Mao Geping (1318 HK: +86.58%) raised $300m while Swedish properties developer Intea Fastigheter (INTEAB SS: +15.00%) raised $194 million.

This week, all eyes are on Kioxia (285A JP), Japan’s 3rd largest IPO this year. The memory chipmaker is set to raise $800m after mid-range pricing - the second of 72 Japanese IPOs this year not to price at the upper end or above. The firm, now valued at $5.1 billion, vs. $18 billion when Bain Capital acquired it from Toshiba in 2018, faces scrutiny on debt and lack of market presence for AI-focused chips.

Visit www.ipox.com or our social media (Linkedin) for the latest updates.